Many traders and investors love to see and find a good breakout pattern on the charts. While such patterns are great, we've got to know when they become parabolic. That's because parabolic charts often signal the time to sell out of the trade.

Parabolic Defined

A parabolic chart is when a stock price rallies sharply higher in a very steep angle on the charts. Often, when a stock surges sharply higher without pulling back, it can only travel so far before the owner of that equity starts to sell out of the position.

Don't Chase Extended Equity

For example, the other day First Solar Inc. (FSLR) soared after reporting better-than-expected guidance. Many short sellers were caught off guard causing a short squeeze in the stock, which rallied higher by $14 on the day from around $27 to $41 intra-day. That type of surge is what we would call a parabolic intra-day move. Now we can only wonder who was buying the stock at $41 after such an enormous intra-day bounce. Some of the buyers were short sellers that had to close out their position while others were likely the misinformed retail traders trying to catch the momentum in the stock. Either way, when you see an equity rally in that type of steep formation, it's unsustainable and the equity will pullback. Today, FSLR stock is trading around the $37 level. The idea here is to make sure that you do not chase the equity when it reaches extended levels. Traders should wait for it to pullback and form a pattern that will signal further upside.

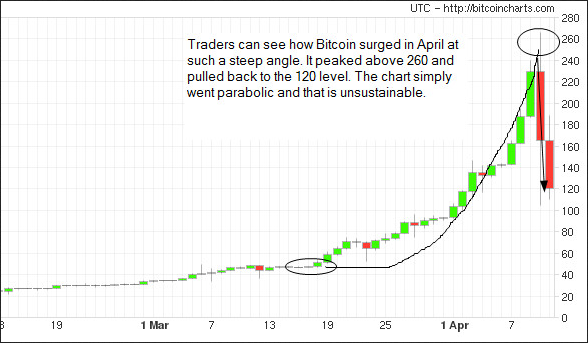

Another good example that occurred recently is the chart on Bitcoin, the virtual currency that has soared recently from under $10 to more than $200. Many investors and traders are asking why the virtual currency sold off so sharply after trading above the $200 level. The reason is the same as any other equity -- it traded in an unsustainable parabolic manner.

In March 2012, the same type of pattern occurred in a stock called Broadvision Inc. (BVSN). This stock surged from $10 a share to $55 in just two months. That type of pattern is again unsustainable and the traders and investors that caught the move are going to sell out of the position at the highs. That stock plunged from a high of $55 a share back down to $10 in just three months.

Watch The Steep Angles

The same parabolic patterns repeat over and over throughout history on all time frames. Traders and investors must simply know that it is not prudent to chase an equity when the chart pattern moves up in a very steep angle. Knowing this pattern should help to keep a lot of novice traders and investors out of buying equities that have already made their momentum move.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI