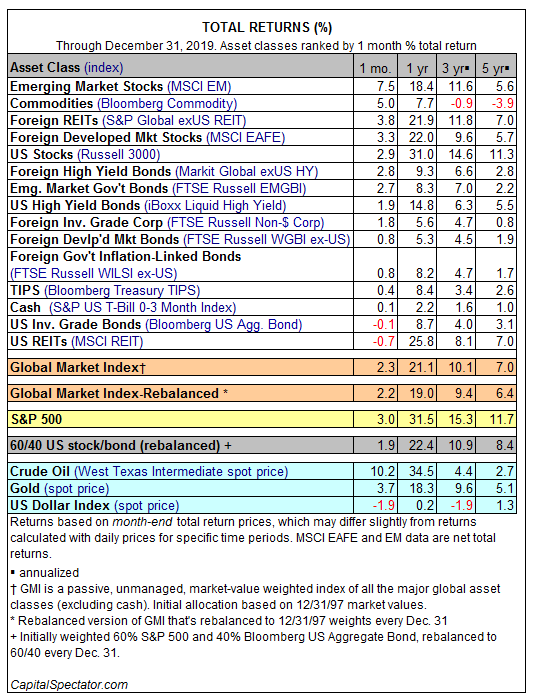

It was a very good year for investors in 2019. So good, in fact, that it was impossible to lose money last year with simple buy-and-hold strategies that owned one or more of the major asset classes.

The biggest winner in 2019: US stocks. American shares surged 31.0% last year, based on the Russell 3000 Index. The gain was moderately ahead of 2019’s second-best performer among the major asset classes: US real estate investment trusts (REITs). MSCI REIT Index climbed 25.8% last year after factoring in distributions. The weakest performance in 2019: cash via S&P US T-Bill 0-3 Index, which gained 2.2%.

Note, too, that for the trailing 3- and 5-year windows, only broadly defined commodities lost ground. Otherwise, all the major asset classes have posted gains based on a start date of 2014’s close. That’s an extraordinary bull run that effectively offered a powerful tailwind for virtually any asset allocation mix. If genius is a bull market, it’s tempting to argue that the world was up to its eyeballs in skilled money managers over the past five years.

Turning to December’s results, emerging markets stocks dominated trading. Shares in this corner rebounded sharply last month as the MSCI Emerging Markets Index jumped 7.5%.

There were only a handful of losses in 2019’s final month of trading. Red ink was limited to a fractional decline for US investment-grade bonds (Bloomberg US Aggregate Bond Index) and a 0.7% setback for US REITs (MSCI REIT Index), the deepest decline in December.

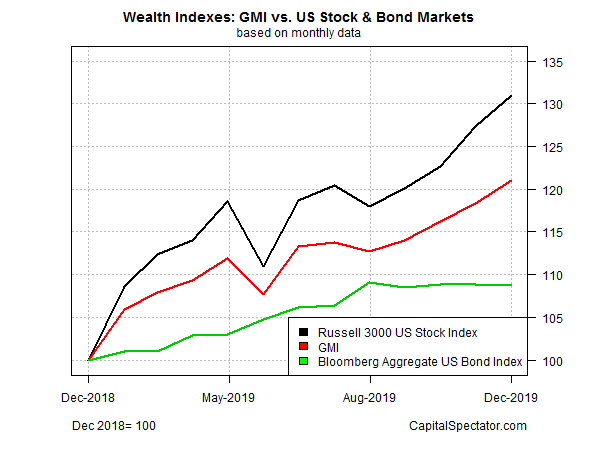

With global markets reflecting widespread gains for the year just passed, the Global Markets Index (GMI) posted a stellar run. This unmanaged benchmark that holds all the major asset classes (except cash) in market-value weights gained an impressive 21.1% in 2019. In December, GMI was up 2.3%. The benchmark’s robust increase of late is a reminder that active asset allocation strategies had a tough time keeping up with simple buy-and-hold benchmarks last year.