Uncertainty represents opportunity. Sportingbet Australia is growing strongly, the Spanish business has just been licensed and we are confident that management can hold Europe at break-even during a period of regulatory and economic change. With over €130m of Turkey disposal proceeds still to come, our sum-of-the parts ranges from 42-55p and the FY13 EV/EBITDA is only 4.2x. Not for the faint-hearted, the shares have significant upside potential on a medium-term view.

Q3 Reflects Changed Business Mix

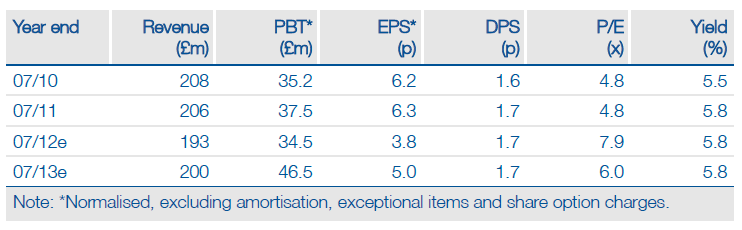

Q3 comparatives (revenue down 21%, EBITDA down 33%) reflect the sale of the Turkish website business, acquisition of Centrebet, and new gambling taxes in Europe. However, the Australian business continues to perform very strongly with like-for-like revenue up 46% and cost synergies coming through well. Our FY12 EPS estimate is unchanged (the mix is a little different). The jump in estimated FY13 profit mainly reflects the benefit of European cost savings, although we have reduced our FY13 EPS from 5.6p to 5.0p (broadly in line with consensus) to reflect management’s intention to reinvest European profits in newly regulated markets. If in-play betting is allowed in Australia (hopefully from end 2012) there will be a positive boost to results.

Surprises -- And Opportunities

Spain finally issued gambling licences on 1 June and miuapuesta.es is trading in time for Euro 2012 (after an injunction had forced the temporary closure of the old website). Sportingbet now derives about 65% of its revenues from regulated markets, although it still faces economic uncertainty in Spain and Greece (together about 22% of revenues). The Spanish events of the last few months were more damaging in that they highlighted the unpredictability of European markets until licensing regimes are fully implemented. However, Sportingbet also has growth opportunities elsewhere: in fast growing emerging markets and potentially also with partners in the US, which is slowly moving towards allowing some online gaming.

Valuation: Sum Of The Parts 42p-55p

On our estimates the FY13 EV/EBITDA is only 4.2x, a significant discount to the sector average. Our sum of the parts is at least 42p (40% above the current share price), even if the high-quality European sports platform is valued at nil. Even our 55p SOTP is based on fairly cautious assumptions, suggesting significant medium-term upside potential. Hoped-for newsflow later in the year regarding Australian products or US partnerships would be very positive triggers.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Betting On Europe

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.