Almost a year ago, I penned Advancing Towards A World Without Jobs concluding that robotic technology will relentlessly eliminate jobs.

Half a century ago futurists predicted a world to come where automation would eliminate the need for humans to do many jobs…. Somewhere between that time and the present someone forgot to plan how these “liberated” people would get enough money to be able to afford to “grow the human experience.”

Economists currently continue to predict improvements in the rate of jobs growth based on historical data. I contend that overall employment will begin to decline before the end of this decade, and that political leaders need to begin now to re-gear the economy for world with fewer jobs.

When I wrote the original automation post, I did not consider 3-D printing (the ability to literally “manufacture” parts on a one-off basis). A post this past week stated:

The 3D printing revolution is not a decade or more away – it’s going to start showing up in mass production within the next five years. Despite skepticism, research demonstrates 3D manufacturing improvements combined with key patents will lead to a 79 percent reduction in average cost to print objects in five years, and a total of nearly 90 percent over the next 10 years.

3-D printing is currently envisioned by futurists as the manufacture of components at the location of assembly and just when needed. This will eliminate jobs and much of imports and exports. I see 3-D printing leading to the potential elimination of much of the goods production sector of the economy.

- Who says that a complete product cannot be printed (like a TV or mobile phone)? It just means the “printer” needs more than one cartridge (like the difference between black-and-white and color printers). How many of the almost 12 million American manufacturing jobs will be eliminated? Globally, how many jobs will be eliminated when goods can simply be printed?

- The supply chain will require almost no transport or warehousing. There will be little need for shipping when the product can be made locally on demand when needed. 35 million are now employed in these sectors of the economy. How many of these jobs will be gone?

- Will Amazon and Walmart just become print shops where you shop in front of a printing machine. How many of the 37 million involved in retail will no longer have jobs?

- How fast employment dislocation caused by 3-D printing begins will depend on the on the swiftness of the reduction “printing” costs.

- What happens if the costs get so low that the average Joe can afford a printer in his house? The ripple effect across the economy could affect most segments of employment and the way society is organized. Will peoples’ jobs be growing the food because goods will almost be free? Could this will reverse a century old migration from the country to the city.

There are growing headwinds (caused by automation, robotics) which in a short period of time will have jobs growth well under population growth, but politicians and economists are not yet reacting to the change in dynamics. There are social issues to deal with when the economy cannot grow jobs.

Are there solutions? I see some but they carry poison to a capitalistic and consumption based economy. I am counting on those smarter than me to engineer an acceptable social and economic solution. Would the government paying people to spit at the moon create an inefficient economy? Being able to produce much of what a population needs with only a small number of that population employed creates a confounding dilemma.

Other Economic News this Week:

The Econintersect economic forecast for June 2012 again declined marginally, and remains under a zone which would indicate the economy is about to grow normally. The concern is that consumers are spending a historically high amount of their income.

The ECRI WLI growth index value has been weakly in positive territory for over four months – but in a noticeable improvement trend. The index is indicating the economy six month from today will be slightly better than it is today.

Current ECRI WLI Growth Index

Initial unemployment claims degraded from 334,000 (reported last week) to 343,000 this week. Historically, claims exceeding 400,000 per week usually occur when employment gains are less than the workforce growth, resulting in an increasing unemployment rate.

The real gauge – the 4 week moving average – improved from 346,000 (reported last week) to 345,250. Because of the noise (week-to-week movements from abnormal events AND the backward revisions to previous weeks releases), the 4-week average remains the reliable gauge.

Weekly Initial Unemployment Claims – 4 Week Average – Seasonally Adjusted – 2011 (red line), 2012 (green line), 2013 (blue line)

Bankruptcies this Week: Maxcom Telecomunicaciones, American Roads Holdings

Data released this week which contained economically intuitive components(forward looking) were:

- Rail movements growth trend is currently decelerating.

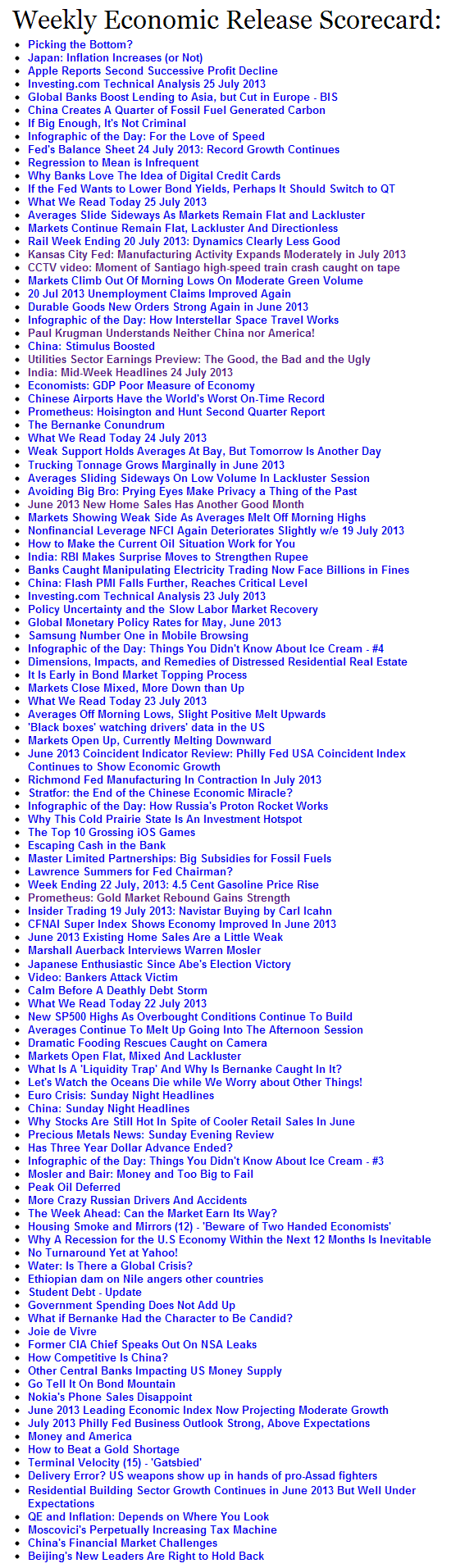

Weekly Economic Release Scorecard:

Click here to view the scorecard table below with active hyperlinks