The week opened on a soft note as Asian markets declined. The Nikkei sagged .5% to 8793, as Mitsubishi Electric tumbled 15% after the government suspended dealings with the machinery-maker, due to accusations of overcharging. The Kospi and Hang Seng skidded 1.2%, and the Shanghai Composite dropped 1.5% as trading resumed after the week-long Lunar New Year. Australia’s ASX 200 posted a modest .4% loss.

Greece failed to reach a deal with private debt holders, pressuring European indexes. Banking shares fell 3.1%. The CAC40 slumped 1.6%, the FTSE fell 1.1%, and the DAX lost 1%. French Banks bore the brunt of the selling, as BNP Paribas, Societe Generale, and Credit Agricole each fell at least 6.5%. Yields on Portuguese debt continued to climb, amid mounting concerns that the country may need another bailout.

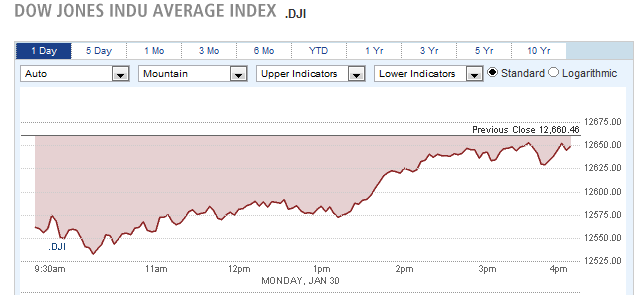

US stocks opened sharply lower, but they recovered most of their losses by the close. The Dow eased a mere 7 points to 12654, after falling as much as 130 points in the first hour of trading. The S&P 500 fell .3% to 1313, and the Nasdaq declined .2%.

Bank of America dropped 3% after Goldman Sachs downgraded the stock to “neutral” from “buy”. Goldman Sachs upgraded Morgan Stanley, but the stock still fell 1.9%.

US Airways surged 4.2% on rumors Delta may make an offer to buy the company.

Currencies

The Yen soared 1.4% to 76.34, a 3-month high, while the Dollar traded modestly lower against most other currencies. The Euro ticked up .2% to 1.3130, the Swiss Franc advanced .3% to 1.0896, and the Pound edged up 8 pips to 1.5701. The Australian Dollar eased .3% to 1.0596, as a drop in commodity prices weighed on the currency.

Economic Outlook

Personal income rose by .5% last month, slightly more than expected, but personal spending, which is considered more important, remained flat, falling short of forecasts for a .2% increase.

Tuesday’s reports will include the Case-Shiller home price index, Chicago PMI, employment cost index, and consumer confidence.

Tuesday’s star-studded earnings lineup will include reports from Amazon, Archer Daniels Midland, Broadcom, Eli Lilly, ExxonMobil, Level 3 Communications, Mattel, Pfizer, UPS, and Valero Energy.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Binary Options Daily Analysis – Greece Debt Deal Remains Elusive, Consumer Spending Disappoints

Published 02/04/2012, 11:31 PM

Updated 05/14/2017, 06:45 AM

Binary Options Daily Analysis – Greece Debt Deal Remains Elusive, Consumer Spending Disappoints

Equities

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.