It will be a hectic week for stocks, with an FOMC meeting and all of the mega-cap stocks reporting results. The market seems overly complacent at this point, with a VIX trading at 23 and a VVIX index at 84.5. With the VIX at 23, it is currently at its lowest level this year, heading into an FOMC meeting, which I find bizarre.

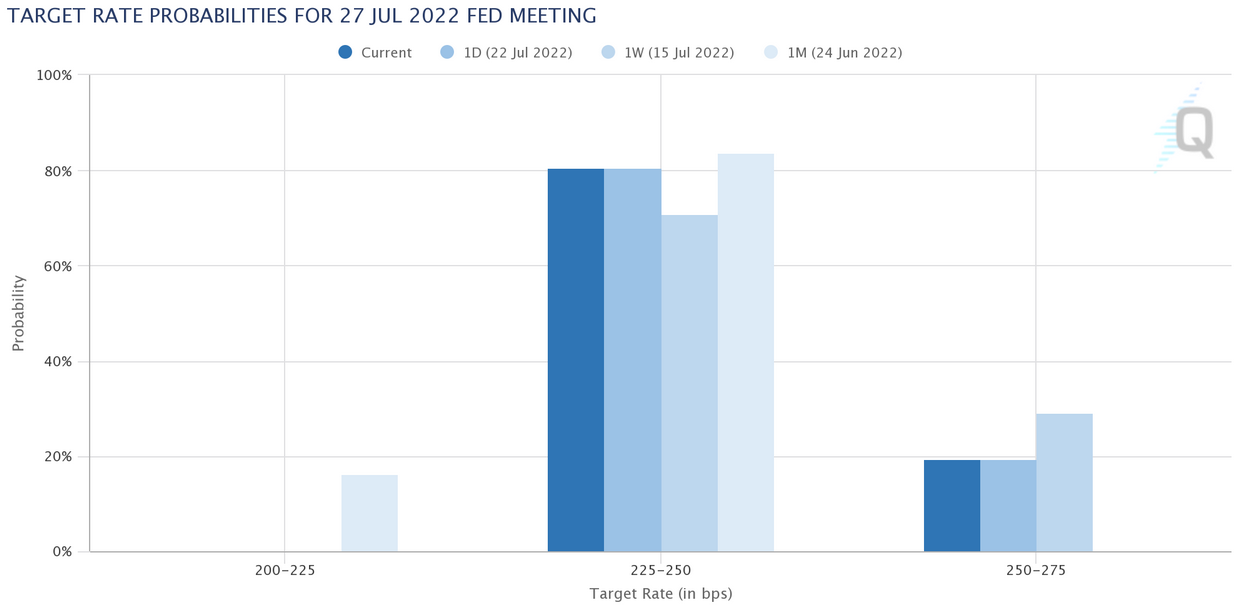

The Fed is likely to raise rates by 75 bps, and the CME fed watch tool even suggests a 20% chance the Fed will raise rates by 100 bps.

