BioMarin Pharmaceutical Inc. (NASDAQ:BMRN) announced that the Biologics License Application (BLA) for pegvaliase has been accepted by the FDA for priority review. A decision is expected on Feb 28, 2018.

BioMarin is looking to get pegvaliase approved for lowering blood phenylalanine (Phe) levels in adult patients with phenylketonuria (PKU), a rare genetic enzyme deficiency disorder, who have uncontrolled blood Phe levels with existing treatment options.

However, the regulatory body has requested additional information onchemistry, manufacturing, and controls related to pegvaliase. The company expects the submission of the information to the FDA to be classified as a major amendment that will extend the review process by three months.

An application in the EU is expected to be filed by the end of the year.

BioMarin’s shares are up 0.2% so far this year, which compares unfavorably with an increase of 9.7% registered by the industry during this period.

We remind investors that pegvaliase’s development/regulatory process has not exactly been smooth. The drug has faced several delays and setbacks, which makes the latest announcement a big positive for BioMarin.

BioMarin is hoping that pegvaliase, if approved, will supplement BioMarin’s phenylketonuria portfolio, which also includes Kuvan. A potential approval will strengthen BioMarin’s commercial leadership in the treatment of PKU, which can drive the company's revenues going forward.

Kuvan generated revenues of $194 million in the first half of 2017, up 16.4% year over year.

However, Kuvan is set to face generic competition from 2020. The approval of pegvaliase will help BioMarin to offset any loss of revenues from Kuvan.

According to information provided by the company, approximately 50,000 individuals in the developed countries are diagnosed with PKU, which represents a significant need for such therapies.

Zacks Rank & Stocks to Consider

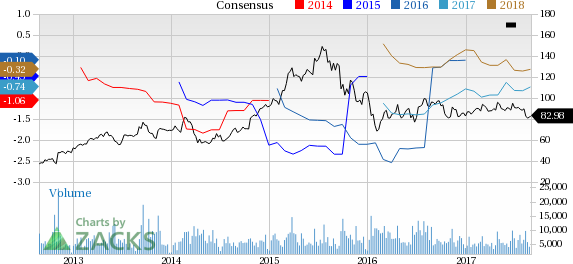

BioMarin has a Zacks Rank #3 (Hold).

Some better-ranked stocks in the health care sector include Alexion Pharmaceuticals, Inc. (NASDAQ:ALXN) , Regeneron Pharmaceuticals, Inc. (NASDAQ:REGN) and Aduro BioTech, Inc. (NASDAQ:ADRO) . While Alexion and Regeneron sport a Zacks Rank #1 (Strong Buy), Aduro carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Alexion Pharmaceuticals’ earnings per share estimates have moved up from $5.57 to $5.61 for 2017 and from $6.90 to $6.92 for 2018 over the last 30 days. The company delivered positive earnings surprises in all the trailing four quarters, with an average beat of 11.12%. The share price of the company has increased 12.5% year to date.

Regeneron’s earnings per share estimates have increased 15.1% to $14.78 for 2017 and 5.8% to $16.21 for 2018 over the last 30 days. The company pulled off positive earnings surprises in two of the trailing four quarters, with an average beat of 10.11%. The share price of the company has increased 30.5% year to date.

Aduro’s loss estimates per share have narrowed 9.6% to $1.32 for 2017 and 12% to $1.24 for 2018 over last 30 days. The company came up with positive earnings surprise in two of the trailing four quarters, with an average beat of 2.53%.

4 Surprising Tech Stocks to Keep an Eye On

Tech stocks have been a major force behind the market’s record highs, but picking the best ones to buy can be tough. There’s a simple way to invest in the success of the entire sector. Zacks has just released a Special Report revealing one thing tech companies literally cannot function without. More importantly, it reveals 4 top stocks set to skyrocket on increasing demand for these devices. I encourage you to get the report now – before the next wave of innovations really takes off.

Alexion Pharmaceuticals, Inc. (ALXN): Free Stock Analysis Report

Regeneron Pharmaceuticals, Inc. (REGN): Free Stock Analysis Report

BioMarin Pharmaceutical Inc. (BMRN): Free Stock Analysis Report

Aduro Biotech, Inc. (ADRO): Free Stock Analysis Report

Original post

Zacks Investment Research