The casual consumer of economic news may be tempted to lump the recent surge in recession warnings as one of a kind. But the quality and reliability in this corner of macro analytics varies widely and so it’s essential to recognize the basics for how and why business cycle profiles diverge.

Recession analytics come in three primary flavors: 1) backward-looking summaries; 2) estimates of the current state of the economy; and 3) projections of the future. For (hopefully) obvious reasons, as you move from 1 to 3, your skepticism should rise.

Too often, however, all three are treated as equivalent. But common sense tells us that a warning that the economy is in danger of falling into contraction a year from now is far less dependable vs. a current assessment of conditions or reviewing recent history. The logic here is that the availability of published data, or the lack thereof, determines how to think about a given recession estimate.

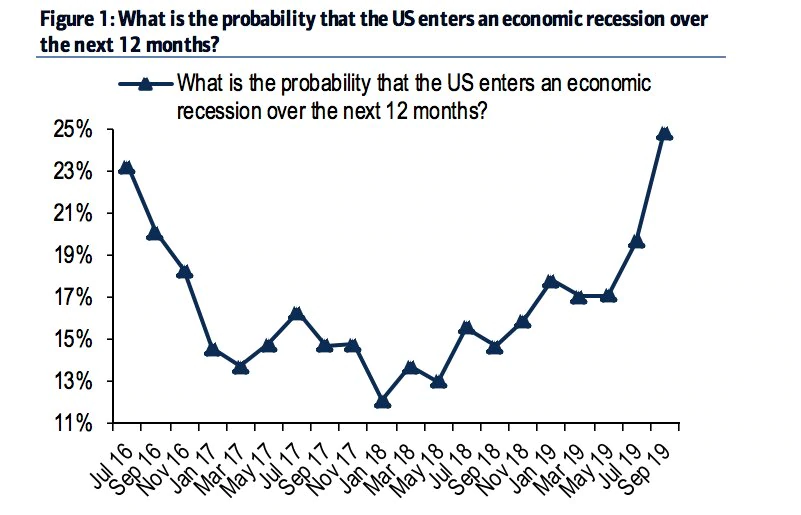

Consider, for instance, a new Bank of America Merrill Lynch (NYSE:BAC) survey of US credit investors, which was breathlessly presented this week as a warning that a “recession fears have hit an all-time high, its highest reading” according to a headline. That sounds worrisome, but the details reveal that “the perceived probability of a recession in the next year spiked to 25%” and the history of the data set are a mere three years old.

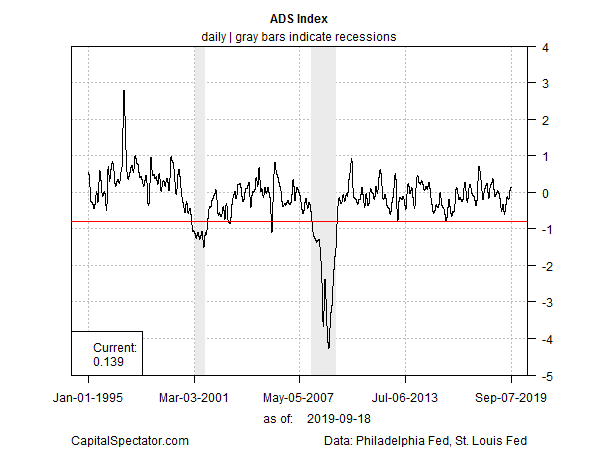

By contrast, yesterday’s update of the Philadelphia Fed’s ADS Index revealed that a backward-looking measure of the economic activity, using hard data, strengthened to a moderate pace of slightly better-than-average conditions (above 0) relative to the benchmark’s multi-decade (albeit partly back-filled) history. Note that the latest reading (+0.139 for Sep. 7) is well above the -0.80 mark (red line in chart below) that a San Francisco Fed paper recommends as a tipping point for signaling the start of a recession for analyzing ADS data.

The ADS Index, as usual, is slightly dated. Industrial production, for example, is one of the index’s inputs and the latest report runs through August. We could, however, supplement the ADS results by estimating how the inputs may evolve and thereby guesstimate current conditions.

As for the business of forecasting proper, these projections come in many varieties, which means that reliability and accuracy can and do vary widely in this niche of recession analytics. As a simple example, looking ahead by a month or two (as I routinely do here) offers a more robust estimate of future economic conditions vs. trying to look out a year from now.

It’s a safe bet that the weakest results will be found in the forecasts that look far ahead, as several studies confirm. Research in 2013 in the International Journal of Forecasting, for instance, found that forecasts of US GDP were considerably better for short-term horizons vs. their longer-term counterparts.

How should an informed consumer of business cycle analytics choose among rear-view mirror profiles, current estimates and forecasts? By not choosing at all. All three are useful, assuming they’re designed intelligently. As a result, backward-looking analysis, current estimates and near-term projections offer valuable information for assessing recession risk and so carefully aggregating data from all three disciplines will likely offer a higher level of reliability and timeliness compared with looking at any one set of metrics in isolation.

Therein lies the reasoning for estimating recession risk based on multiple business-cycle indicators. The real-time results have been encouraging in recent years, largely by minimizing the noise and emphasizing the signal.

At some point a new recession will strike. The only question: Will you be looking at a reliable, timely signal for guidance? Unlikely… if you’re relying on the usual suspects and/or cherry-picking indicators.