Asian markets rallied to their highest level in more than a month, following news the IMF is hoping to raise $600 billion in funding to help tackle the euro debt crisis. The Nikkei gained 1% to 8640, the Kospi jumped 1.2%, and the Hang Seng rallied 1.3%. China’s Shanghai Composite climbed 1.3%, nearly erasing Wednesday’s 1.4% drop. Australia’s ASX 200 lagged the region, easing .1%, as employment data showed an unexpected drop of 30K jobs in December.

France’s CAC40 soared 2% to 3329, as European indexes traded higher, following strong bond auctions in Spain and France. The DAX gained 1%, and the FTSE rose .7%, as European banks rocketed up 7.4% on hopes the IMF will help address the ongoing debt crisis.

US stocks posted moderate gains, thanks to positive economic and earnings news. The Dow rose 45 points to 12624, the Nasdaq rallied .7%, and the S&P 500 gained .5% to 1314.50.

Morgan Stanley shares jumped 5.4% after the company beat earnings forecasts, even though the company reported a decline in revenue to a legal settlement.

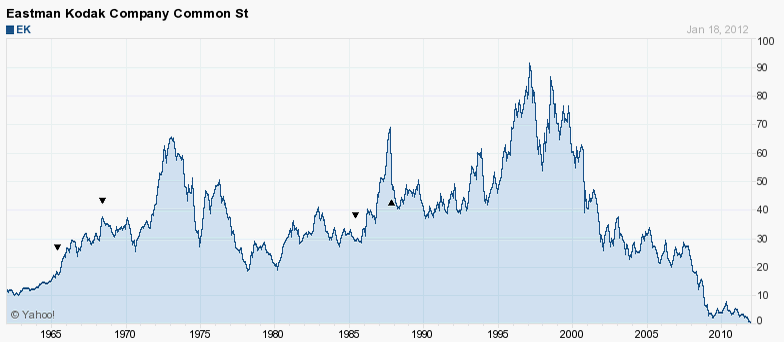

Kodak filed for bankruptcy, and the company said it had received a $950 million credit facility from Citigroup to keep the company operating.

Currencies

European currencies advanced, as renewed hopes for a debt solution lifted the region. The Euro and Swiss Franc gained .8%, and the Pound rose .4% to 1.5484. The Yen fell .4% to 77.12, while the Australian Dollar closed down .1% to 1.0412.

Economic Outlook

Weekly unemployment claims dropped to 352K, vastly exceeding analyst expectations of 387K. CPI was flat, while core CPI rose .1%, in line with forecasts. On a weaker note, housing starts fell to 660K, 30K short of forecasts.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Binary Options Daily Analysis – Stocks Gain on IMF Hopes, Kodak Files for Bankruptcy

Published 02/04/2012, 11:48 PM

Updated 05/14/2017, 06:45 AM

Binary Options Daily Analysis – Stocks Gain on IMF Hopes, Kodak Files for Bankruptcy

Equities

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.