Over the last few weeks, there have been an inordinate number of articles concerning the high probability of a stock market crash. One theory is that the super-sized year-to-date gains of the Dow coupled with the summertime interest rate spike is analogous to what transpired prior to Black Monday on October 19, 1987. Another premise for a miserable September regards the fact that price-to-earnings (P/E) ratios are growing faster than at any time since the dot-come bubble burst in March of 2000. Last, but hardly least, margin debt is at its highest level since the 2007-2008 financial meltdown.

And If You Thinks That's Bad..

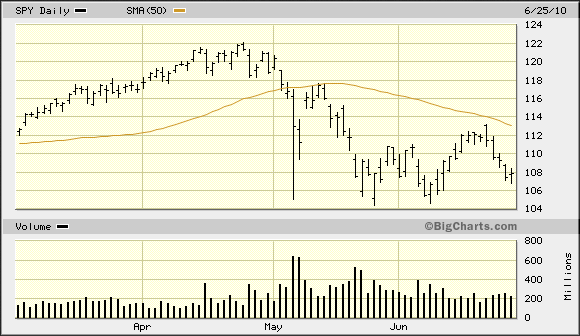

Of course, why should commentators stop at these comparisons? Our country’s M2 Money Supply as measured by currency in circulation as well as short-term deposits at banks appears to be slowing in the same manner as it did prior to the “October 1929 Crash.” What’s more, the S&P 500 SPDR Trust (SPY) is hanging around its 50-day moving average; the infamous “Flash Crash” in May of 2010 happened just as SPY had failed to maintain support at its 50-day trendline.

Granted, I am being a tad bit facetious with my commentary. I do not subscribe to the notion that one can predict when a genuine crash will occur. Nevertheless, I acknowledge that there is no shortage of reasons to be wary. Institutional investors have been selling into August strength, Federal Reserve tapering uncertainty is serving to slow more than the rate of bond purchases and we’re once again bumping up against another debt ceiling debate.

Enviable Attributes

For many of my client portfolios, we are maintaining a commitment to funds like SPDR Select Health Care (XLV), PowerShares Pharmaceuticals (PJP) and iShares DJ Aerospace and Defense (ITA). These ETFs have enviable defensive attributes where performance does not rely on an interest rate addiction nor economic cycles. They are hardly immune to sell-offs, pullbacks and crashes, but they do have staying power. (I’d consider buying more in a downturn.)

While I expect September to be weak for stocks due to a wide variety of economic, political and fundamental headwinds, those who believe a stock crash is imminent might consider one or more “reversal ETFs.” Specifically, the yen via CurrencyShares Yen Trust (FXY) could strengthen in a reversal of the carry trade, volatility via iPath S&P 500 VIX Short-Term (VXX) could rocket in a reversal of the complacency trend and extended duration Treasuries via Vanguard Extended Duration (EDV) could surge on a reversal of the “rates-can-only-go-up” thinking.

Disclosure Statement:

ETF Expert is a web log (”blog”) that makes the world of ETFs easier to understand. Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc., and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Best ETFs For A September Crash

Published 08/26/2013, 04:15 PM

Updated 07/09/2023, 06:31 AM

Best ETFs For A September Crash

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.