Outstanding earnings from Apple on Tuesday evening helped propel Asian markets higher on Wednesday. The Nikkei rallied 1.1% to 8840, as a drop in the Yen boosted exporters such as Sony, which surged 4.8%. The ASX 200 climbed 1.1%, and the Kospi inched up .1%. Markets in China and Hong Kong remained closed for the Lunar New Year.

Concerns over Greek’s debt situation pressured European banks, sending the FTSE down .5% and the CAC40 down .3%. Nonetheless the DAX managed a slight gain. The European mobile sector fell after Ericsson missed profit forecasts.

US stocks advanced in the afternoon, thanks to a commitment from the Fed not to raise interest rates for at least 2 years. Tech shares led the advance, as the Nasdaq gained 1.1% to 2818. The Dow rose 83 points to 12759, and the S&P 500 closed up .9%.

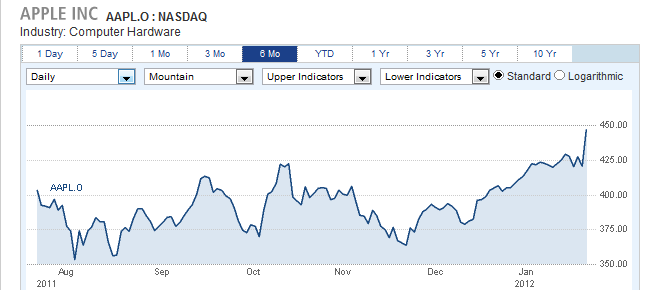

Apple shares surged 6.2% to 446.66 after reporting earnings which exceeded analyst forecasts. 15 brokerage firms raised their targets on the stock, which settled at an all time closing high.

Currencies

The Australian Dollar jumped 1.2% to 1.0606, as the US Dollar fell against its peers. The Euro and Canadian Dollar both rose .6% to 1.3115 and 1.0039 respectively, and the Pound gained .3% to 1.5670. The Yen eased fractionally to settle at 77.72, and the Swiss Franc advanced .7% to 1.0858.

Economic Outlook

Pending home sales fell 3.5% in December, following November’s 7.3% advance. On the plus side, the OFHEO home price index rose by 1%, more than expected.

Thursday’s economic calendar will include durable goods, weekly jobless claims, new home sales, and leading indicators.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Binary Options Daily Analysis – Fed Pledges to Keep Rates Steady Until 2014

Published 02/04/2012, 11:39 PM

Updated 05/14/2017, 06:45 AM

Binary Options Daily Analysis – Fed Pledges to Keep Rates Steady Until 2014

Equities

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.