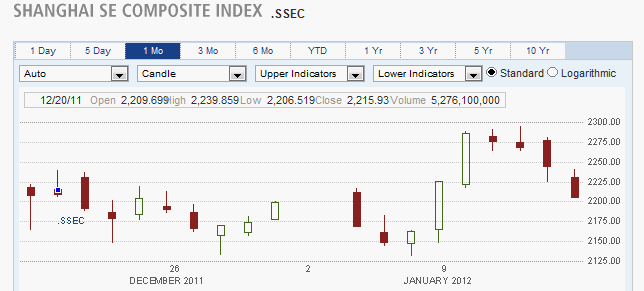

Over the weekend, S&P downgraded the debt ratings of 9 out of 17 euro zone countries, sending Asian markets lower on Monday. The Nikkei sank 1.4% to 8378, as the Euro-Yen (EURJPY) fell to 97.22, its lowest level in more than a decade, hurting exporters. In Korea, the Kospi shed .9%, and Australia’s ASX 200 dropped 1.2%. The Hang Seng slid 1% to 19012, while the Shanghai Composite tumbled 1.7%, largely erasing last week’s gains.

In contrast, European markets climbed, despite the wave of credit downgrades. The DAX rallied 1.3%, the CAC40 climbed .9%, and the FTSE rose .4%. Late Monday, S&P downgraded the European Stability Fund’s credit rating by one notch, which may make it harder for the fund to obtain cheap funding.

US markets were closed for Martin Luther King Day

Currencies

Global currencies traded in relatively narrow ranges, thanks to the US holiday. The Canadian Dollar gained .5% to 1.1081, ahead of the Bank of Canada’s rate decision on Tuesday. The Swiss Franc slipped .3% to 1.0478, the Australian Dollar eased .2% to 1.0306, and the Euro edged down .1% to 1.2664. The Yen rose .2% to 76.78.

Economic Outlook

Tuesday’s sole economic report is the Empire State manufacturing survey. Analysts are expecting the index to rise to 10.8 from last month’s 9.5 reading.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Binary Options Daily Analysis – European Markets Shrug Off S&P Downgrades

Published 02/04/2012, 11:53 PM

Updated 05/14/2017, 06:45 AM

Binary Options Daily Analysis – European Markets Shrug Off S&P Downgrades

Equities

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.