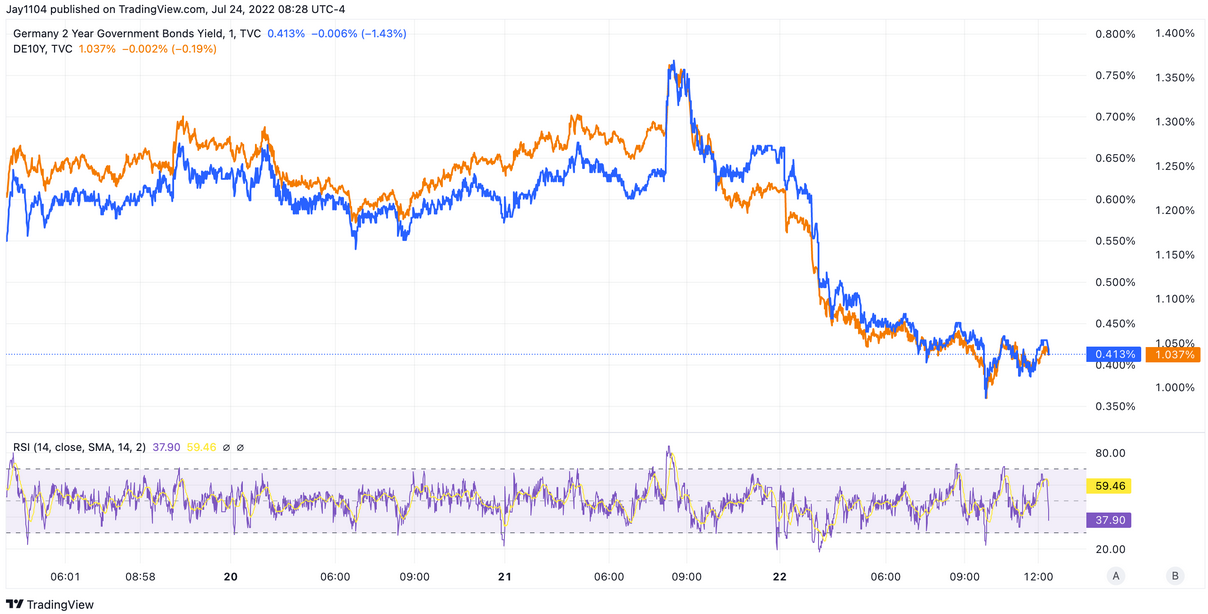

Rates fell sharply on Friday, but a lot of that decline came from a sharp move lower in European rates, with the German 2-year falling 23.5 bps to 41 bps. Yes, the German 2-year’s yield fell 36% on Friday. The German 10-year yield fell 18 bps to 1.04%. The decline in European yields is primarily due to the ECB’s non-approach to monetary policy. The ECB did raise rates by 50 bps last Thursday but failed to give any guidance for the September meeting and also noted that the 50 bps increase last week would not change the expected terminal rate.

Despite the US 10-year rate falling by 12 bps on Friday, the spread between the US and German 10s widened by five bps. That spread is likely to widen more, especially if the Fed delivers and indicates more rate hikes in the future.

Meanwhile, last Thursday, the BOJ left its monetary policy unchanged, which means that the anchor of the Japanese bond market will continue to help suppress global rates. Currently, the spread between a US and Japanese 10-year is extremely wide. With the BOJ holding to its yield curve control, it will be harder for yields in the US to extend much higher for the time being since the spread is already at past record highs.

