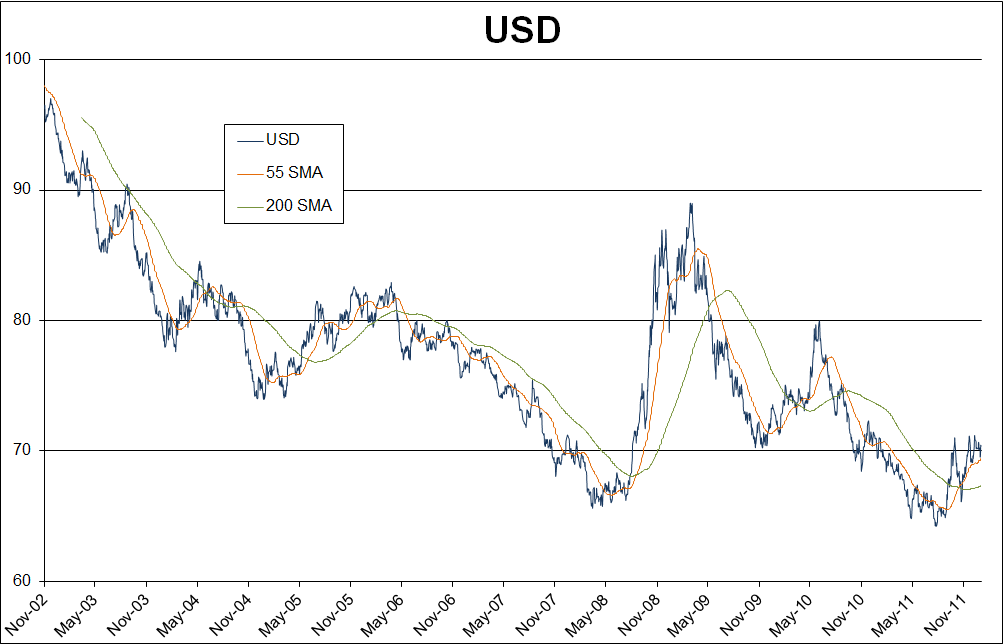

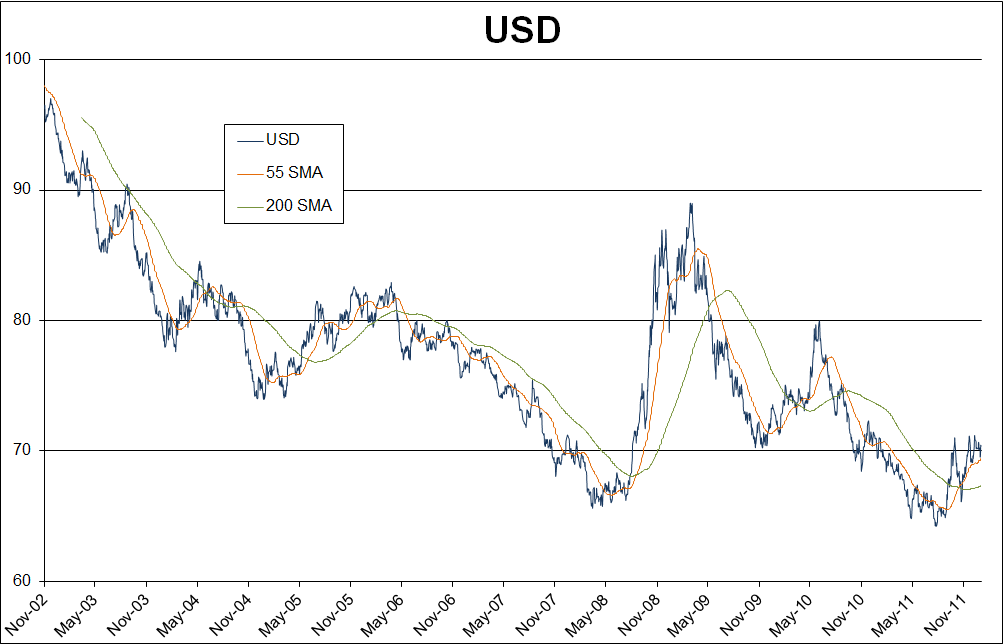

USD

The USD/G10 basket has yet to extend beyond its recent tops as the pro-risk currencies have held their own against the greenback even as the Euro has suffered of late. The relative strength of the greenback in an environment of still elevated risk appetite is significant relative to previous behaviour.

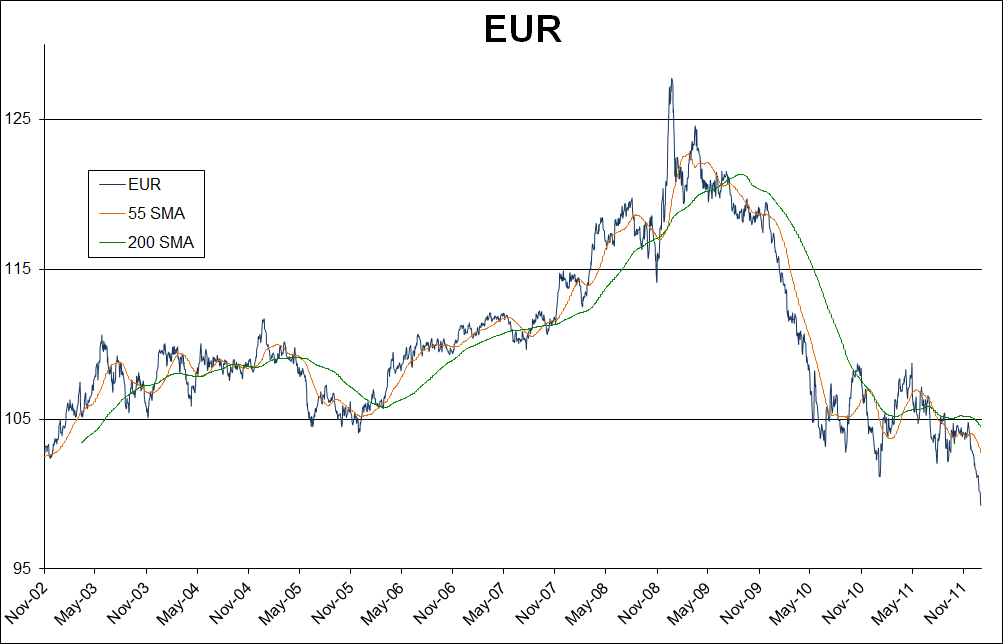

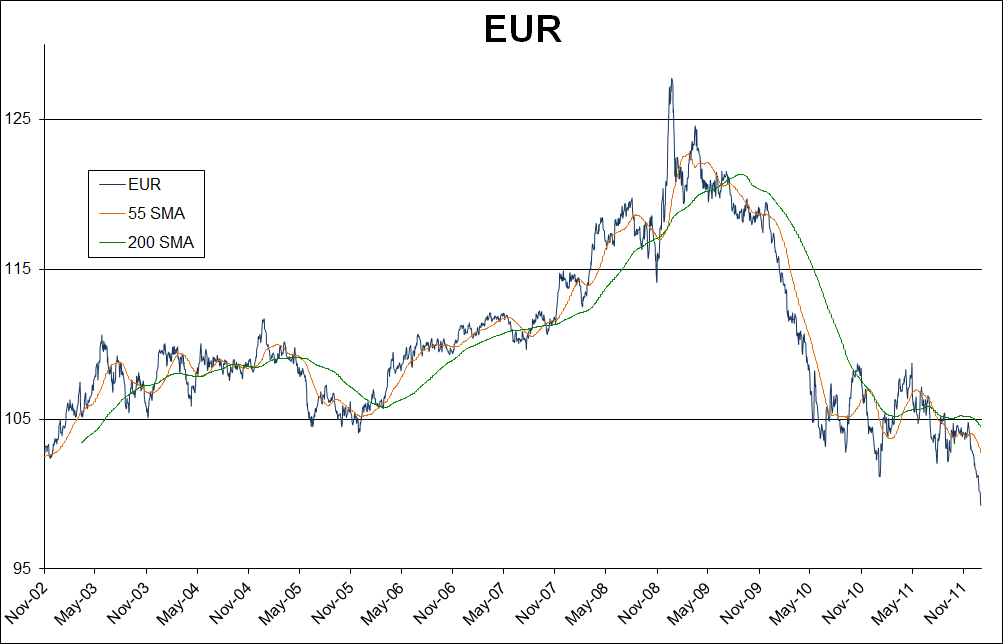

EUR

The Euro has obviously been the weakling of the G10 as it has crumbled down through the levels at which it began trading back in early 2002. It’s relative performance versus the basket is not likely to continue much longer at this remarkable pace. Best candidate in a world where mean reversion happens? .

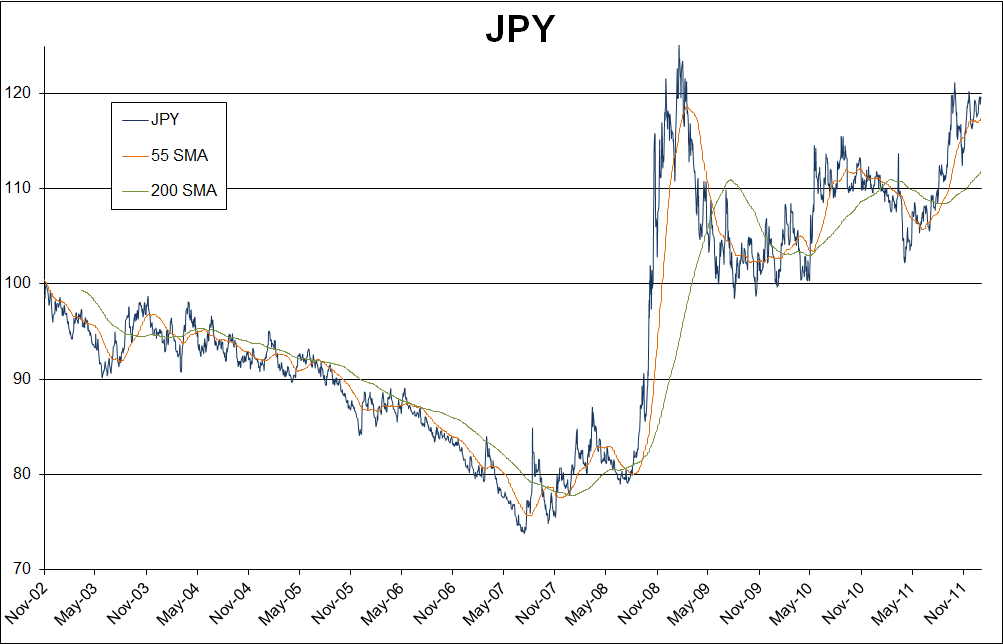

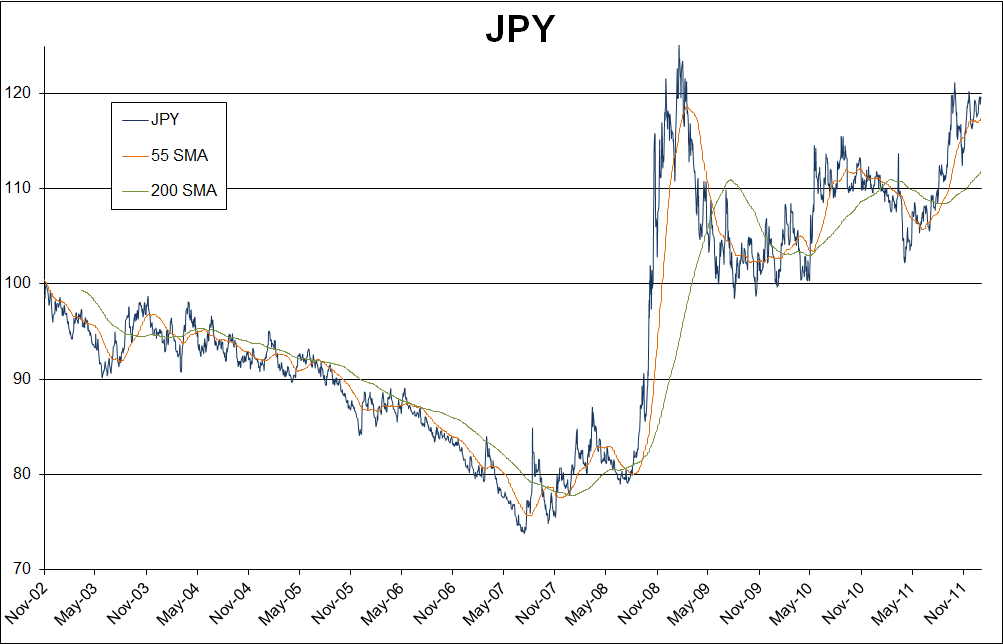

JPY

The JPY is pushing at its all-time high against the G10 with its latest surge. If interest rates remain very low and risk appetite rolls over, it could extend its gains. Interest rates and the determination of the intervention effort are the two critical factors this year.

