Asian markets traded mostly higher, encouraged by the Fed’s commitment to keep interest rates unchanged through 2014. The Hang Seng soared 1.6% as Hong Kong’s markets returned from the Lunar New Year Holiday, although volume was light, since China’s markets will remain shut until Monday. The Kospi edged up .3% despite weak 4th quarter GDP data. Meanwhile, the Nikkei skidded .4% to 8849, and markets in Australia were closed

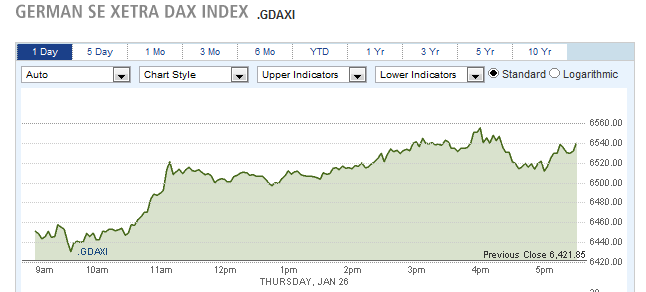

European markets posted strong gains on hopes that Greek debt negotiations were progressing. The DAX surged 1.8%, the CAC40 climbed 1.5%, and the FTSE gained 1.3%. Shares in retailer, Carrefour, jumped 7.5% on rumors of a change in management, and Nokia shares rallied 3.1% on strong earnings data.

US stocks pared early gains to close lower. The Dow slipped 22 points to 12735, the Nasdaq dropped .5%, and the S&P 500 fell .6%.

Netflix shares surged 22% to 116.01 after announcing subscriber growth which exceeded forecasts. AT&T fell 2.5% on weaker than expected profits.

Currencies

Currencies traded in narrow ranges, as the dollar fell modestly. The Australian dollar, Japanese Yen, and Canadian dollar all gained .3%, and the Pound edged up .2% to 1.5691. The Euro inched up 6 pips to 1.3106, while the Swiss Franc rose .2% to 1.0865.

Economic Outlook

Thursday’s economic data was mixed. Weekly jobless claims were 6K more than expected, rising to 371K from last week’s 351K reading, and new home sales fell to 307K from last month’s 314K. On the bright side, durable goods orders rose 2.1%,, and core durable goods order jumped by 3%, both better than forecast.

Friday’s reports will include advance GDP, which is expected to indicate growth of 3%. Also due is consumer sentiment from the University of Michigan.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Binary Options Daily Analysis – European Shares Rally on Hopes for Greek Debt Plan

Published 02/04/2012, 11:36 PM

Updated 05/14/2017, 06:45 AM

Binary Options Daily Analysis – European Shares Rally on Hopes for Greek Debt Plan

Equities

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.