The market has taken an irrational view of the failure of un-partnered TB-402 and the return of rights to TB-403. TB-402 accounted for only 4% of Edison’s future revenue estimate, while TB-403 contributed no value. The events focus BioInvent (BINV.ST) on to its two most valuable assets: BI-204 for atherosclerosis and BI-505 for multiple myeloma and possibly other cancers.

Data on both products are due in Q3 and good indicative results on BI-204 could lead to a milestone, sale of ex-North America rights and Genentech/Roche making significant further investments.

Focus on wholly owned, core projects

The two remaining lead projects are the most valuable. If BI-505 can be developed and directly marketed, it would be very valuable given its orphan indication (multiple myeloma). However, as a partnered product, it would be at a reduced value. As the current trial is doses ranging only, the product should progress to Phase II. BI-204 is more experimental and the Phase II data in stable angina, due in mid Q3, should determine whether Genentech starts aggressive development with perhaps Roche acquiring ex-North American rights. However, this is a higher risk inflection point and if BI-204 fails to reduce plaque inflammation, it could lead to project termination.

Lower-value project problems

With only 40% of any returns, the two ThromboGenics-partnered projects needed significant royalties to be of substantive value. TB-402 in the Phase II hip trial was comparable in efficacy to Bayer’s Xarelto (5.3% vs 4.7%), but there was a significantly high bleeding risk (6.5% vs 1.4%). This was very surprising as TB-402 was meant to have a very safe anti-coagulation effect and the results have killed the project. TB-403 is an antibody against PlGF but Roche’s development was desultory and it has now returned all rights. TB-403 may have a role in eye disease, albeit with ThromboGenics.

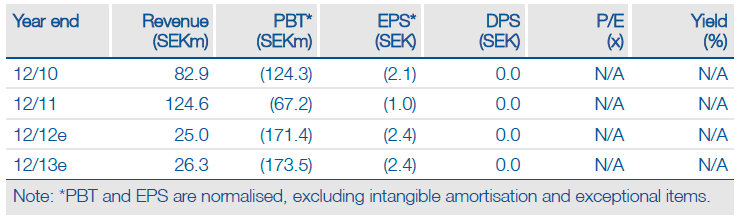

Valuation: Minor fall in indicative value to SEK19.26/share

The market had an irrational view of TB-402, which was never a plausible value driver and accounted for only 4% of Edison’s valuation, while TB-403 effectively contributed no value. Even without possible TB-402 milestones, Edison’s valuation has only fallen to SEK19.26 per share before any BI-204 milestones. If BI-204 moves to Phase IIb, at 35% probability, the value rises to SEK23.66/share. However, if BI-204 does not progress, the value on BI-505 only with direct sales is SEK14/share. Q2 cash is estimated at SEK200m.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

BioInvent International: Focus On Wholly Owned, Core Projects

Published 06/17/2012, 03:00 AM

Updated 07/09/2023, 06:31 AM

BioInvent International: Focus On Wholly Owned, Core Projects

Survival of the fittest

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.