Investing.com’s stocks of the week

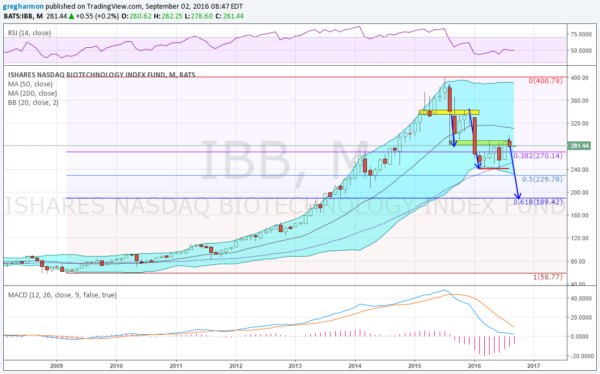

The entire healthcare space had a great run higher in the stock market off its long-term bottom in 2009. The biotech sector specifically rose over 580% at its peak in July of 2015. But since then, as the broad market settled and started moving sideways, the Biotech Index has had a rough go of it. From a high of over $400 it has fallen as low as $240 and is now consolidating.

So is the worst over?

The long-term chart below suggests that despite the patient being out of intensive care, it still needs to be monitored. The good news is that the momentum to the downside seems to have stalled and is leveling. The RSI is holding near the mid line while the MACD is leveling into the zero line. Stabilizing.

But there are signs that suggest the whole ailment may not have run its course. Since the top, IBB has fallen in two steps of about equal length. Each time it, though, it has bounced slightly, up to prior support levels. The first time that happened, biotech fell hard again in its second plunge. August saw another rise to prior support.

The first two moves lower suggest that a 3-Drives Pattern may be playing out. A third correction of about equal length would put the ETF at a 61.8% retracement of the entire leg higher from 2009, which would be a critical retracement level for traders.

iShares Nasdaq Biotechnology (NASDAQ:IBB) could continue to move higher and a close over $320 would be a sign that the sector is back in peak health.

But until then, more observation is necessary on the timeframe.