Over the last few years, investors have been increasingly interested in the biotechnological sector of the stock market. Despite the global crisis started in 2008, most biotechnological stocks have been showing outstanding performance, gaining up to 60% per year. Therefore, these companies are still attractive in terms of investment prospects.

Market Leader asked representatives of Alpari, one of the heavyweights in the trading industry, about the current state of affairs and the prospects of the biotech sector.

Alpari on Biotech Stocks

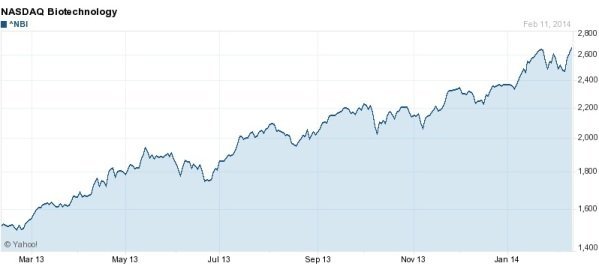

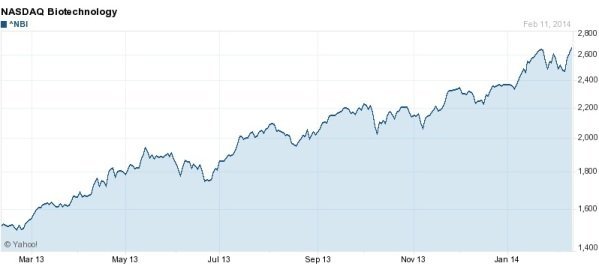

According to the experts, the first thing you should pay attention to when deciding to invest in biotech stocks is the index called NBI (NASDAQ BiotechIndex). At this point, the index includes 112 biotech companies.

The following criteria are used when adding a biotech stock to the index:

This should be a NASDAQ-traded stock

This should be a biotech or pharmaceutical stock

The company shouldn’t be on the verge of bankruptcy

The company’s market capitalization should be over 200 million dollars

The average daily trading volume should be over 100K shares

The stock should be traded over 6 months

The experts note that there is an alternative to the index when it comes to technical or correlational analysis. This is ETF iShares Nasdaq Biotechnology Index Fund (IBB), which is based on NASDAQ Biotechnology Index. The ETF copies the biotech index and is freely available at many resources.

For example, in 2013, major US indices gained: Nasdaq Comp gained 33,1% ($4143,07), SP500 – 26,3% ($1848,36), DJIA –23.5% ($16576,66). At the same time, NBI gained 60,3% up to $2369,53, while IBB gained 60,1% up to $227,06.

The global market of biotech products is currently estimated at 170bn dollars. US companies are the frontrunners in terms of market capitalization. Other countries include the EU, China and India. The total market capitalization of biotech companies from around the globe is estimated at $593bn (218 companies worldwide).

When it comes to the best investment opportunity in the biotech sector, the experts name PDL BioPharma Inc. The company's market cap is $1,3bn. The company is currently showing excellent financial performance. This company doesn't sell medicine, it runs intellectual property assets in the biotech sector (patents etc.). As a company owning multiple patents on different medical products and services, PDL BioPharma Inc. Gets its own piece of the cake.

Apparently, not all investors can invest directly in the company's stock for many reasons. Still, Alpari gets them covered. In particular, the broking company offered a structured product on biotech stocks with 100% safety of capital. This is the best way to invest in PDL BioPharma Inc. indirectly.