Asian markets ended mixed after conflicting data from China failed to provide direction. The official PMI data pointed to an expansion in manufacturing, while HSBC PMI data indicated a mild contraction. The Shanghai Composites slumped 1.1%, the ASX 200 dropped .9%, and the Hang Seng dipped .3%. Amongst the gainers, the Nikkei inched up .1%, and the Kospi edged up .2%. Korean builders soared, as Samsung Engineering and Hyuandai Engineering both gained nearly 5%.

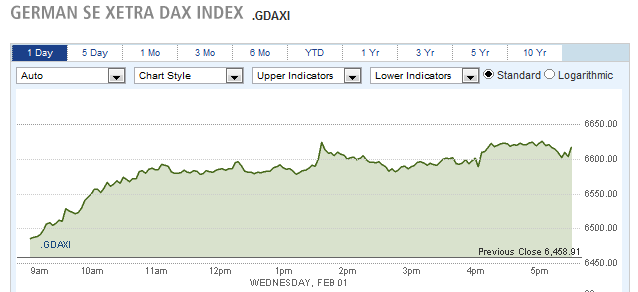

European markets rallied strongly, supported by upbeat economic news from Germany and the US. The DAX surged 2.4%, the CAC40 climbed 2.1%, and the FTSE jumped 1.9%. Banking shares rebounded 3.8% on news a Greek debt deal was imminent.

DAX Rallies 2.4% on Strong German Manufacturing Data

US stocks climbed as well. The Nasdaq outperformed, closing up 1.2%, followed by the S&P 500, which rose .9% to 1324. The Dow rose 84 points to 12716, ending its 4-day slide.

Amazon shares tumbled 7.7% after the company reported a sharp drop in revenue, and lowered its outlook. Whirlpool shares surged 13.5% after issuing a strong outlook, and Broadcom jumped 8.1% after beating analyst profit forecasts.

Currencies

The Dollar settled modestly lower against global currencies. The Euro rose .5% to 1.3156, recovering from an earlier drop down to 1.3028. The Australian Dollar settled up .7% to 1.0698, while the Pound and Swiss Franc advanced .4%. The Canadian Dollar broke through the parity level, gaining .3% to .9988, and the Yen inched up .1% to 76.22.

Economic Outlook

Wednesday’s ADP Employment report showed the economy gained 170K jobs last month, falling short of expectations of 189K, but still a very respectable figure. The official government non-farm payroll report will be released on Friday.

Construction spending rose by 1.5% last month, more than forecast, and auto sales unexpectedly jumped to an annualized rate of 14.2M, up from last month’s 13.6M reading.

Manufacturing PMI data from Germany rose to 52.1, significantly better than the 50.1 forecast.

Thursday’s data will include weekly unemployment claims, productivity & labor costs, and chain store sales.

Earnings are due from Beazer Homes, Boston Scientific, Cigna, Deutsche Bank, International Paper, Kellogg’s, Merck, Sony, Take Two and Unilever.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Binary Options Daily Analysis – Western Stocks Rally, Boosted by Positive Data

Published 02/04/2012, 11:23 PM

Updated 05/14/2017, 06:45 AM

Binary Options Daily Analysis – Western Stocks Rally, Boosted by Positive Data

Equities

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.