The mainstream narrative as it relates to Chinese money is “tightening.” Having survived the economic downturn last year, we are to believe that the People's Bank of China (PBOC) is once again on bubble duty. They raised their reverse repo rates, considered to be their policy benchmarks, three times up to mid-March.

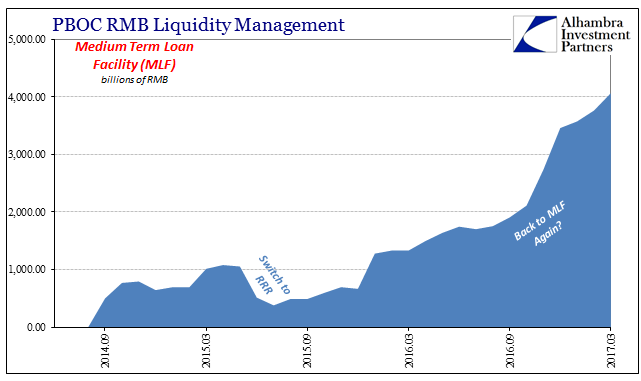

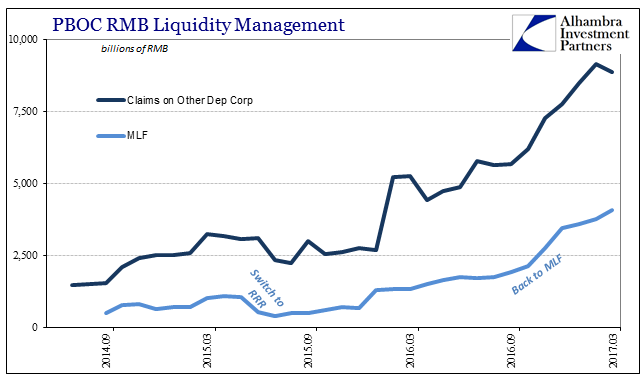

The central bank also increased the rate on its Medium Term Lending Facility (MLF) which has been a main source of RMB liquidity but for reasons that don’t conform to the narrative.

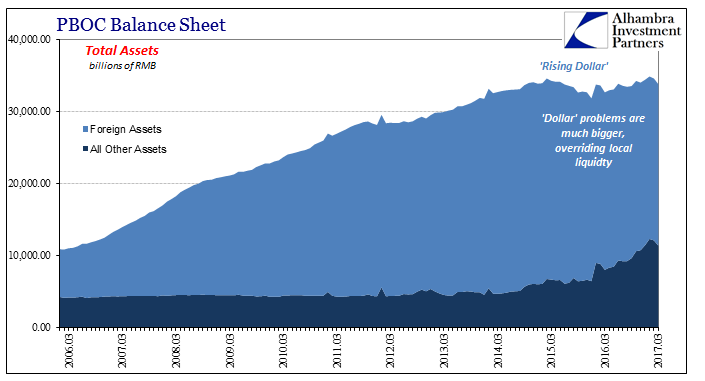

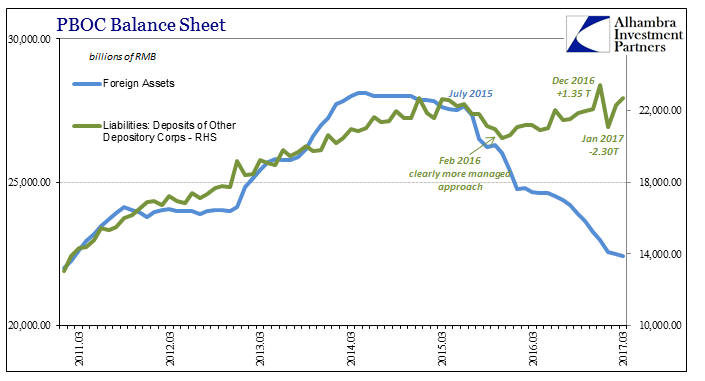

The PBOC balance sheet for the month of March 2017 shows us the impacts of both its currency policy as well as at least some outward appearance of tightening. There was very little change in the monetary base, which for China means forex “reserves.” It is actually consistent with Morgan Stanley (NYSE:MS) Market Vectors Renminbi USD (NYSE:CNY) being unusually stable well past its “ticking clock”, meaning that the PBOC is doing other things that don’t show up here. Those “other” transactions typically result in a tightening of RMB relationships.

As a purely monetary matter, bank reserves in March increased as a result of winding down holiday measures (including a much lower government balance). The post-2015 trajectory for bank reserves remains, which suggests a neutral policy rather than tight or loose.

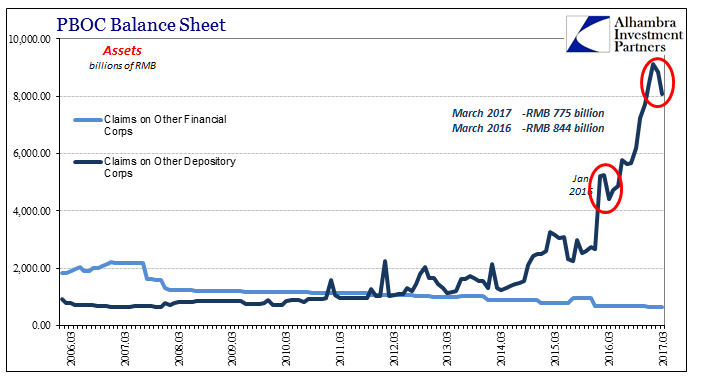

The only real drain on the asset side, and therefore an intentional monetary act, was for Claims on Other Depository Institutions. This has been the area where rather than exhibit a negative monetary stance the PBOC has been in RMB overdrive, acting hugely acquiescent instead. Though the balance fell for March, that wasn’t unusual given typical seasonality surrounding the offside of the New Year holiday. The decline on this line was actually less than it was in March 2016, suggesting that the PBOC left some additional RMB in the system.

While overall Claims had declined in normal seasonality, the primary source of expansion the past three years, the MLF, increased significantly. The PBOC reported a total MLF balance of more than RMB 4 trillion for the first time last month. It was an increase of RMB 303 billion, double the rate of expansion in February. In just the past five months going back to (and including) November, MLF usage has nearly doubled, rising an astounding RMB 1.95 trillion. It is that short amount of time which is exactly the period this “tightening” policy has supposedly been in place according to the narrative.

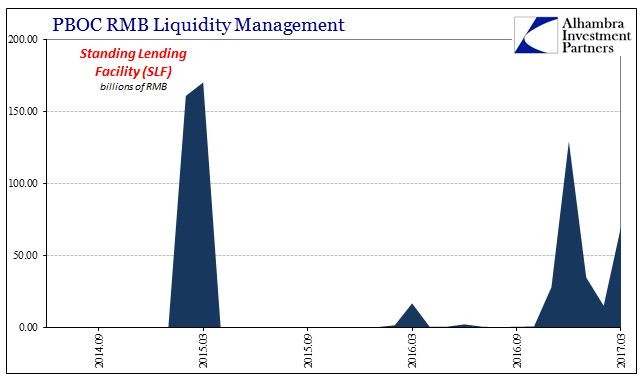

Not only that, someone in China has been using the SLF (Standing Lending Facility), like the MLF a relatively new tool supposed to operate like the US Federal Reserve’s Discount Window. The balance at the end of March was RMB 70 billion, an unusually high figure for any climate.

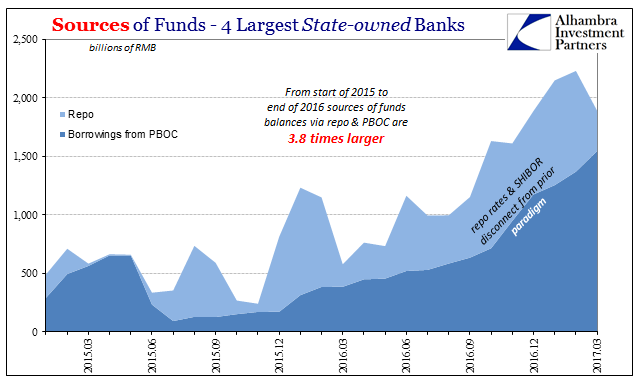

The effects of the PBOC balance sheet transfer directly to the financial conditions of China’s Big-4 State-owned Banks (SOB). These heavyweights had been over the past few years sourcing more and more RMB from repo markets than they have been redistributing excess RMB back into them. They have done this even though in parallel these banks are using the MLF (and possibly the SLF) to such a huge degree.

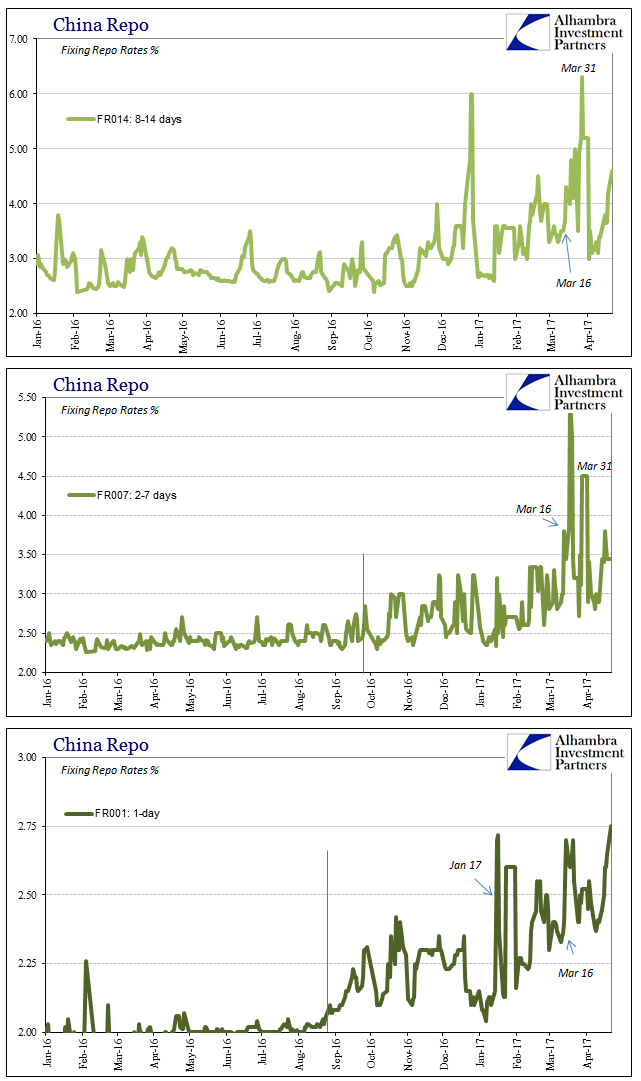

In March, however, they scaled back dramatically from sourcing the repo market and depended instead on the MLF for marginal funding. The reason is surely repo rates, which have moved far out of proportion with the description of monetary policy tightening.

Instead, more expensive private funding to such a considerable degree meant that in March it was much cheaper even at the elevated policy rate to borrow from the PBOC, which was only too happy to oblige.

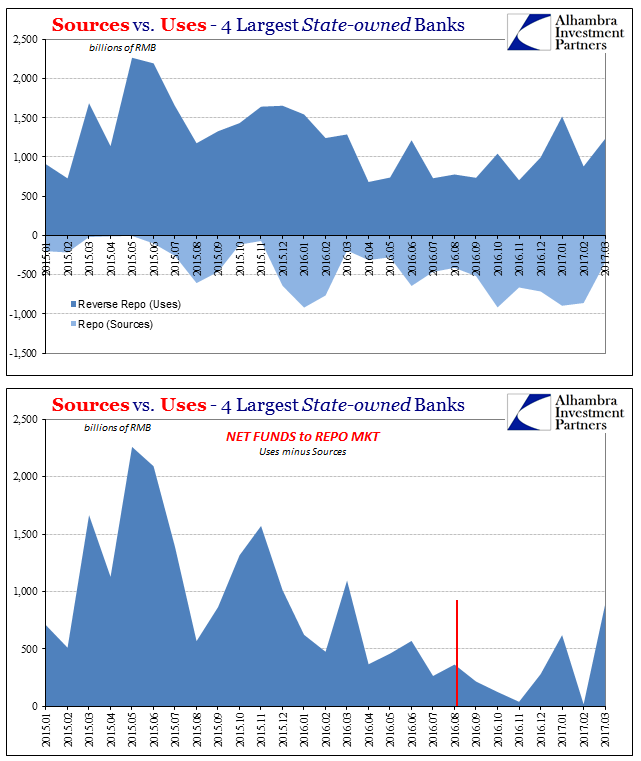

That should have reduced pressure in Chinese repo markets, without the Big-4 absorbing such enormous spare funding.

In February 2017, the total net supply from versus what was added back in repo was nearly zero, meaning that these large banks were adding nothing to repo where in years past they were among the largest supply channels. In March, however, the net to repo was the highest positive (shown above) since early last year, as these banks switched from sourcing repo to sourcing MLF (and other PBOC programs).

With such an accommodative balance from the central bank, you might surmise that repo rates in March were at least relatively better than in February and January. They weren’t.

Quite the opposite, actually, as repo rates throughout March rose far more than the policy reverse repo benchmarks. Taken together with the MLF activity and other huge accommodations, especially to the Big 4, I don’t see how “tightening” adds up to a policy direction.

If anything, we have to take the PBOC at its word, which remains a neutral policy position. Therefore, the accommodation especially through the MLF makes sense as the central bank struggles through excess RMB (and an enormous quantity of it) just to keep to that neutral position. Judging by rates in April, they have yet to achieve that desired outcome.

That leaves, as always, “something” else doing the tightening in RMB, more mechanical than intentional.