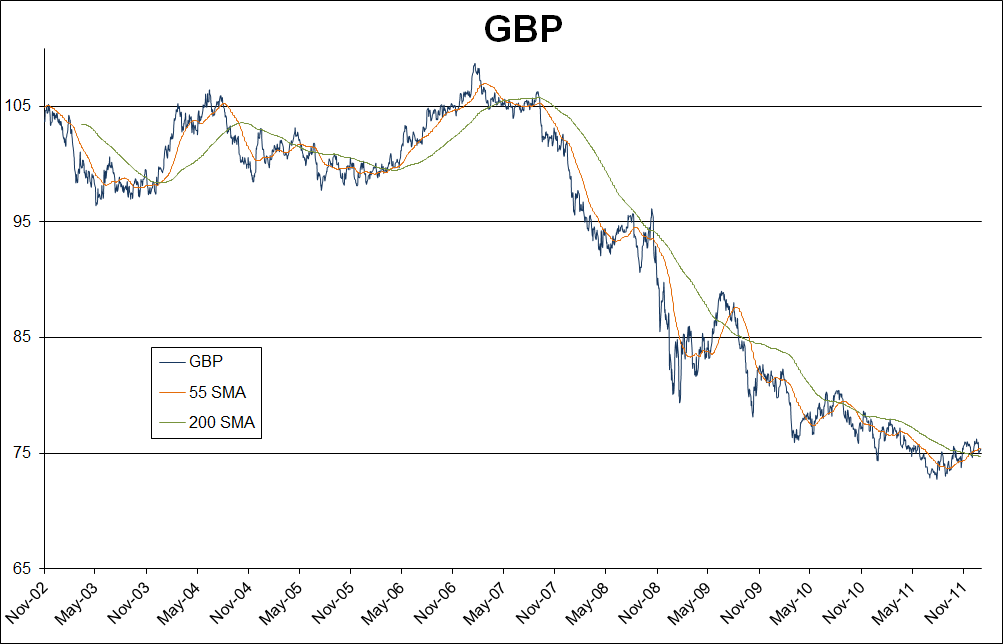

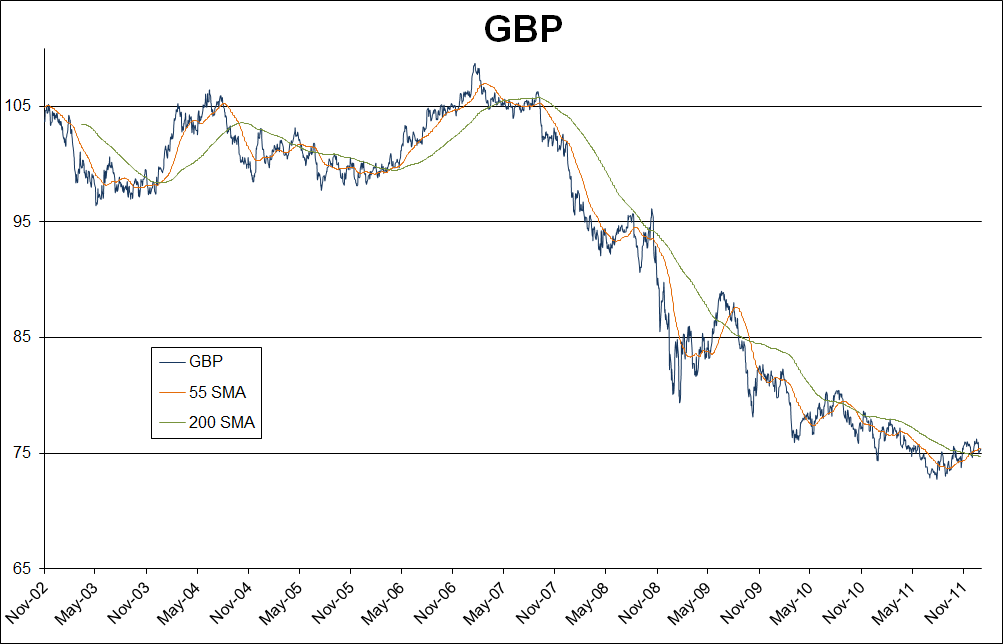

GBP

The pound stopped bleeding some time ago, but mostly only against the Euro and Swiss and the rally of the last few months hasn’t been particularly compelling. Elsewhere its performance hasn’t been particularly inspiring as its moves weakly echo those of the USD.

CHF

The SNB may be side-lined for a time until/unless we see more clarity and stability for the Euro Zone, or at least see the Euro regaining its feet. But even maintaining the floor in has seen Switzerland piggy-backing impressive declines against a basket of other G10 currencies.

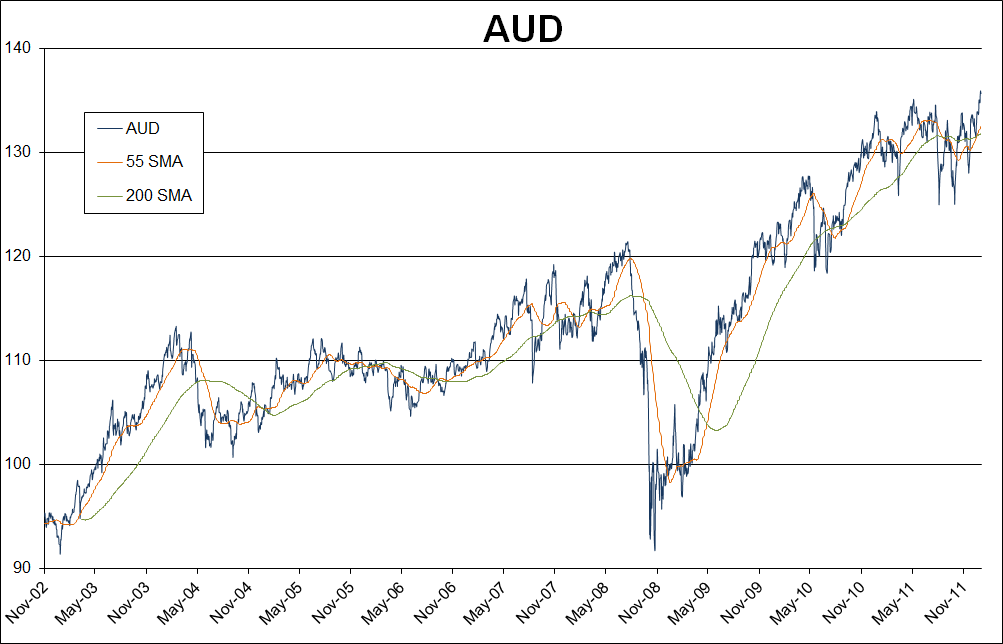

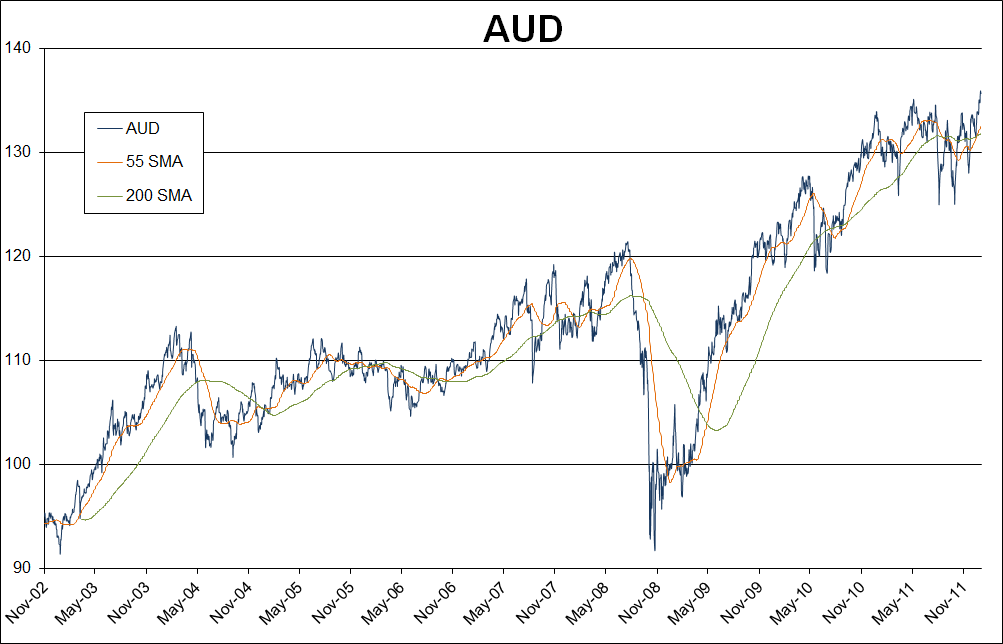

AUD

A new high for the currency. Maintaining these levels will require that commodities boom anew, that the Australian financial sector avoids too much damage from the domestic property bubble bust, that RBA easing expectations continue to ease and that China has a soft landing or better. That’s a tough prescription to write.

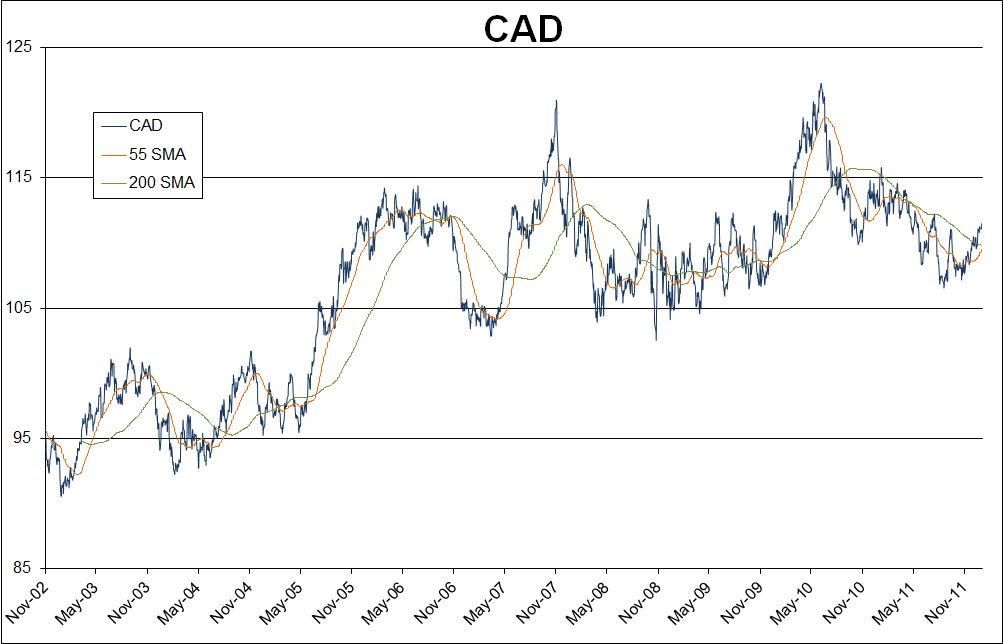

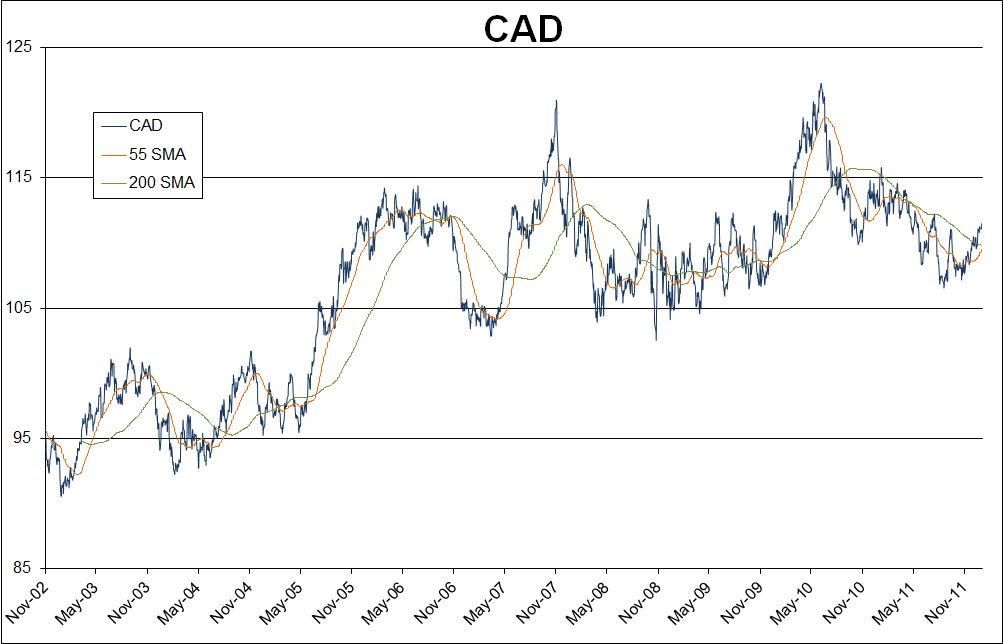

CAD

CAD has rallied respectably on the strength in the US economy and on relatively high risk appetite and the oil rally of late. It may continue to perform in a middle of the road fashion among the G10 going forward, with oil as an important wild card.

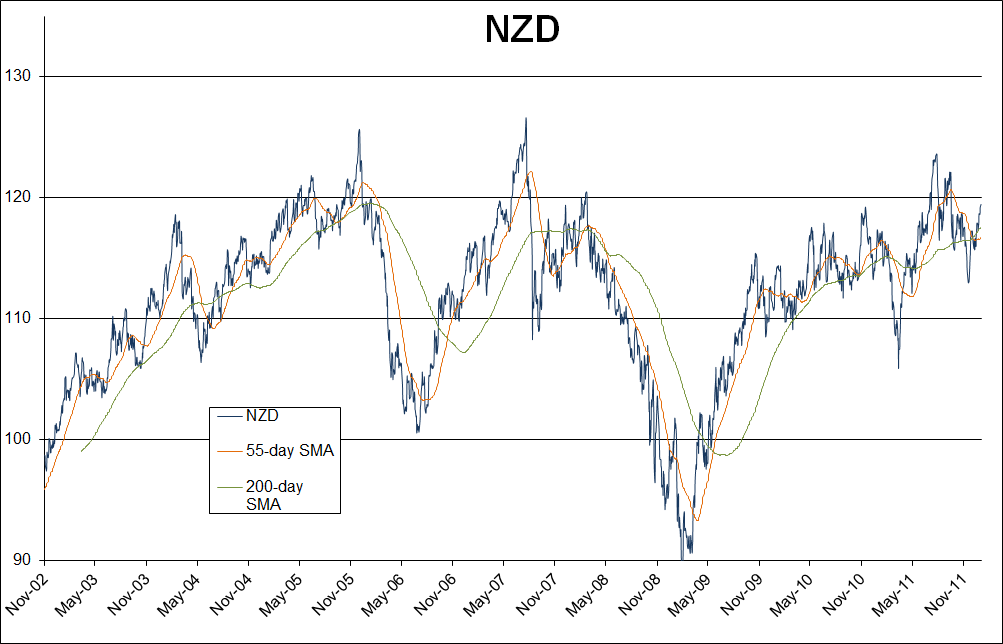

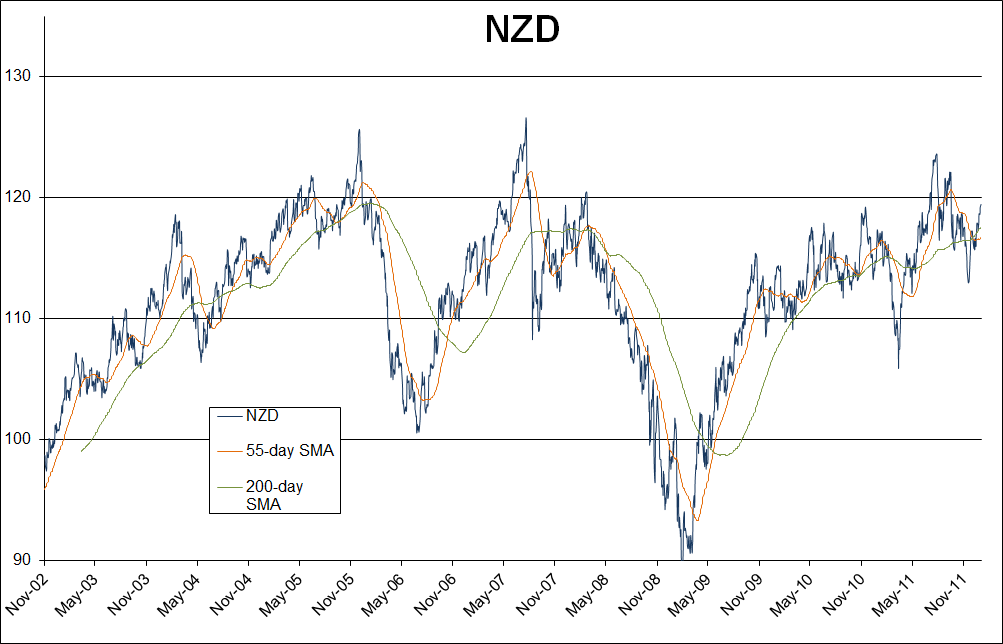

NZD

The kiwi is getting overambitious again with its rally back towards the cyclical top from last year. The drivers are solid risk appetite and the currency’s still relatively attractive 2.5% yield in an otherwise low-yielding world.

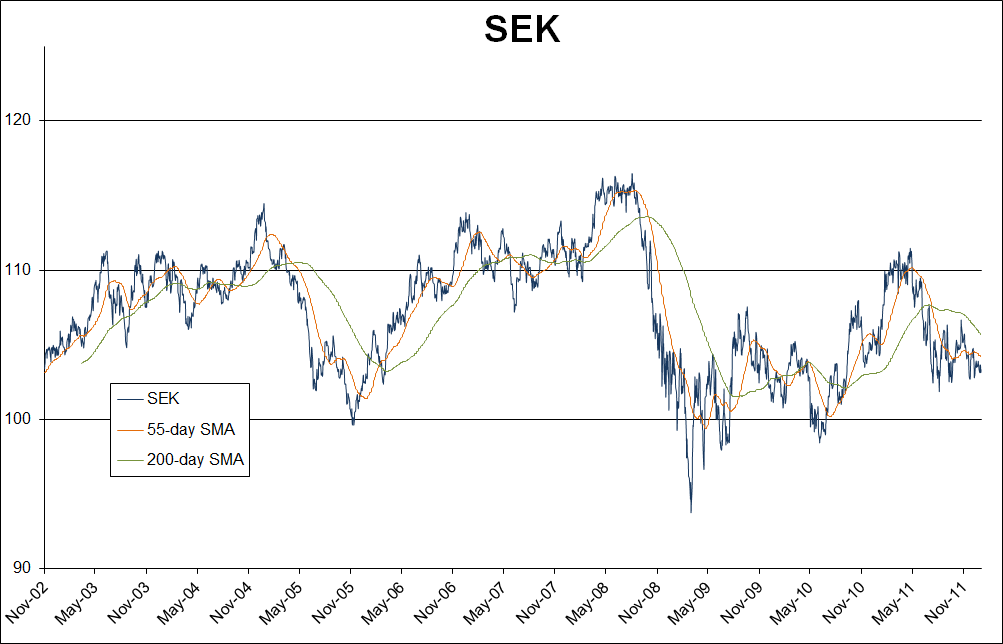

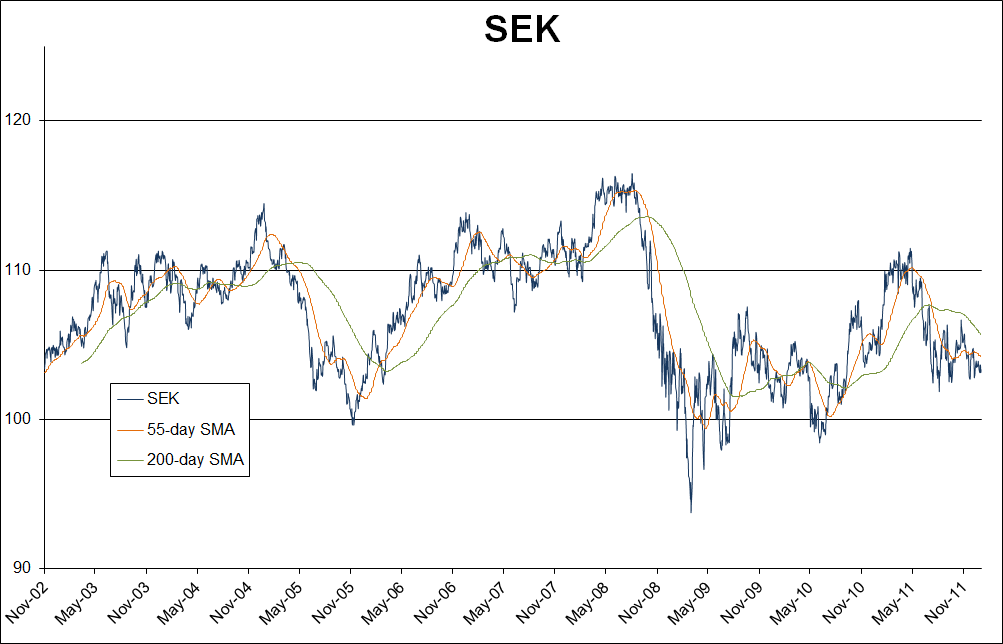

SEK

Against the broader G10, the SEK performance has been relatively weak of late, though it has clearly been dragged lower by Euro exposure. Still, its strength against the Euro itself has been marked, particularly given the fears for Euro Zone growth and what this will means for Swedish export prospects.. Sovereign stability is a critical factor in these markets.

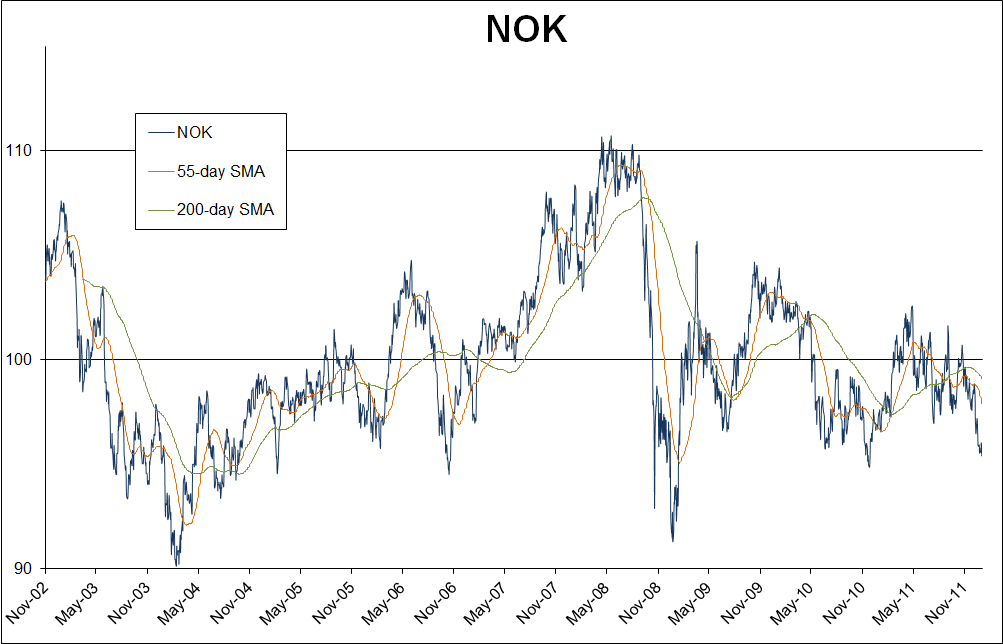

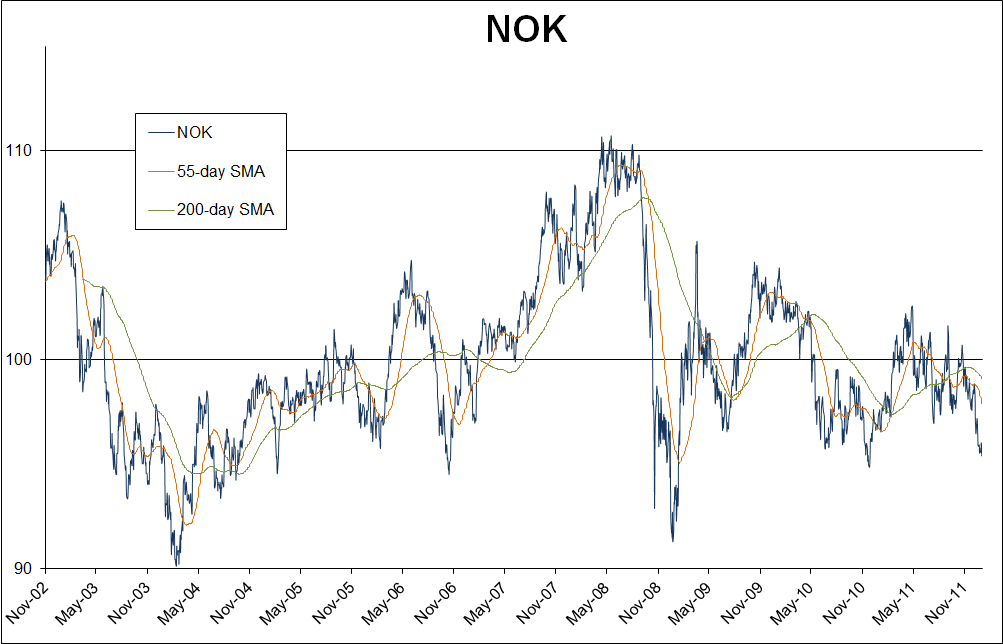

NOK

NOK is getting cheap down here, and its recent poor performance may simply reflect exposure to the weakening Euro and the fact that it has become more of a safe haven currency, so it will be interesting to see what happens for the currency when/if risk appetite sours, particularly if oil remains expensive.