In the past week, the municipal bond market back-up was exacerbated, on top of an already sloppy six weeks. The culprits this week were the usual suspects: retail selling of bond funds and terrible, nearly nonexistent liquidity provided by the Wall Street firms that underwrite issues.

In addition, the Chairman of the Federal Reserve, Ben Bernanke, goes on speaking in what we have observed to be terribly obfuscated language regarding Federal Reserve policy. When that happens and retail investors are confused, they hit the sell button. Stocks and bonds have both been clobbered over the past week.

Furthermore, it is rumored that a number of bank arbitrage accounts that buy municipal bonds on a highly leveraged basis are being forced to unwind. That means they are selling large blocs of bonds into a market lacking any depth or serious bidding. This has caused a sharp upward movement in scales. Thus, we see an almost unprecedented opportunity in longer-maturity municipal bonds.

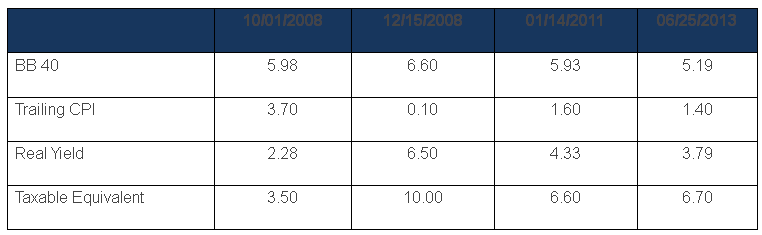

We use the Bond Buyer 40. It is a long-term index that tends to reflect the longer end of the market and more of the bonds that are in retail bond funds and accounts with an income orientation.

The four periods we show are (1) the month after Lehman Brothers went bankrupt; (2) December 2008, when all markets were in free fall (3) the height of the Meredith Whitney meltdown in January 2011; and the present. Leaving aside December 2008 – a statistical anomaly, in our opinion – notice the drop in inflation (trailing CPI) since 2008. Municipal bonds are the cheapest they have been in years on an after-inflation, taxable-equivalent basis. It is also instructive to note the yield ratio of the long Bond Buyer 40 to the 30-year Treasury. It is now 146 percent, versus 131 percent during the Whitney meltdown.

In our view, the July rollover period for munis will have to bring some stability to the muni market and crossover buyers. Traditionally, taxable buyers come into the tax-exempt space in early summer. We are already starting to see some deals being pulled from the market. This is how the muni market usually self-corrects. Meanwhile we are acting opportunistically.

Trailing headline inflation climbed to a peak of 4 percent in September 2011. It has been falling since September 2012.

This is the best opportunity to buy munis for Cumberland portfolios in over two years. We are lengthening durations and maturities of portfolios as well as locking in higher yields.

BY John Mousseau

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Best Opportunity To Buy Munis

Published 06/26/2013, 02:28 AM

Best Opportunity To Buy Munis

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.