Shares of Big Lots, Inc. (NYSE:BIG) are down 1.8% at $48.20, at last check, as discount retailers swoon in sympathy with Dollar Tree (NASDAQ:DLTR) and Dollar General (DG). Big Lots is slated to unveil its own second-quarter earnings report before the market opens tomorrow, Aug. 31. Below we will take a look at how BIG stock has been performing on the charts, and dive into what the options market has priced in for the shares' post-earnings moves.

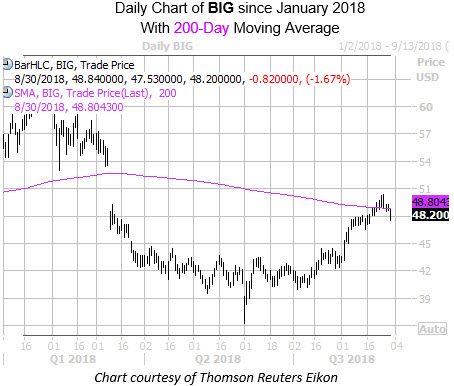

Big Lots stock has rebounded nearly 28% since its June 1 two-year low of $36.20. However, the shares have struggled to overtake the $48-$50 region -- where they landed after a post-earnings bear gap in March. This area is also now the home to BIG's 200-day moving average.

Looking at the stock's earnings history, BIG has closed lower the day after the company reported in five of the last eight quarters, including the last four in a row. Over the past two years, the shares have averaged a 3.8% move the day after earnings, regardless of direction. This time around, the options market is pricing in a 10.1% move for Friday's trading -- more than double the norm.

Digging deeper, it looks like recent options buyers are betting on Big Lots to break its streak of negative earnings reactions. Data from the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) shows BIG with a 10-day call/put volume ratio of 9.87, suggesting nearly 10 calls have been bought to open for every put in the past two weeks. What's more, this ratio ranks in the 96th percentile of its annual range, suggesting a much healthier-than-usual appetite for bullish bets over bearish of late.

As such, BIG's Schaeffer's put/call open interest ratio (SOIR) of 0.46 ranks in the 14th percentile of its annual range. This indicates that near-term call open interest more than doubles put interest right now, and that short-term traders have rarely been more call-biased in the past year.

However, some of the recent call buying -- particularly at out-of-the-money strikes -- could be attributable to BIG shorts seeking an options hedge before earnings. Short interest accounts for 24% of the stock's total available float. At BIG's average pace of trading, it would take shorts nearly two full weeks to buy back their bearish bets.