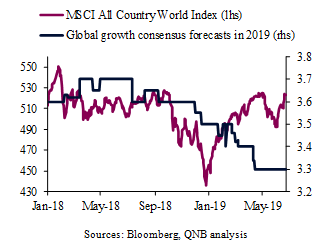

The outlook for the global economy continues to weaken. In fact, Bloomberg consensus forecasts for global growth in 2019 has changed from 3.6% in Q4 2018 to 3.3% at the time of writing. Similarly, the IMF has revised down its projections for global growth in 2019 twice since October 2018, from 3.7% to 3.3%. Importantly, leading indicators of global demand continue to deteriorate and move away from their 2017-2018 peaks. The IHS Markit global manufacturing Purchasing Managers’ Index (PMI) has recently turned into contraction territory (below the 50 mark) for the first time in more than three years.

Nevertheless, market sentiment has been improving in 2019. Equity markets and volatility metrics, key benchmarks for investor sentiment, are both pointing to a more benign environment at the time of writing than in late 2018. In fact, the MSCI All Country World Index, a free-float weighted equity index of both developed and emerging markets, is up 15% so far this year, washing out last year’s losses. Moreover, the Chicago Board Options Exchange Volatility Index (VIX index), which is a traditional “fear gauge” for markets and moves in opposite direction to sentiment, has eased significantly with a 40% decline year-to-date.

The main driver for such divergence between macroeconomic conditions and market sentiment has been the so-called US Federal Reserve “dovish pivot,” i.e., a marked change in US monetary policy stance from a steady tightening to a full pause with the possibility of rate cuts down the road. As bond markets start to expect aggressive US rate cuts over the coming quarters, investors move to take on more market risk.

However, market sentiment is notoriously prone to sudden changes, especially in the context of slowing global growth. On top of that, a plethora of high and rising political risks could potentially produce sizable shocks that would likely prompt a reversal in risk sentiment and further deterioration in macroeconomic conditions. Our analysis delves into three of the most relevant economic-related political risks and how they can produce a negative shock to the global economy.

First, the US-China trade war has recently changed for the worse with the US hiking tariffs on USD 200 Bn of imported Chinese goods from 10% to 25%. The Chinese retaliated with tariffs on USD 60 Bn of imported US goods. The conflict is quickly spilling over to broader economic disputes as both sides have been waging non-tariff bilateral protectionist measures. US actions against Chinese giant Huawei and Chinese implicit threats to stop exporting strategic raw materials such as rare earth to the US. The situation may escalate further if the US imposes additional tariffs on all remaining imports from China (about USD 600 Bn). Should that take place, market sentiment is likely to reverse, producing a risk-off movement that would tighten global financial conditions. Moreover, such shock would disrupt global supply-chains, affect real incomes as well as impact corporate profits on both, the US and China.

Global growth expectation vs. equity markets

Second, the risks of global trade conflicts between the US and other key US partners such as Mexico and the European Union (EU) are increasing. Trump has recently threatened to slash tariffs on Mexico in order to force the country to prevent immigration into the US from other Central American countries via Mexico. Moreover, the EU is seen as a potential target for US tariffs on car imports. Should trade tariffs on Mexico, the EU or any other US partner materialize in a significant way, the sentiment would likely deteriorate sharply with a potential expansion of trade risks much beyond the US-China disputes.

Third, Brexit-related uncertainties (associated with the framework for the formal UK exit of the EU) are a permanent drag on the UK economy and a headwind for the EU. Risks of a disorderly Brexit have increased as three different proposals of “Brexit deals” have been rejected by the British Parliament. After several delays, the new deadline for a formal Brexit is the end of October 2019. A hard or disorderly Brexit would severely hit the UK economy and would generate political and economic shockwaves in the EU.

All in all, despite the Fed’s “dovish pivot,” weakening global demand and outstanding political risks are creating a challenging environment for investors.