Remember all the stories depicting Best Buy (NYSE:BBY) as just another showroom for Amazon.com (NASDAQ:AMZN)? They couldn't give away merchandise. People were actually ordering items from Amazon on the floor of a Best Buy using its WiFi. Bold.

Maybe nothing has changed or maybe it all has. But I don't hear those stories anymore. And now the stock seems to have bottomed and is reversing higher. The chart below looks pretty good for more upside and with short interest near 9% there is some fuel available to help it higher with a lot of time to run until it reports earnings in mid May.

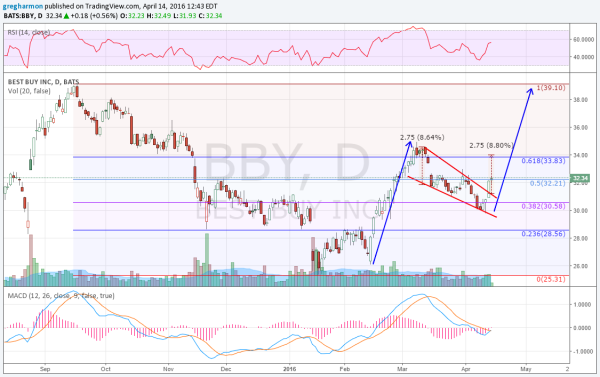

The chart shows the move higher in mid February, which exceeded a 61.8% retracement of the downward move from September. The pullback from there retested the 38.2% retracement level and then bounced. That bounce pushed the price up through a falling wedge, which is where it gets exciting.

The wedge break gives a short-term target to just over 34, and back to that 61.8% level. But the break higher also creates a Measured Move to about 39, back to the prior high. Momentum is on its side as well. The RSI is making a higher high and on the verge of a move over 60 -- into the bullish zone. And the MACD is about to cross up, giving another buy signal.

Maybe it's time to shop for Best Buy again.