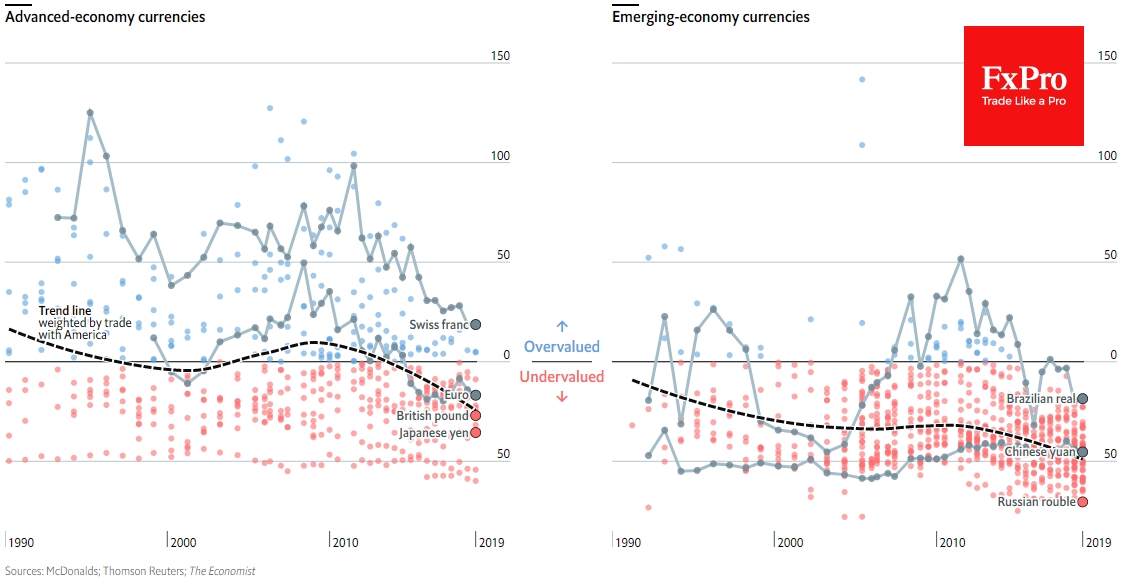

The Economist has published its updated estimates of exchange rates based on the Big Mac index. Among the popular undervalued currencies are the South African rand (-62.00%) and the Russian ruble (-61.2%), as well as the Turkish lira (61.0%). The ruble stands out in this trio, as its rate grew against the dollar by more than 10% last year. At the other end of the spectrum, the Norwegian krone, which is overvalued by 5.3% and the Swiss franc (18.4%).

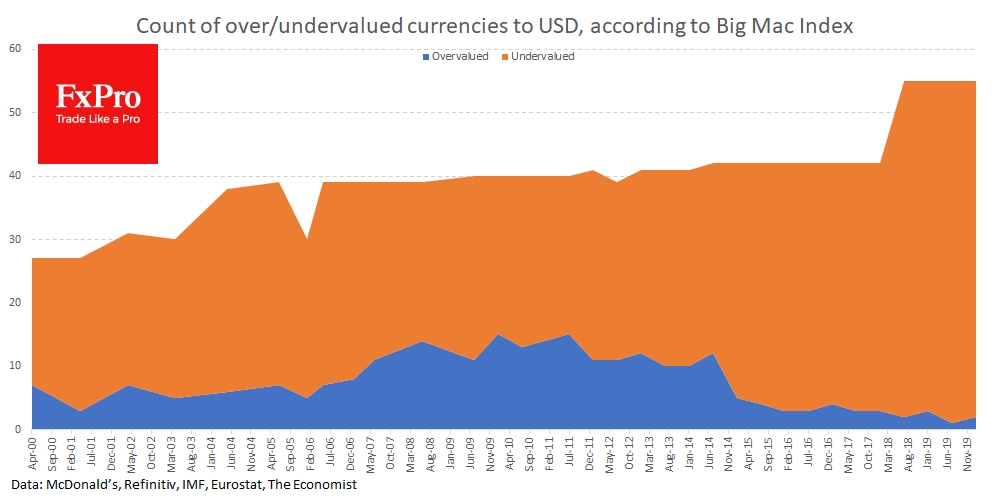

However, these local stories may not be interesting for global investors, they will only look at the dollar positions. By the beginning of 2020, only the above two currencies were overvalued against the dollar, while ten years ago there were 15 such currencies, and 14 before the Global Financial crisis (estimated as of June 2008).

What does it mean for the dollar for now? Absolutely nothing. History shows that while currencies tend to compensate for their under/overpricing, this path takes years and can be abruptly interrupted at any moment by sudden economic shocks.

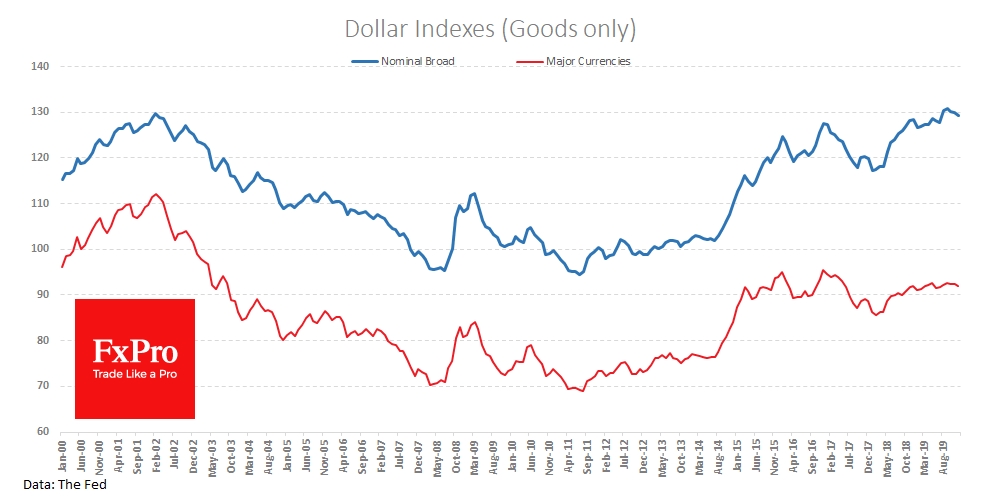

If we look at a longer perspective, it turns out that Trump is right about the excessively high dollar rate. Perhaps, Trump is also correct, blaming it the Fed’s tight policy, as USD has moved up sharply due to signals of tightening monetary policy in 2014.

This growth had stopped by Trump’s tax reform in 2017, and the global growth became synchronous and accelerated for several quarters. This weakening of the dollar was also arrested by Trump, who decided to revise trade agreements one after another.

The history of the index is not very extensive, so it isn’t easy to make unequivocal forecasts based on these data. However, it follows from these data that the dollar has noticeably broken away from major currencies. This theory suggests that this or next year the dollar may be under pressure, starting to compensate some overvalue.

We observed A similar pattern after 2001 when only three currencies were overvalued against the dollar. And this trend developed up to the middle of 2008 when the dollar started to grow actively in response to the increased demand for protective assets.

The FxPro Analyst Team