Biotech stocks ran higher from May through to August. There were a couple of set backs along the way, but a strong move higher. Large cap healthcare was looking good. Companies like Eli Lilly and Pfizer (NYSE:PFE) were climbing. The Medical Devices field was also showing strength. It seemed like a change of leadership in the stock market was upon us with healthcare taking the lead.

After a short pullback in September Biotech stock prices were rising again into the end of the month and finished September at 3 year highs. All looked well for the sector. And then October started. Of the first 7 trading days in October the Biotech Index has been down 6 of them including the last 4. A 6% drop in just over a week. Is it time to panic?

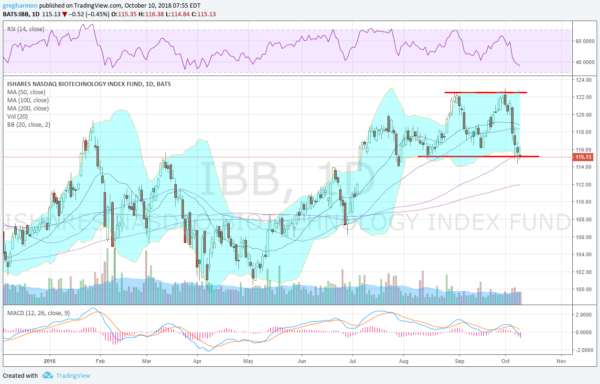

The pullback brought the Biotech Index ETF, $IBB back to its 100 day SMA. It bounced the last time it touched there in June. But momentum is weaker this time. The RSI is making a 6 month low and pushing into the bearish range. And the MACD is negative. It has not dipped to negative since May, when it was rising out of the April low.

These alone do not state the case to sell Biotech yet. Looking at the price action, it has stalled in the move lower at the prior low from August, creating a channel. If it continues below the July dip there is likely trouble ahead as a double top would confirm. Time to protect you Biotech and watch closely.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.