Amarin Corporation plc (AMRM) is a late-stage biopharmaceutical company with expertise in lipid science focused on the treatment of cardiovascular disease. The Company’s product candidate is AMR101, an ultra-pure omega-3 fatty acid. It is developing AMR101 for the treatment of patients with high triglyceride levels, or hypertriglyceridemia.

This is a vol and stock note on a bio-tech with $0 in revenue but a $2 billion market cap. The stock has been and continues to be the subject of takeover rumors and a huge FDA approval meeting (PDUFA) is due out July 26th. The vol is at a 2-year high (at least).

I last wrote about AMRN on 4-25-2012 (so ~2.5 months ago). The stock was trading $10.05 and vol was spiking at 100.58%. The Livevol® Pro Summary from that date is included below.

That blog post focused on the takeover rumors that were swirling and pushing vol up. Those rumors resurfaced on Friday and with the impending FDA decision, 100% vol and a $10 stock are no longer the story -- it's a $15 stock with 130% vol that we're lookin' at now. You can access the original post in April on AMRN here.

Moving on to yesterday's action, let's start with the news. First, the takeover spec, then the FDA ruling. Then we can look at how the vol reflects both of these phenomena in distinctly different ways. Very, very cool.

News

7-5-2012

Rumor activity resumed yesterday on a soft note:

• Chatter circulated that AstraZeneca (AZN) could be interested in Amarin (AMRN).

While many rumors circulate during the day, and the validity of the source of these rumors can be questionable, the speculation may increase volatility in the near term. -- Source: Provided by Briefing.com (www.briefing.com)

7-9-2012

Shares [of AMRN] have been trading between $5.99 and $15.60 during the past 52 weeks, and are poised to trade higher as the company draws closer to an FDA approval decision for its prescription fish-oil AMR101 on July 26th, 2012, which I believe the FDA will approve.

AMR101 is an investigational ultra-pure omega-3 fatty acid in a capsule, comprising not less than 96% icosapent ethyl (ethyl-EPA) in a capsule. Amarin is developing AMR101 for the potential treatment of patients with very high triglyceride levels and high triglyceride levels, or hypertriglyceridemia. Triglycerides are fats in the blood. Amarin's cardiovascular strategy leverages our extensive knowledge and experience in lipid science and the potential therapeutic benefits of polyunsaturated fatty acids in cardiovascular disease. -- Source: Seeking Alpha via Yahoo! Finance; Bio-Pharma Movers For Monday, July 9 , written by Scott Matusow.

So there you go... Let's turn to the Charts Tab (six months), below. The top portion is the stock price, the bottom is the vol (IV30™ - red vs HV20™ - blue vs HV180™ - pink).

On the stock side, we can see how AMRN climbed abruptly in mid/late Mar on takeover spec. That's what the first blog post focused on. At its peak, the stock popped ~70% from that news (from ~$7 to ~$12). The stock came back down and settled at $10 (ish). However, starting in late May, the stock has found legs to the upside again and is now trading above $15.

On the vol side, we can see how the implied popped abruptly to triple digits in mid/late Mar (see first blog for details) off of the takeover rumors, but then settled to the mid 70's. But, since 6-20-2012, the IV30™ has steadily but substantially increased from 63.98% to now over 133%. That's a 108% rise in vol as the stock has risen 20% over the last three weeks. As I noted at the top of the article, the level of the implied now is well into new 2-year high territory (the prior high was 126% (ish)).

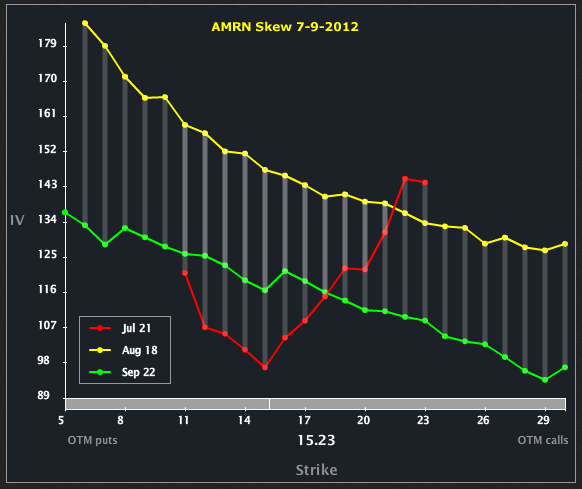

Let's turn to the Skew Tab and we'll be able to see both the impact of the takeover rumors and the PDUFA date / decision.

We can see that Aug vol is well elevated to Sep (on all strikes) and Jul (for the ATM). In fact, the ATM vol in Jul is the lowest of the front three expiries. This elevated vol in Aug is a reflection of the risk inherent in the FDA decision. That vol will rise as we get closer tot he PDUFA date as long as (1) no news is broken early and (2) the PDUFA date remains in the Aug cycle (no delays).

We can also see the incredible vol in the upside calls in Jul. In fact, the vol is at such a fevered pitch in the Jul OTM calls that they surpass the vol in Aug which has the PDUFA date. It's that reverse skew that reflects the risk of the takeover.

So, in English, what we see are two distinct vol phenomena -- the risk of the FDA decision and the risk (potential) of the takeover. It's fascinating to watch the takeover spec given the fact that this firm has $0 in revenue yet is worth $2 billion in market cap. One might say that the FDA decision is a "big" one for AMRN...

Finally, let's turn to the Options Tab, for completeness.

Across the top we can see the monthly vols are priced to 102.67%, 147.67% and 120.43% respectively for Jul, Aug and Sep. Keep in mind that Aug vol comprises of a month worth of days (or whatever). We're looking at a bunch of "normal" vol days, and one "huge" vol day (the PDUFA ruling). As we move through the "normal" days in Aug and approach the singular "huge" vol, the overall level of Aug vol will rise substantially. A very rough back of the envelope calculation shows me that the vol on the day of the FDA decision is priced at ~500% (that's assuming 100% vol is "normal"). That doesn't mean Aug vol goes to 500%! But you already knew that... right?...

Disclosure: This is trade analysis, not a recommendation

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Bio-Tech Vol Tops 2-Year High As FDA Decision Looms; Takeover Spec Heigh

Published 07/10/2012, 03:46 AM

Bio-Tech Vol Tops 2-Year High As FDA Decision Looms; Takeover Spec Heigh

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.