- Bill Gross, a.k.a the “bond king,” says the Fed “knows nothing” in an exclusive interview with Investing.com

- The central bank’s inflated balance sheet means a Volcker moment won’t work

- As we enter a new era for the global economy, cash looks more attractive

Legendary investor Bill Gross isn’t pulling any punches. In his latest letter to the public, the superstar fund manager and co-founder of Pacific Investment Management Company (PIMCO) painted a rather challenging picture of the U.S. (and global) economy going forward.

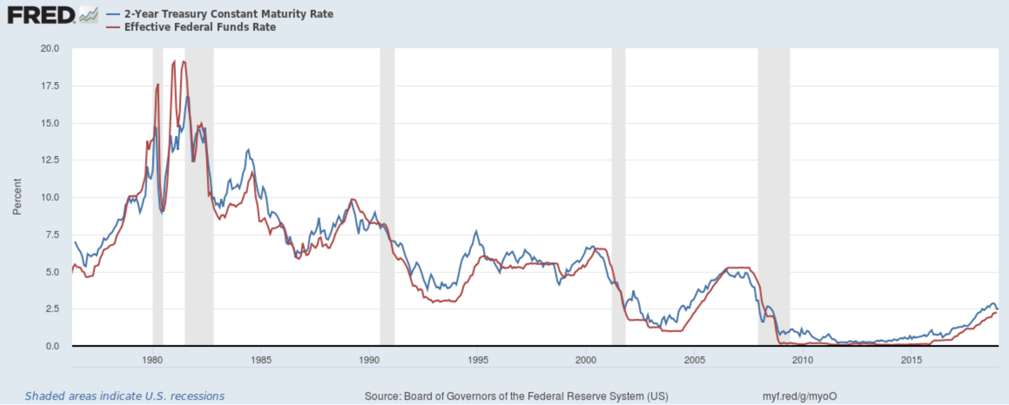

According to Mr. Gross, Jerome Powell has been deploying the same tactics as Paul Volcker in the late 1970s and early 1980s, but without taking into consideration the fact the economy is much more leveraged now. As he explains, if the Fed’s rate hikes stop at 4.5%, we can still see only a ‘mild recession’; however, anything above 5% would lead to a severe global recession.

“Recent events in the U.K., cracks in the Chinese property-based economy, war and a natural gas freeze in Europe, and a super strong dollar accelerating inflation in emerging market economies, point to the conclusion that today’s 2022 global economy in no way resembles Volcker’s in 1979."

Source: Yardeni Research

Bill Gross revolutionized the investment world by creating the first investable market for fixed-income securities and made a fortune by beating the market for decades in a row by trading bonds. However, late last year, he turned on the very asset that made him “bond king,” calling U.S. Treasuries “garbage.” Needless to say, he was right, as bonds went on to one of their worst selloffs in history.

In an exclusive interview for Investing.com early this week, the legendary investor was blunt to say cash is the best investment at the moment, as the Fed has “already gone too far.” In his direct style, Mr. Gross also noted that investors must recognize the new era for the global economy may be brewing and invest accordingly.

Investing.com: You recently stated that the U.S. economy could withstand a 4.5% interest rate with only a ‘mild recession'; however, 5% would be the breaking point. Why do you draw the line at that particular point?

Bill Gross: Real federal funds markets are at an approximate 2% rate, a level that, in prior economic cycles, has induced future recessions. In this cycle, financial and economic leverage is much higher than witnessed prior to the Great Recession, which argues for an even lower yield, implying the Fed has already gone too far.

IC: We are already very near your cited breaking point—especially if the Fed raises rates by the expected 50bps at its December meeting. Do you think Powell doesn’t share the same thoughts as you do?

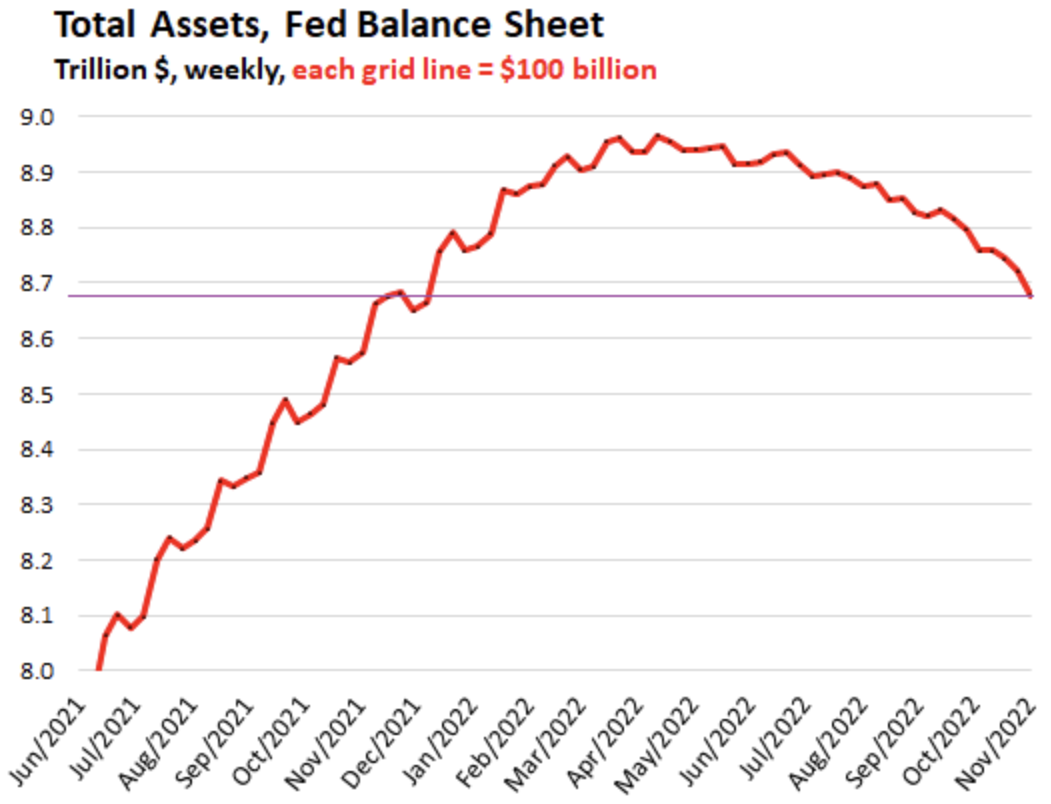

BG: The Fed, as Jim Cramer once said, “knows nothing.” Can anyone doubt that based upon the past few years’ experience of 0% yields, incessant quantitate easing (QE), and the expansion of its balance sheet from $1 trillion to $8.7 trillion?

Source: Wolf Street

IC: Does the Fed think the U.S. economy actually needs a ‘mild recession’ to be more economically efficient in the long run?

BG: Yes – it needs a recession to increase unemployment and lower wage gains.

IC: Do you think U.S. bonds are oversold?

BG: Hard to say an “oversold” bond market. A crisis such as witnessed with crypto or potentially with the Japanese yen devaluing would turn things quickly.

Source: Fed

IC: Is this a better time to buy stocks or bonds? Or neither?

BG: Cash!

IC: Are we entering a new era for the global economy? Or are we facing just a temporary headwind?

BG: A new era. We are deglobalizing, and equity investors recognize future headwinds associated with global warming, geopolitical conflicts, and aging demographics.

Disclosure: Thomas Monteiro does not own U.S. government bonds.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI