As I glance out the window, the yard is drenched with rain. Those of you who don’t live in the Bay Area need to understand why I point this out. It never rains except from November to March. Ever. For it to rain in June is the equivalent of Hillary Clinton successfully visiting the petites section at Bloomingdales and fitting into everything she tries. It’s the equivalent of a snowstorm in Phoenix in August. It just. Doesn’t. Happen. But……..

In other words, every negative prediction they’ve made (Japanese radiation, the Greek situation destroying the market, the markets crashing, gold zooming to thousands of dollars per ounce) never seems to pan out. Only the cynical stuff does.

This “opposite effect” struck me also yesterday when I glanced at MarketWatch and saw none other than Bob Prechter prominently featured as the most important article. My heart sank, because when a rah-rah permabull site like MarketWatch (which is sort of the USA Today equivalent of the financial media world) has Prechter as its lead story, you know that a rally is imminent.

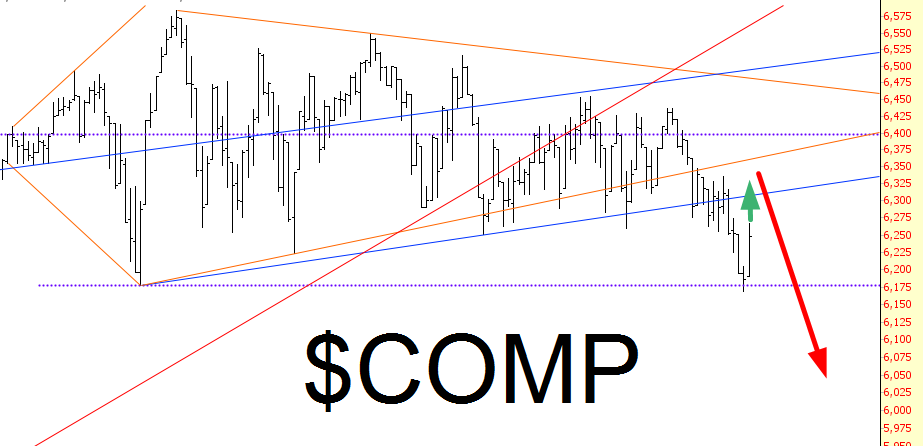

And so it was………but I gotta tell ya, this is not a solid base on which the bulls can build. It’s a bounce. An oversold bounce.

Looking at the S&P 100, for instance, it’s self-evident there are a series of lower lows and lower highs, and although today’s rally was powerful, it’s simply trekking its way back toward resistance.

My fervant hope, of course, is that we wrap up this bounce nonsense and resume the good, clean fun of price diminishment.

What appears to be driving this latest roar higher is the idiotic, never-ending Greece/Germany “who’s going to blink first?” insanity. That’s where today’s rally came from. An honest-to-God deal might make these lines of resistance moot. As always, we shall see, fingers crossed.