December has historically been a bullish month for Wall Street. In fact, we recently outlined the best stocks to own in December, as well as the stocks to avoid, if past is prologue. But what about specific sectors? Historical data indicates that one exchange-traded fund (ETF) in particular tends to shine in the final month of the year: the PowerShares Dynamic Leisure & Entertainment (NYSE:PEJ).

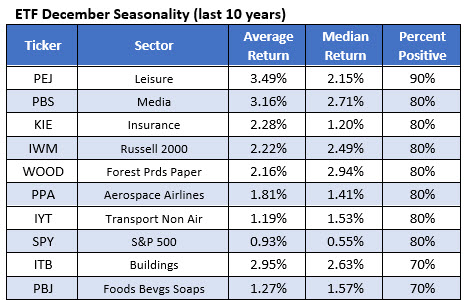

Below are the 10 best ETFs to own in December, looking back 10 years, per Schaeffer's Senior Quantitative Analyst Rocky White. The list is sorted by percent positive, with PEJ the lone fund to boast a 90% monthly win rate. On average, PEJ has advanced 3.49% in the month of December -- the highest of all funds that we track.

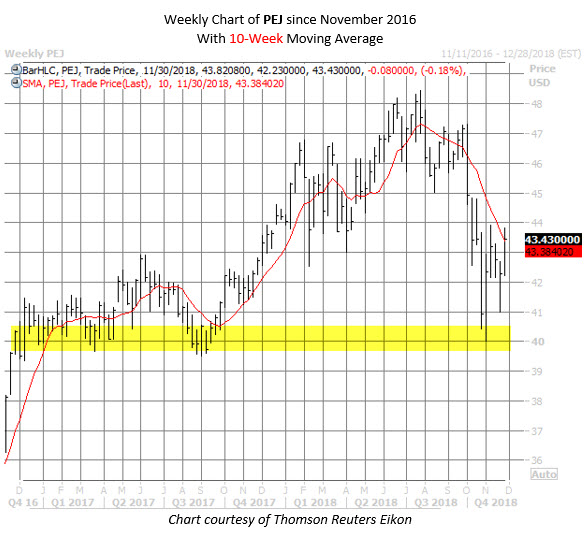

PEJ is already set to wrap up November with its biggest monthly gain since May, up nearly 3% so far. Further, the ETF is set to topple its 10-week moving average for the first time since late September, before the shares pulled back to test the round-number $40 region, which acted as a floor in 2017. At last check PEJ was trading at $43.43. A similar December rally next month would put the fund just under $45 heading into 2019.

Among the Invesco Dynamic Leisure and Entertainment ETF's top holdings are airline stocks United Continental Holdings Inc (NASDAQ:UAL) and Delta Air Lines, Inc. (NYSE:DAL). The airline sector has already enjoyed a banner November, thanks to lower oil prices and upwardly revised guidance. In fact, UAL stock today touched a record high of $96.25, and DAL shares hit an all-time best of $61.32.

Outside of airlines, blue chip Walt Disney Co (NYSE:NYSE:DIS) is also a top PEJ holding. In fact, DIS stock itself tends to outperform in December, averaging a monthly gain of 2.55%, and ending the month higher nine of the past 10 years.