Biotech stocks are one of the sexy areas of the market. And they are one of the most volatile when dealing with individual company stocks. A failed trial can cut the stock in half overnight, while a success gives a double. So for many without the expertise or time to understand the science (like me) investing in them comes best with an ETF.

This smooths out the wide swings of any one company. And it allows investors access to the entire sector. The iShares Nasdaq Biotechnology (NASDAQ:IBB), is one good way to get exposure. And if you did not hold your nose and buy on Christmas Eve it is giving you a reason to right now.

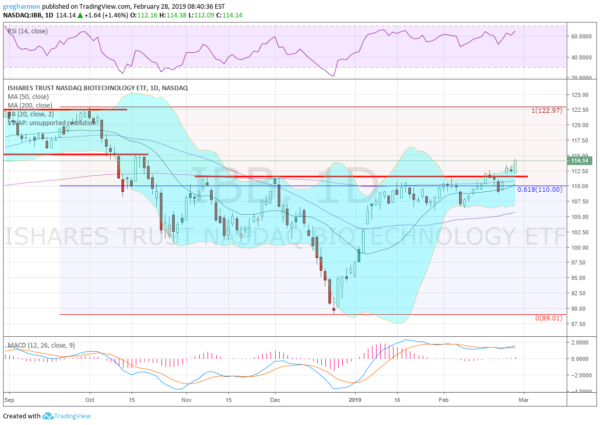

The chart above shows the price action since the top in early October. It pulled back and consolidated through November before dropping to that December low. Since then it made a quick retracement of 61.8% of the total drop and consolidated. This was also right at the top of the November consolidation range.

But this week it has pushed above that resistance to new 4 month highs. It has the momentum to continue higher. The RSI is rising in the bullish zone with the MACD positive and starting to turn up. The Bollinger Bands® had squeezed in and are now opening to the upside. All of these support further upside.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.