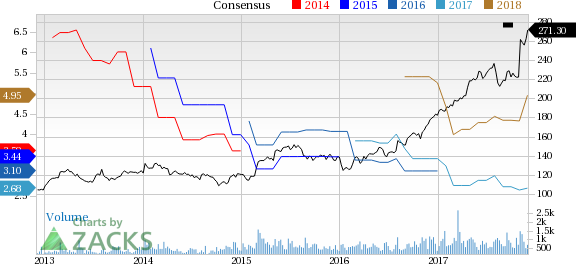

Shares of Bio-Rad Laboratories, Inc. (NYSE:BIO) scaled a new 52-week high of $273.87 on Nov 30, closing nominally lower at $271.30. The company has gained 18.8% in the last six months, much higher than the S&P 500’s 7.6%. Bio-Rad has also surpassed the broader industry’s gain of 4.2%. The stock has a market cap of $8.03 billion.

Bio-Rad’s estimate revision trend for the current year is favorable. In the past seven days, one estimate moved up with no movement in the opposite direction. Consequently, estimates were up from $2.65 per share to $2.68.

The company also has a trailing four-quarter average positive earnings surprise of 61.2%. Its positive long-term growth of 25% holds promise as well.

Growth Drivers

The market is upbeat about Bio-Rad’s recently reported third-quarter performance. The year-over-year growth in earnings and revenues is encouraging. Sales growth was majorly driven by strong sales of Droplet Digital PCR instruments and consumables, cell biology and food safety products in the life science group. Also, strong growth in products used for blood typing, quality control and autoimmune testing in the diagnostic group contributed to the top line in the quarter under review.

.jpg)

Additionally, the company has a strong cash balance that enables it to carry out share repurchases and in turn provide solid returns to investors. The expansion in gross and operating margin also buoys optimism. The company is also constantly investing in R&D for product innovation.

Zacks Rank & Key Picks

Bio-Rad carries a Zacks Rank #3 (Hold). A few better-ranked stocks in the broader medical sector are PetMed Express, Inc. (NASDAQ:PETS) , Myriad Genetics, Inc. (NASDAQ:MYGN) and Luminex Corporation (NASDAQ:LMNX) . PetMed, Luminex and Myriad sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

PetMed has a long-term expected earnings growth rate of 10%. The stock has rallied roughly 74.1% in a year.

Myriad Genetics has a long-term expected earnings growth rate of 15%. The stock has soared 107.9% over a year.

Luminex has a long-term expected earnings growth rate of 16.3%. The stock has gained 7.9% over the last year.

5 Medical Stocks to Buy Now

Zacks names 5 companies poised to ride a medical breakthrough that is targeting cures for leukemia, AIDS, muscular dystrophy, hemophilia, and other conditions.

New products in this field are already generating substantial revenue and even more wondrous treatments are in the pipeline. Early investors could realize exceptional profits.

Click here to see the 5 stocks >>

PetMed Express, Inc. (PETS): Free Stock Analysis Report

Luminex Corporation (LMNX): Free Stock Analysis Report

Bio-Rad Laboratories, Inc. (BIO): Free Stock Analysis Report

Myriad Genetics, Inc. (MYGN): Free Stock Analysis Report

Original post

Zacks Investment Research