Leadership Provides Insight Into Market’s Tolerance for Risk

Supply and demand is a simple and powerful concept. When investors are confident about future economic outcomes, they gravitate toward growth-oriented and higher beta ETFs. When investors are concerned about the economy and earnings, demand for conservative assets, such as consumer staples and bonds, begins to increase. There is a reason monitoring the big picture was included in the Four Ways To Improve Your Investing Game article; it helps us stay properly allocated between stocks and conservative assets.

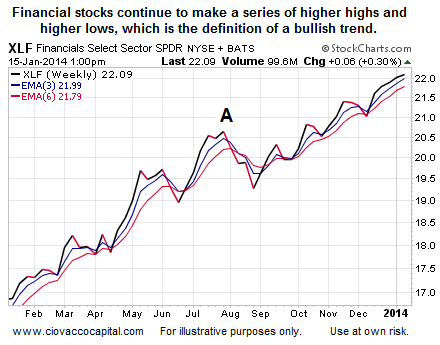

Demand For Banks Sides With Stock Bulls

While markets can rally with banks lagging, all things being equal we would prefer to see a healthy financial sector (XLF) during a market advance. The sector got a boost from Bank of America (BAC) Wednesday. From Bloomberg:

Bank of America jumped 2.4 percent after the second-biggest U.S. lender reported fourth-quarter earnings and revenue that beat analysts’ estimates. Apple Inc. gained 2.5 percent after China Mobile Ltd. said pre-orders for iPhones had reached 1 million. Regeneron Pharmaceuticals Inc. declined 3.6 percent amid an analyst downgrade.

The demand for financial assets has remained strong enough to propel the sector to new highs. When the chart below morphs into a look similar to point A, our concerns about the general market will increase.

Subdued Inflation Pressures

Central banks tend to maintain easy-money policies until inflation rears its ugly head. While Wednesday’s report was highlighted by higher gas prices, the Fed should not be overly concerned with the current inflation figures. From Reuters:

U.S. producer prices recorded their largest gain in six months in December as the cost of gasoline rebounded strongly, but there were few signs of any sustained price pressures. Even with the latest rise, however, prices at the wholesale level were up only 1.2 percent from a year-ago, suggesting a continued lack of pressure on the prices consumers pay. “We are still seeing very subdued inflation pressures. The type of economic growth we see in 2014 is likely to lead to a slow normalization in consumer prices, not a fast one,” said Laura Rosner, an economist at BNP Paribas in New York.

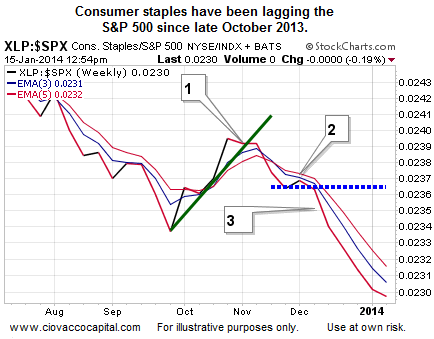

Fear Not Showing In Consumer Staples

As described in this video clip, many institutional money managers must stay fully invested all the time. Therefore, they often overweight defensive consumer staples stocks when they are concerned about future economic and market outcomes. We last referenced the chart below on December 27; it continues to align with a bullish or “risk-on” environment for investors. The three steps confirmed a bearish reversal in consumer staples relative to the S&P 500 Index.

Investment Implications – Staying Long Until Evidence Shifts

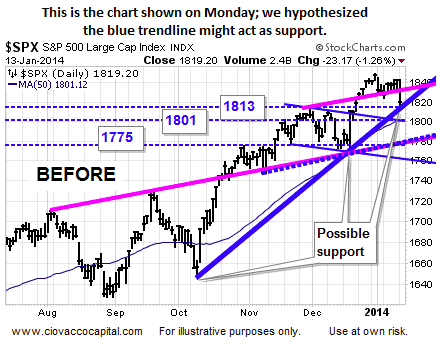

After Monday’s equity selloff, we reduced our exposure to stocks in an incremental manner noting:

Incremental risk reduction admits “we could be wrong here”, meaning if buyers step in at the trendline below, we still have exposure to stocks, just not as much as we had last Friday.

The trendline and chart we referred to after the close Monday is below.

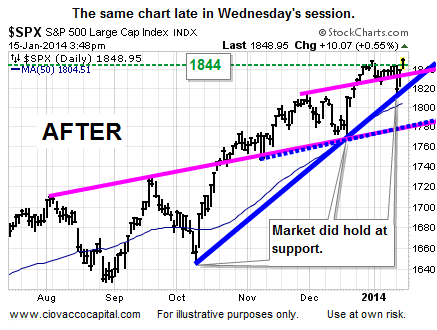

As you can see below, buyers did step in near the blue trendline and stocks rallied.

The small incremental change to our allocation allowed us to enter Tuesday’s session with a still significant exposure to stocks, permitting us to participate in the big gains Tuesday and Wednesday. The market’s risk profile continues to call for equity exposure. Consequently, we continue to maintain positions in U.S. stocks (VTI), financials (XLF), technology (QQQ), small caps (IJR), Europe (FEZ), and global stocks (VT).

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Big Picture Continues To Align With Bullish Case For Stocks

Published 01/16/2014, 12:26 AM

Big Picture Continues To Align With Bullish Case For Stocks

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.