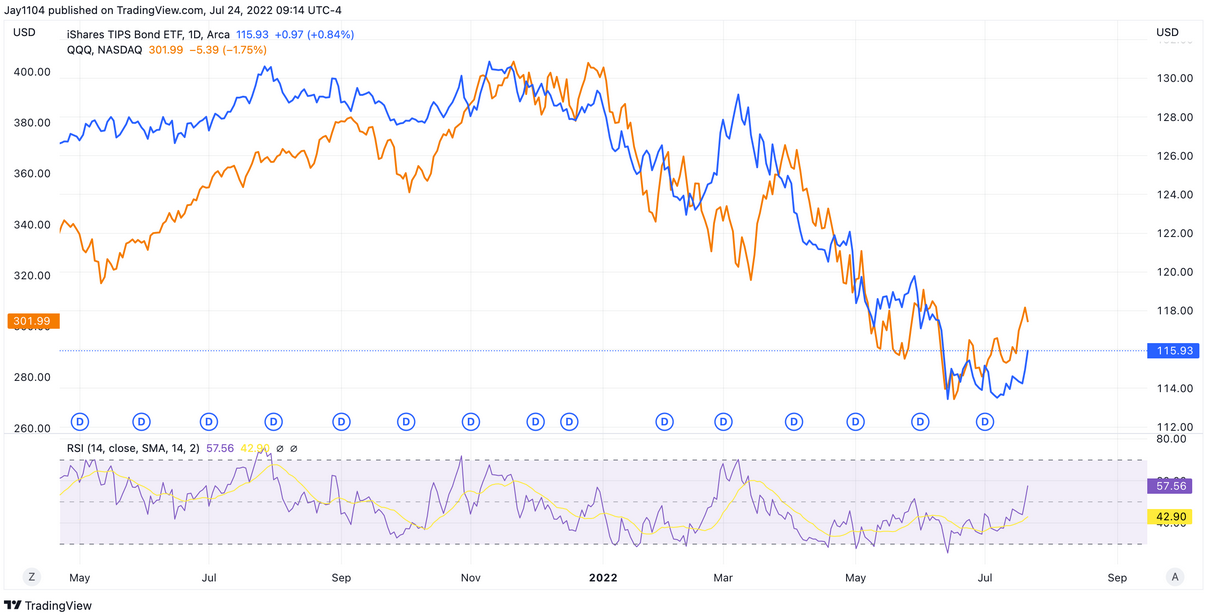

It tells us that move down in yields on Friday is less of a reflection of the current economic situation here in the US but a reflection of central bank policy action of late last week. It is essential to understand this topic because inflation expectations did not fall at all on Friday, despite the sharp move down in yields. That means real yields were falling to keep pace with falling nominal yields to keep inflation breakevens flat. As a result, the TIP ETF rose sharply. This helped the gap between the QQQ and the TIP close a little bit.

NASDAQ

The NASDAQ futures have been in a rising channel, and to this point, the move up from the July 13 lows to the July 22 highs equaled the June 17 lows to the June 27 highs, which could suggest that we have completed the ABC retracement wave off the June lows. This may very well indicate the QQQ the NASDAQ futures are heading back to the lower end of the trading channel.

