In the world of gold investment we are constantly finding ourselves looking incredulously at the manner in which Western forecasters recommend buying gold and therefore the way many Western investors do buy gold.

As we saw last year and into this year, when the price of gold is falling many investors close to home decide to sell their holdings. This is in contrast to the East where a falling gold price is a strong signal to buy, buy more and even more after that. Who’s on the right track?

Obviously we believe those who buy gold when the price is down is on the right track, why buy something you want when the price is going up? But how are you supposed to know when this will happen?

Gold seasonality is something which is often discussed. During forecasting analysts will refer to Indian wedding seasons or Chinese New Year, when looking for some indication of price action. But how much do these events matter and what happens during the rest of the year?

We looked into when the best time to buy gold is sometime ago and concluded that while there are clear trends and the gold price is seasonal it is not always worth relying on such data to determine your investment decisions. Interestingly, however, Jeff Clark of Casey Research has looked into this curious area and has concluded that March is most certainly the best time to invest in gold. This may seem curious in 2014 given gold’s stellar performance so far, however in the first week of this month gold did fall from its five-week winning streak. Perhaps Mr Clark is onto something?

Many investors, especially those new to precious metals, don’t know that gold is seasonal. For a variety of reasons, notably including the wedding season in India, the price of gold fluctuates in fairly consistent ways over the course of the year.

This pattern is borne out by decades of data, and hence has obvious implications for gold investors.

Can you guess which is the best month for buying gold?

When I first entertained this question, I guessed June, thinking it would be a summer month when the price would be at its weakest. Finding I was wrong, I immediately guessed July. Wrong again, I was sure it would be August. Nope.

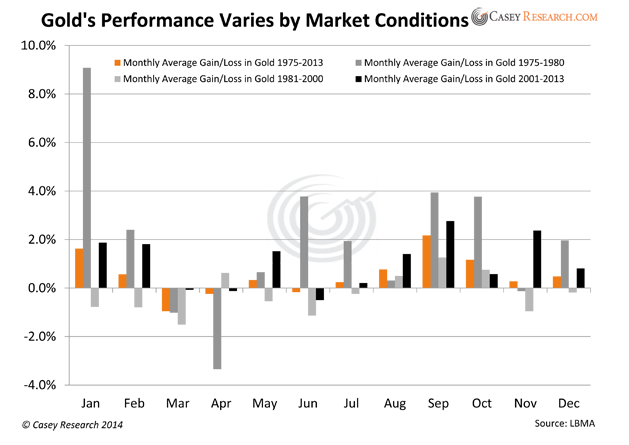

Cutting to the chase, here are gold’s average monthly gain and loss figures, based on almost 40 years of data:

Since 1975—the first year gold ownership in the US was made legal again—March has been, on average, the worst-performing month for gold.

This, of course, makes March the best month for buying gold.

But: averages across such long time frames can mask all sorts of variations in the overall pattern. For instance, the price of gold behaves differently in bull markets, bear markets, flat markets… and manias.

So I took a look at the monthly averages during each of those market conditions. Here’s what I found.

Key point:

The only month gold has been down in every market condition is March.

Combined with the fact that gold soared 10.2% the first two months of this year, the odds favor a pullback this month.

And as above, that can be a very good thing. Here’s what buying in March has meant to past investors. We measured how well gold performed by December in each period if you bought during the weak month of March.

Only the bear market from 1981 to 2000 provided a negligible (but still positive) return by year’s end for investors who bought in March. All other periods put gold holders nicely in the black by New Year’s Eve.

If you’re currently bullish on precious metals, you might want to consider what the data say gold bought this month will be worth by year’s end.

Regardless of whether gold follows the monthly trend in March, the point is to buy during the next downdraft, whenever it occurs, for maximum profit. And keep your eye on the big picture: gold’s fundamentals signal the price has a long climb yet ahead.

Everyone should own gold bullion as a hedge against inflation and other economic maladjustments… and gold stocks for speculation and leveraged gains.