Were there any silver linings to last Friday’s terrible jobs report?

Is it finally time to stop envying the performance of hedge funds?

Should billionaire Bill Gates start worrying about being de-listed from the Forbes 400 list?

And does anyone really expect volatility to return with a vengeance in 2014?

We’re tackling all these questions (and a little more) in this week’s edition of Friday Charts.

Enjoy!

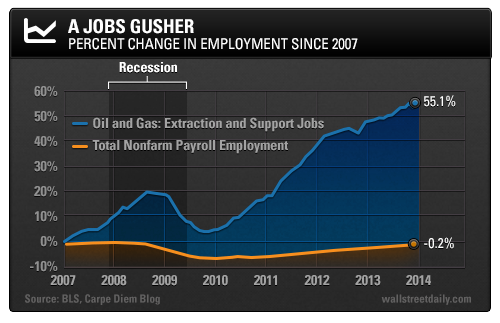

Need a Job? Head to Texas or North Dakota

Last week, the Bureau of Labor Statistics revealed that the economy only added 74,000 jobs in December.

Panic ensued. Why? Because it represented a big, Jesse Barfield-style swing and a miss. Economists expected close to 200,000 new jobs for the month.

But the report wasn’t a complete nightmare. And I’m not just saying that because I’m the “glass is half full” guy.

As I’ve shared before, boom times are here for one sector in the U.S. economy – energy. And the latest jobs report confirms it.

Total direct oil and gas industry employment reached 504 million jobs in December. That’s up 55% since 2007.

As Dr. Mark Perry of the American Enterprise Institute notes, the sector has been adding about one new job every four minutes – for the last two years.

Go ahead. Call it an energy revolution. Then start figuring out how to invest in it by following my colleague and friend, Karim Rahemtulla, over at Oil & Energy Daily.

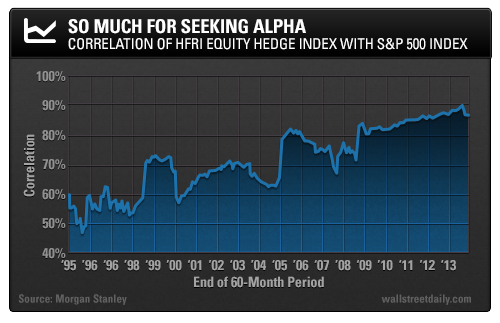

I Pity the Hedge-Fund Fool

For the fifth year in a row, the average hedge fund failed to outperform the S&P 500 Index. Not by a slim margin, either. But by 23 full percentage points.

The Bloomberg Hedge Fund Aggregate Index rose 7% in 2013, compared to a 30% rise for the S&P 500.

Yet a staggering $2.5 trillion – equal to the GDP of France – is invested in hedge funds. Yes, we should pity the fools!

The drubbing got so bad, in fact, that hedge fund managers apparently decided to admit defeat. Instead of trying to beat the market, their funds are “becoming” the market.

In the last year, the correlation between hedge funds and the S&P 500 hit nearly 90%.

Still got hedge fund envy? Save yourself the underperformance and expense by investing in a cheap, exchange-traded fund like the SPDR S&P 500 Fund (SPY). From an investment standpoint, the two are virtually identical.

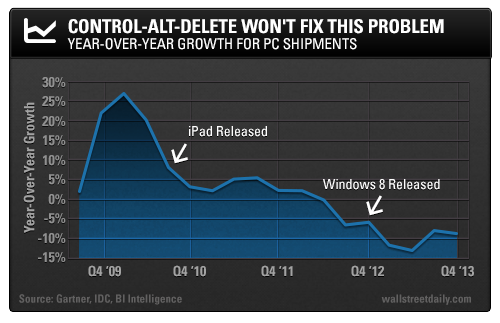

No Resurrection Here

Bill Gates is the richest man in the world. No doubt, he’s a smart guy. But even if he returned to be the CEO of Microsoft (MSFT), I don’t think he could overcome this epic crash.

“Global PC shipments suffered the worst decline in PC market history [in 2013],” according to tech research firm, Gartner.

Total shipments dropped 10%.

That’s terrible news for computer companies like Microsoft – and, in turn, Mr. Gates. (He still owns a massive stake in the company.)

While he might never lose his billionaire status completely, a few demotions in the rankings might be on the horizon.

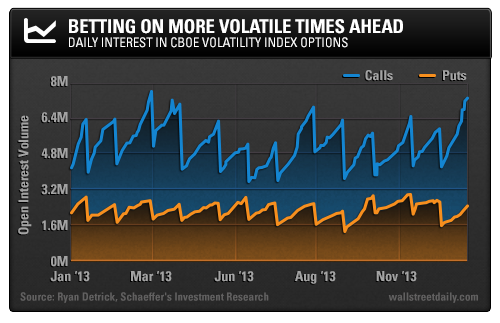

A Contrarian Take on Volatility

During the throes of the financial crisis, daily swings of 2% for the S&P 500 were the norm.

By comparison, 2013 was a ho-hum year for volatility, with the market swinging 0.55% higher or lower on any given day.

That volatility is going to return with a vengeance in 2014, though.

Open call options on the VIX Volatility Index (VIX) stand at 7.4 million, according to a recent tweet from Ryan Detrick, Senior Technical Strategist at Schaeffer’s Investment Research.

(In case you didn’t get the memo, we’re on Twitter, too. Follow me @LouBasenese.)

The volume of bullish bets on volatility is a stone’s throw away from the record high hit last March. Translation: There’s a lot of groupthink going on.

In this situation, I can’t help but bring up Humphrey B. Neill’s famous line, “When everybody thinks alike, everyone is likely to be wrong.” We’ll find out soon enough.

Original Post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Bill Gates Booted Off the Forbes 400 List?

Published 01/17/2014, 12:55 PM

Updated 05/14/2017, 06:45 AM

Bill Gates Booted Off the Forbes 400 List?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.