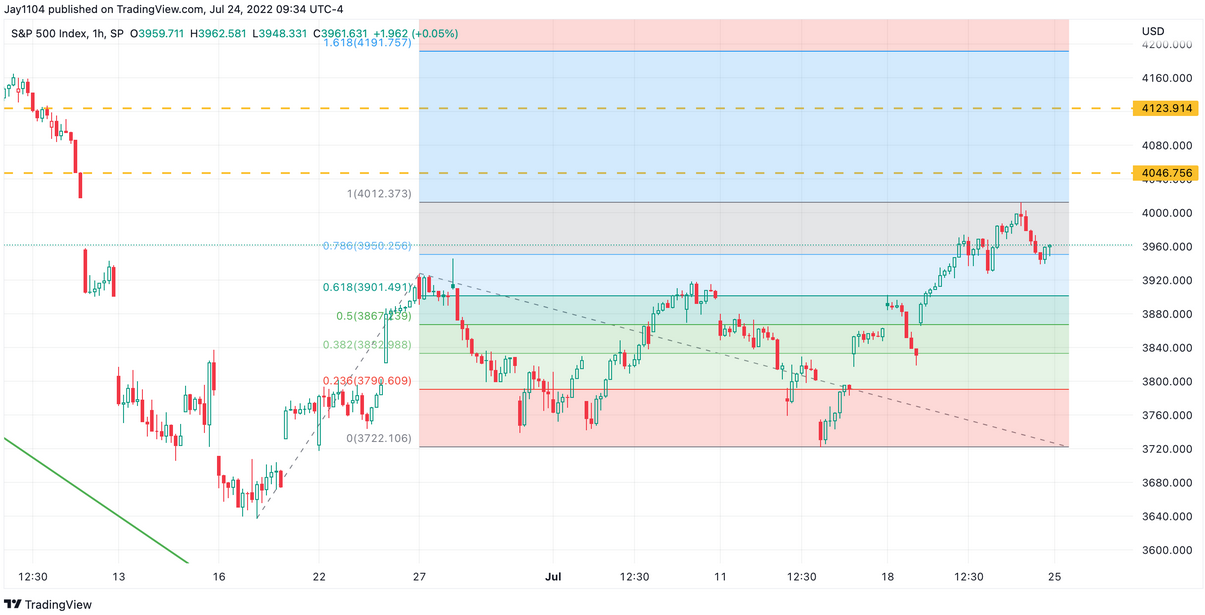

S&P 500

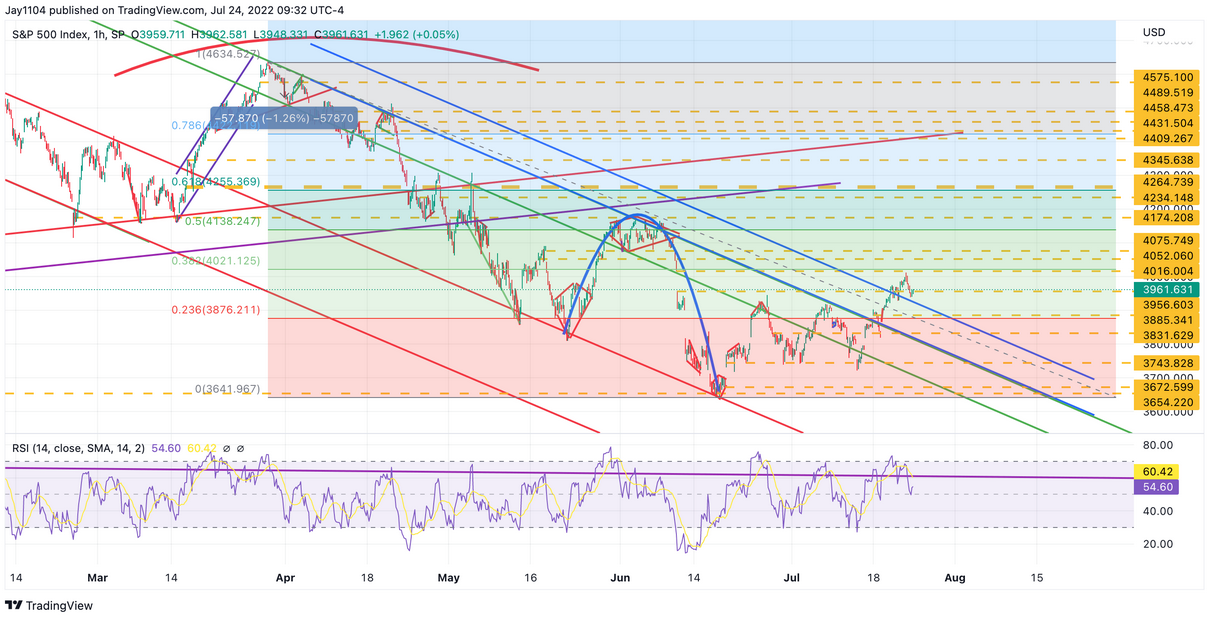

Meanwhile, the S&P 500 has completed a 38.2% retracement of its move lower from its March 30 high to the June 17 low.

The S&P% 500 has also now seen a 100% extension of its June 17 low to June 27 high…

And a 161.8% extension of its June 30 low to its July 8 high.

It would seem like the highs witnessed on Friday would be the perfect location for the S&P 500 to have at least put in a short-term top. It is an even better place to see a sharp decline, and given how low the VIX is, it wouldn’t take much to get this market moving lower with a gap fill at 3,830, the most reasonable first target level.

Visa

Visa (NYSE:V) will report results this week, with inflation running at almost 9% and strong nominal GDP growth. I think Visa would be a big beneficiary of this environment since payments are nominal and not in inflation-adjusted terms. To me, Visa and Mastercard (NYSE:MA) seem like good inflation hedges but get little attention. Maybe this quarter changes things for both.

Visa is at a significant downtrend, which has presented resistance two times now. It seems like a good technical setup for the stock to break out if the company delivers better than expected results.

Mastercard

Mastercard will also report results this week and has a similar setup to Visa from a technical stance.

Apple

Apple (NASDAQ:AAPL) reports this week too, and I have seen expectations for some slowing of service revenue growth. But then factor in the terrible results from Verizon (NYSE:VZ) and AT&T (NYSE:T); I can only wonder about the health of Apple’s handset market and the potential outlook. Also, Apple is likely to see a big hit on revenue and earnings due to the strong dollar, but the stock hasn’t been acting like anything wrong is happening.