January 2013 brought a clear safety and dose signal in the BI-505 Phase I for relapsed and refractory multiple myeloma (MM). In preclinical studies, BI-505 showed a tumour cell killing effect possibly by making myeloma cells susceptible to apoptosis. The Phase I was dose escalating with a safety end point. Interestingly but anecdotally, seven of 29 patients (24%) on extended dosing showed stable disease. BI-505 will progress to a small Phase IIa during 2013. BioInvent (BINV.ST) intends to partner BI-505

The one: BI-505 is crucial to current value

BI-505 is the remaining clinical programme from the January 2012 portfolio. Hence, gaining maximum value is important for investors. A deal by GenMab in August 2012 with J&J on a Phase I MM antibody, daratumumab, shows possible value. GenMab, a larger company, gained $55m upfront and $88m in equity with milestones and a 10%+ royalty. However, such Phase I deals are infrequent and BioInvent investors need to be prepared to fund BI-505 to add value by generating Phase II efficacy data.

Into two at 10: BI-505 progression to Phase II

BI-505 blocks the function of the cell surface adhesion molecule ICAM-1 (CD54). In the cancer literature, myeloid cells show cell-adhesion mediated drug resistance if attached to other cells. In BioInvent’s patent EP 2468775 (priority December 2006), ICAM blocking is claimed to cause apoptosis (cell suicide). The 35-patient dose escalation study in relapsed and refractory MM tested 11 dose stages of 0.0004mg/kg to 20mg/kg. BI-505 at 10mg/kg saturated the ICAM sites on bone marrow myeloma cells; this dose will be used for Phase II. Stable disease (based on M protein biomarker levels) was seen in 24% of the 29 patients who received extended dosing over 0.06mg/kg (level 6). The likelihood of success remains at 30%.

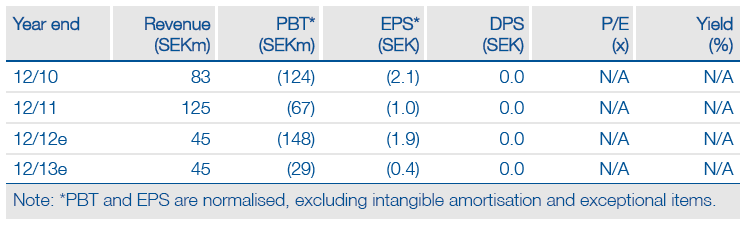

Valuation: Cash conservation to rebuild the portfolio

BioInvent had Q3 ytd cash of SEK153m with revenues of SEK 34m. Estimating year-end 2012 cash is difficult due to the actual H212 restructuring costs; SEK25-40m seems a probable range. The company needs to invest in BI-505, bring forward two other candidates into Phase I and support n-CoDeR. Operating cash costs in 2013 should be SEK75m. The small Phase IIa BI-505 study due to start sometime in 2013 will be inexpensive; a broader Phase IIb may eventually follow. Collaborations may generate milestones in 2013 if partners designate clinical candidates. This could give funding into 2014 before any BI-505 deal value, if partnered in 2013.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

BioInvent International BI-505 First Clinical Data Now Available

Published 02/05/2013, 11:48 PM

Updated 07/09/2023, 06:31 AM

BioInvent International BI-505 First Clinical Data Now Available

The one into two at 10

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.