The Federal Reserve, as expected, left interest rates unchanged in yesterday’s policy announcement. The Fed funds target rate remains pinned to the 0%-to-0.25% range and so on that front nothing’s changed. But it’s another story when you look at the Fed’s new economic forecasts, in which case the status quo narrative trembled.

In particular, the central bank sharply raised its inflation outlook. That should come as no shock to anyone watching recent inflation numbers, which have surged lately. The Fed took the hint and lifted its Core PCE inflation forecast for 2021 to 3.0% -- up sharply from its 2.2% estimate in March.

The shift is tame by some standards, but that’s a big change for the Fed in just one meeting period.

In keeping with its forecast that higher inflation is transitory, however, the central bank projects that pricing pressure will pull back to roughly its target in 2022 and 2023.

Meanwhile, the Fed is pulling its estimates for interest rate hikes forward and now sees two hikes in the cards by the end of 2023. In addition, Fed Chair Jerome Powell advised that while scaling back its monthly bond purchases is still far off, he noted there is “progress” in moving closer to that date, whenever it is.

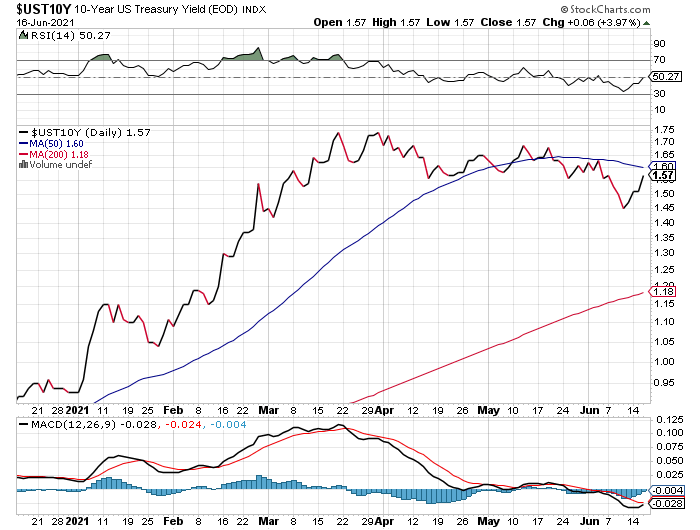

It’s too early to tell if today’s Fed news is the stuff of regime change or another run of noise, but the Treasury market certainly took notice of the change in tone. The 10-year Treasury yield jumped 6 basis points on the day, rising to 1.57%, the highest in more than a week. That’s hardly a smoking gun, but it’s a sign that the bond market’s focused on the possibility that higher rates appear to be on the horizon.

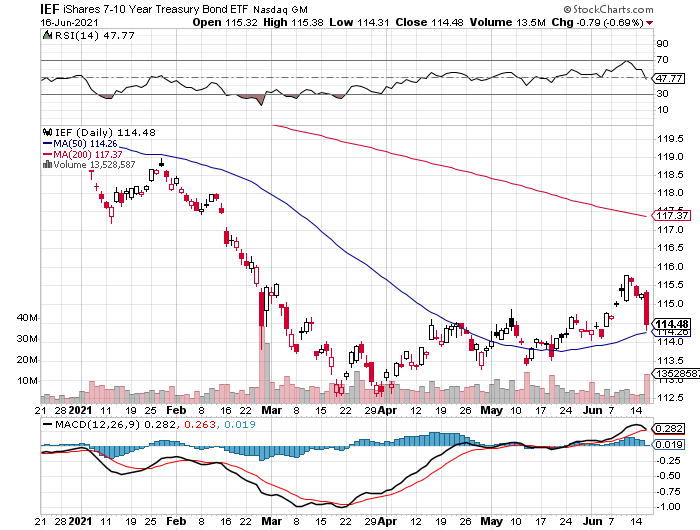

Treasury bond prices took a hit in the process: iShares 7-10 Year Treasury Bond ETF (NYSE:IEF) tumbled 0.7%.

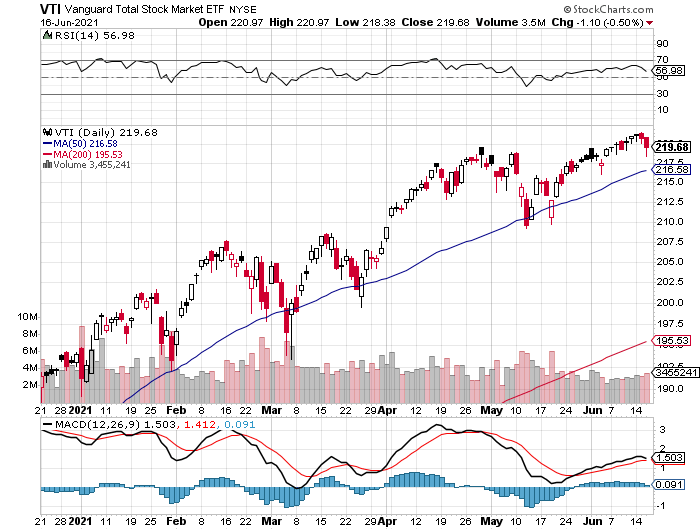

US equities also retreated via Vanguard Total US Stock Market (NYSE:VTI), which gave up 0.5% on the day.

It’ll take time to know if today was the turning point when the care-free run of risk-on sentiment became less care-free. A big piece of the mystery is still linked to whether higher inflation is transitory or persistent. Another factor is deciding how much resiliency the economy can muster if rates start moving higher from current levels.

No matter how all this plays out, this much seems clear: analyzing the outlook for macro and markets outlook is becoming a good deal more complicated relative to the past year, when you basically had a binary decision: the rebound continues or not. The path ahead will likely offer a far more nuanced set of possibilities, for good or ill.