Governments involved in financial repression (keeping savings rates below the inflation rate) encourage their citizens to do stupid things by reaching for yield. Remember, most people think of yield as a magic chicken that lays eggs on schedule, and never gets sick or dies. Those who truly understand markets know that yield is an allocation of free cash flow, and that many businesses can’t control their free cash flow, so dividends are less than fully certain.

And so, I’m skeptical of the focus on income investing. With bonds, I am not as skeptical, because there is a promised, though not guaranteed return of principal. That doesn’t mean there aren’t problems there. We are having a record year for issuance of corporate bonds. Abbott Labs is offering a huge deal. My experience with huge deals is to avoid them, unless there is some special reason to play, kind of like the last bond deal from Household International in 2002, where I bought and then traded them away for the 30-year non-deal protected bonds bigtime.

That said, I get concerned over:

- Preferred Stock

- Mortgage REITs

- Private REITs

- Limited Partnerships

- Junk Bonds and bank loans

- Structured Notes

- Ponzi Schemes (they sometimes look reasonable, like Madoff)

- Even dividend-paying common stocks

China has low interest rates for savers, so many Chinese turn to Wealth Management Products in order to earn something decent on their money. Many of them may be little different than a Ponzi scheme. When governments do not allow savers to earn rates exceeding inflation, savers turn to all manner of products that could harm them, both legitimate and illegitimate.

The same thing goes on in Malaysia with their Gold Plans, and suchlike. But let’s keep things simple: let’s invest in the best corporate bond investment out there: long Baa bonds.

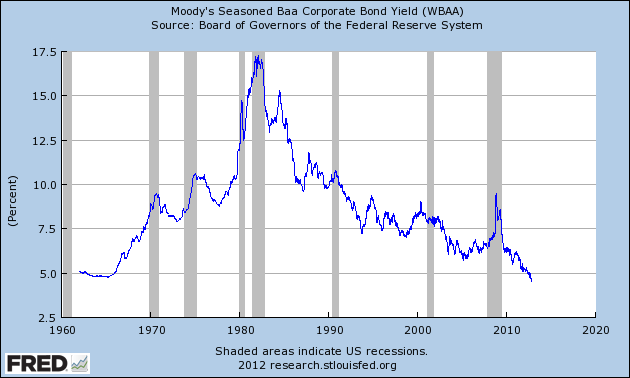

What’s that I see? We’re at a 50-year low for yields on low investment-grade-rated bonds. Surely the economy should be booming.

What, like the Great Depression, we are in a liquidity trap? Seems that way. Additional capital finds rare incremental productive uses, and often the best use is shrinking the company by buying back stock.

Part of that stems from the folly of the Federal Reserve using its balance sheet to buy up all manner of high quality debts by expanding its balance sheet — its cost of finance is 0% (maybe, wait till the losses come, they came to Fannie and Freddie). By doing so, they distort pricing in the debt markets, favoring issuers over lenders, favoring the government over the private sector.

It leads to nothing good, because increasingly marginal projects get financed. As in Japan, the marginal efficiency of capital fell dramatically, and has not risen for two decades plus. Though it would have been painful it would have been better to have more failures and longer recessions 1986-2007. The Fed should have kept rates higher for longer. We would have normal markets today if they had.

As I have said before, investors don’t do well when they don’t have a place to park excess money for a small real return. I’m not looking for the ’80s, when the return was often huge, but something above inflation, fairly estimated. Until then, the misguided plans of the Fed will continue to do little, as businesses look at the low marginal efficiency of capital, and shrink their operations. Remember, when businessmen see economic policies that can’t persist, they don’t take advantage of the situation — they pull in their horns and become defensive. Thus the budget deficits, QE, and the ZIRP lead to a slower economy in the intermediate-term.