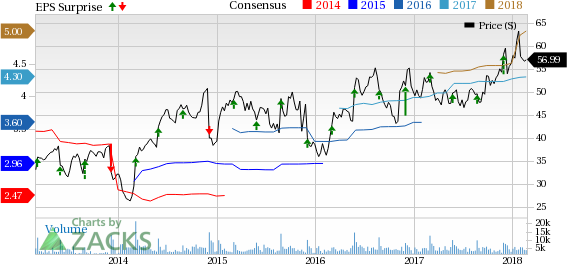

Big Lots, Inc. (NYSE:BIG) is expected to report fourth-quarter fiscal 2017 results on Mar 2. Notably, the company’s earnings have outpaced the Zacks Consensus Estimate for eight straight quarters now, with a trailing four-quarter average of 11.1%.

Moreover, the Zacks Consensus Estimate of $2.42 for the fiscal fourth quarter has moved up by a penny in the last 30 days and is likely to witness a year-over-year growth of more than 7%. Analysts polled by Zacks also expect revenues of $1,649 million in the impending quarter, up nearly 4.3% from the year-ago quarter.

Let’s see how things are shaping up prior to the earnings announcement.

Factors Likely to Impact 4Q17

Big Lots’ furniture financing programs and soft home category have been consistently gaining traction, which is likely to continue in the fourth quarter as well. Meanwhile, management has been expanding assortments in the furniture category by including lawn and garden items. In order to tap the opportunities in the furniture and soft home categories, the company also added more brands and revamped the food department by giving it a fresh look for the convenience of customers. Moreover, the company’s merchandising strategies and effective marketing seem to be paying off quite well.

Notably, all these initiatives are driving the company’s comparable-store sales (comps), which increased in 13 of the trailing 15 quarters. For the fourth quarter, comps are expected to be up in the range of flat to up 2%. Comps are likely to grow roughly 1% in fiscal 2017. Further, adjusted earnings per share are envisioned in the band of $4.23-$4.28 for the fiscal, which represents growth of 16-18% from the previous year. For fiscal 2017, the Zacks Consensus Estimate is pegged higher at $4.30.

However, Big Lots is not doing well on the revenue front. Its sales have lagged estimates in seven of the last nine quarters. Also, management had earlier trimmed sales guidance for fiscal 2017. Sales growth for the year is projected to be up approximately 2% compared with 2-2.5% anticipated earlier. Analysts surveyed by Zacks expect revenues of $5.28 billion for the fiscal year.

Moreover, sluggishness in electronics, toys and accessories remains a concern. Gross margin is expected to decline year over year in the final quarter of fiscal 2017 as well.

What Does the Zacks Model Unveil?

Nonetheless, our proven model shows that Big Lots is likely to beat earnings estimates this quarter. This is because a stock needs to have both — a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) — for this to happen. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Big Lots has an Earnings ESP of +0.87% and a Zacks Rank #2, making us reasonably confident of an earnings beat.

Other Stocks With Favorable Combination

Here are some companies you may want to consider as our model shows that these too have the right combination of elements to post an earnings beat:

G-III Apparel Group, Ltd. (NASDAQ:GIII) has an Earnings ESP of +22.45% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Dollar General Corporation (NYSE:DG) has an Earnings ESP of +1.07% and a Zacks Rank of 2.

Best Buy Co., Inc. (NYSE:BBY) has an Earnings ESP of +4.59% and a Zacks Rank #2.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

See This Ticker Free >>

Best Buy Co., Inc. (BBY): Free Stock Analysis Report

Dollar General Corporation (DG): Free Stock Analysis Report

Big Lots, Inc. (BIG): Free Stock Analysis Report

G-III Apparel Group, LTD. (GIII): Free Stock Analysis Report

Original post

Zacks Investment Research