Last week, the Dow Jones Industrial Average (DJIA) gained 1.0%, but the Nasdaq Composite (COMPQ) lost 1.1%, making for a rather sizeable weekly price divergence of more than 2% between the two popular stock market indexes. Although it is unusual when two or more of the major indices trend in the opposite direction of one another, it occasionally happens.

A significant part of the recent weakness in the Nasdaq could be blamed on the dismal performance of Apple Inc. (AAPL), which plunged nearly 9% last week and closed back down near its mid-November low. Since AAPL carries roughly a 10% weighting in the Nasdaq, the stock has a tendency to lead the entire Nasdaq index in either direction.

Regardless of Apple’s dead weight effect on the Nasdaq last week, the actual reason for the sudden “emergence of divergence” between the Nasdaq and Dow is largely irrelevant to us. Rather, as technical traders, it is more important to simply be aware the price divergence is taking place, then take that into consideration if entering any new positions in the coming days.

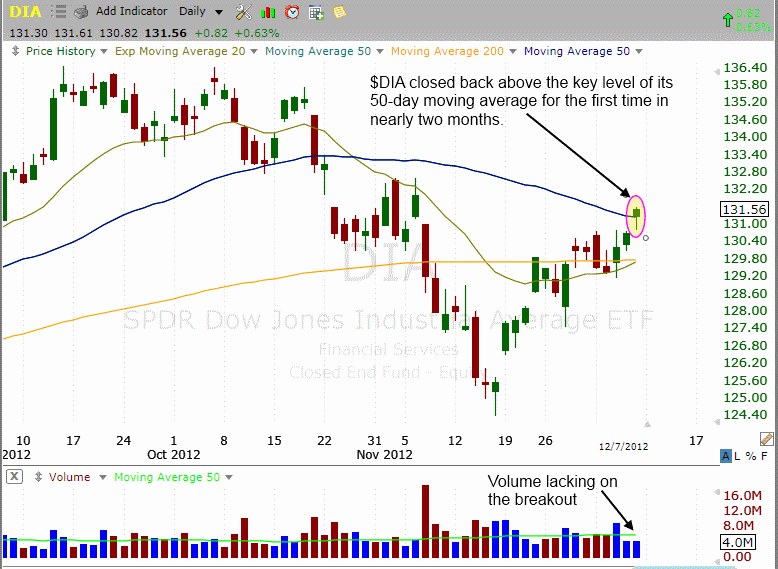

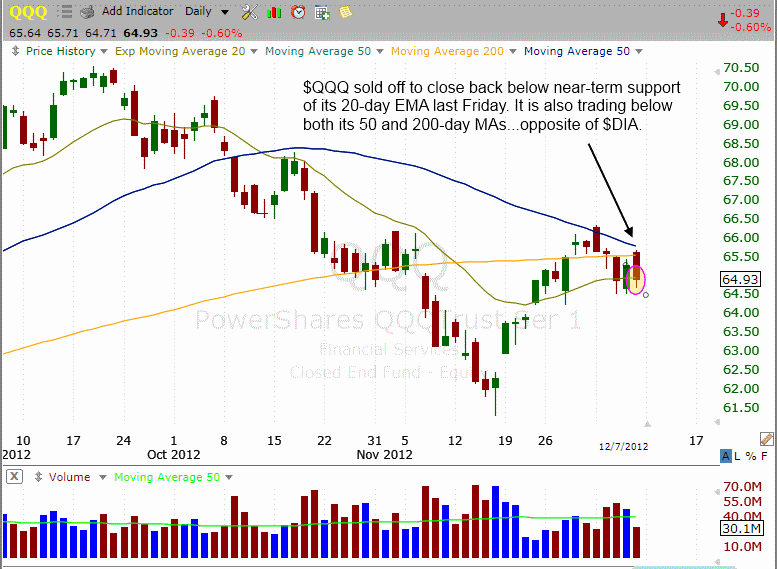

Below are the daily charts of Dow Jones SPDR (DIA) and PowerShares QQQ Trust (QQQ), two popular ETF proxies for the Dow Jones Industrial Average and Nasdaq 100 Index respectively. When comparing the prices of both ETFs in relation to their respective 20, 50, and 200-day moving averages, the substantial and increasing price digression becomes easy to see:

On the first chart above, notice that last Friday’s gain enabled DIA to close above key intermediate-term resistance of its 50-day moving average for the first time in nearly 2 months. DIA is now trading firmly above both its 20 and 200-day moving averages as well.

Conversely, QQQ reversed sharply lower after gapping to open at resistance of its 50-day moving average, which led the ETF to subsequently sliding back below both its 20 and 200-day moving averages as well. Put simply, the Dow is trading above support of the near, intermediate, and long-term moving averages we closely follow, while the Nasdaq is trading below resistance of the same three moving averages.

One simple way a short-term ETF swing trader could attempt to profit from the current parting in the broad market is through buying DIA and/or simultaneously selling short QQQ. Doing so might position oneself to benefit from the mixed price action the main stock market indexes are currently showing. However, we have found from years of experience that swing trading often becomes more challenging in periods when such price dissemblance exists.

More specifically, we know that market conditions such as the present often leads to an increase in the number of erratic, whipsaw-like trading sessions, which are caused by an increasing tension in a match of tug-of-war between the bulls and bears. Therefore, rather than entering new ETF or stock trades to attempt to profit from this price divergence, our preferred plan of action is to merely focus on managing the existing positions in The Wagner Daily model trading portfolio for maximum profitability and minimum risk. With regard to new swing trades, we are shifting into “SOH mode” (sitting on hands) at the present time.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Beware The 'Emergence Of Divergence' Sparked By Apple

Published 12/10/2012, 07:33 AM

Updated 07/09/2023, 06:31 AM

Beware The 'Emergence Of Divergence' Sparked By Apple

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.