Exploiting IP from the land of milk and honey

BioLineRx, (BLRX.TA) is entering a catalyst-rich phase over the next 12 months, which will see early clinical data from studies of two internal R&D projects, BL-8040 (acute myeloid leukaemia) and BL-8020 (HCV). Pivotal data should also emerge in 2014 from BioLineRx’s lead partnered programme, BL-1040, for the prevention of cardiac remodelling following acute myocardial infarction and from BL-5010 for benign skin lesions. Ahead of these key catalysts, we value BioLineRx at $210m, equivalent to $8.9/ADR (basic) or $7.9/ADR (fully diluted).

Catalyst-rich period ahead for key trial results

BioLineRx is entering a catalyst-rich phase over the next 12 months. It will see the data from the outcome of a pivotal study of BL-1040 (bioabsorbable cardiac matrix), for the prevention of cardiac remodelling after acute myocardial infarction and from a pivotal CE mark registration study for BL-5010 (benign skin lesions). Data from early studies of BL-8040 (acute myeloid leukaemia) and BL-8020 (hepatitis C virus infection) will also emerge in 2014.

BL-1040 data in 2014 is a key event

The outcome, due in 2014, of the 306-patient PRESERVATION-1 study of BL-1040 is likely to be a major stock catalyst. The study has been conducted by BioLineRx’s partner Ikaria and is designed to support a CE Mark application. A separate US registration study is expected to get underway in the near future, BL-1040 addresses a large and currently un-served market opportunity, which could potentially be valued at ~$2bn/year.

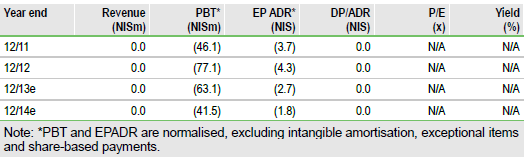

Financials

BioLineRx ended the third quarter with US$20m in cash, which should be sufficient to last to mid-2015, without the receipt of milestones. We presume milestones are payable on a successful result in the PRESERVATION-1 study, a CE mark filing and approval, which may be received during this period, as well as from other possible sources of funding, such as potential out-licensing deals.

Valuation: $210m or $8.9/ADR

Considering only five key pipeline assets, we value BioLineRx at $210m, equivalent to $8.9/ADR (basic) or $7.9/ADR (fully diluted). This indicates over 200% upside to the current share price, an unusually high ratio. It should also be stressed that this is a current fair value and not a future-orientated price target.