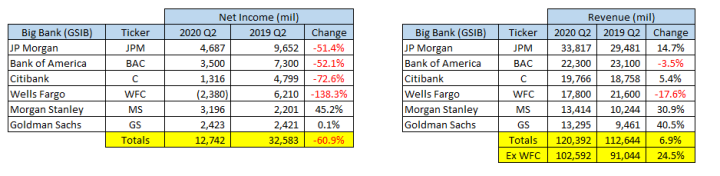

In the middle of the largest economic decline in history in the 2nd quarter of 2020, the big banks reported their best revenues ever, defying all expectations. The top six big banks – JPMorgan Chase (NYSE:JPM), Bank of America (NYSE:BAC), Citigroup (NYSE:C), Wells Fargo (NYSE:WFC), Morgan Stanley (NYSE:MS) and Goldman Sachs (NYSE:GS) – reported a 6.9% increase in revenues from last year which itself was a record year for banks.

If we exclude the debacle at the troubled Wells Fargo, the revenue increase was an astounding 24.5%. These are results coming in a quarter where the Atlanta Fed GDPNow is projecting a -34.7% decrease in GDP, the largest quarterly collapse in US economic history. This is an incredible story.

What is the cause for this surprising revenue surge? All of the big banks have sizable consumer and investment banking divisions. While consumer banking suffered as you would expect in the middle of an economic downturn, the trading units inside investment banking divisions posted record revenues. This is more easily seen in the results of traditional investment banks like Goldman Sachs and Morgan Stanley which saw 40% and 30% increase in revenues respectively. The Corporate and Investment Banking (CIB) division of JP Morgan made ever more money than its famous competitors posting 66% increase in revenues from $9.8 billion to $16.3 billion. Just astounding numbers.

Why do trading divisions make more money in a downturn? Because market volatility rises. Some investors seek to protect capital from losses while others see the opportunity to risk capital and make higher returns. When investors move money around, they pay trading fees and lose money to market makers in wider bid-ask spreads. All of the big banks are major market makers and in times of record market volatility like in Q2 their market-making units will make record revenues.

Investors don’t seem to appreciate this secret earning power of the Big Banks, this massive hedge against recessions. There are concerns about business bankruptcies from the COVID recession hitting bank profitability and causing big losses. Banks have been proactive and very conservative and took record amounts of credit loss provisions in Q1 and Q2. Yet despite all of those write-offs, banks as a whole posted $12 billion in profit. The Q2 economic downturn was worse than the worst stress testing scenario the Fed could imagine just 6 months ago and the banks passed this test with flying colors (Wells Fargo excluded). Going forward, as the economies of Europe, US and China recover and the COVID epidemic is better controlled, we can only expect smaller credit loss provisions and higher profitability.

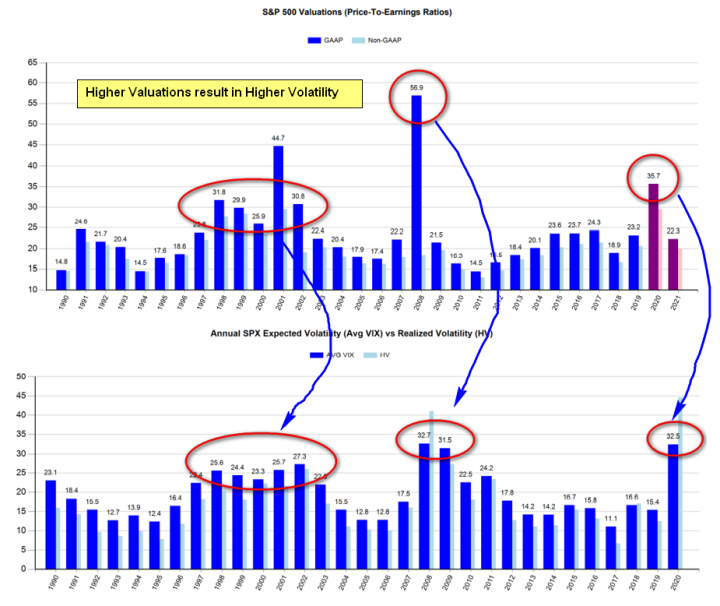

The question today is whether investment banks can continue to post these incredible results over the next 3-4 years. The answer to that question without any hesitation is YES. Investment banks make more money during times of higher volatility and higher volatility is correlated to higher valuations. As valuations of stocks become more detached from fundamentals, value investors have reasons to sell. There is presence of selling pressure when valuations are high than doesn’t exist at average or below-average valuations. That selling pressure from value investors makes assets more volatile. As you can see from the charts above, when stock multiples in the late 90s expanded above 25, the VIX started to average above 20. The same thing happened in 2008 and 2009. The same thing is happening in 2020. When valuations rise so does volatility.

Many market experts tell us to be ready to accept higher stock valuations that we have seen in the past over the next few years because of Fed policies and various other reasons. What that means is that we also have to accept higher levels of stock market volatility. The big revenue quarters put forth by the investment banks in Q2 are not a one-time occurrence. They will be a recurring revenue stream going forward. And that means that big bank multiples need to expand.

Goldman Sachs is trading at 80% price to book value and has a PE of 11. Morgan Stanley is trading at 9.5 multiple. Yes, less than 10. These are ridiculously low multiples. These companies are worth more broken up than together. Their trading units get no credit from investors. This is very similar to how the Amazon (NASDAQ:AMZN) Web Services division was undervalued for a long time because it was bundled with the online retail division of Amazon. This is similar to how the Azure cloud division was undervalued for a long time because it was bundled with the legacy Windows division inside Microsoft (NASDAQ:MSFT). We saw over the past 2 years how investors finally recognized the earning power of those cloud divisions and finally rewarded Microsoft and Amazon shareholders.

The same multiple expansion opportunity exists today for big banks and their trading divisions. The multiple of Goldman Sachs and Morgan Stanley can go up substantially towards the 16-17 level where it should be at minimum and would still be below the average market multiple. That represents at 40-50% return from current levels. JP Morgan can easily add another 20-30% to its market cap for its own trading division.

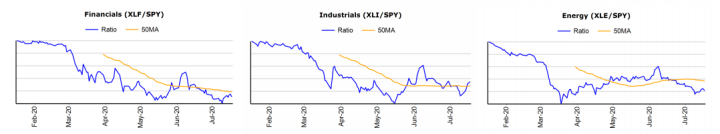

You can take advantage of this opportunity by buying XLF (Financial Select Sector SPDR Fund) or for investors with higher risk tolerance you can use targeted ETNs like BNKO (MicroSectors US Big Banks Index 2x Leveraged ETN) or BNKU (MicroSectors US Big Banks Index 3x Leveraged ETN). The big banks and, in particular, the investment banks are a strong conviction BUY. And even after this big stock market rally. Financials have lagged during this SPX rally. Financials continue to get no credit from investors like all other cyclical sectors and that presents an opportunity.