The Health Care sector ranks 2nd out of the ten sectors as detailed in my sector roadmap. It gets my Neutral rating, which is based on aggregation of ratings of 22 ETFs and 86 mutual funds in the Health Care sector as of April 13, 2012.

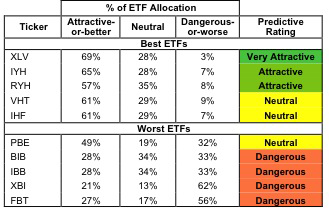

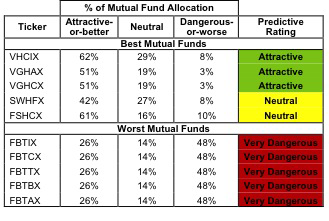

Figures 1 and 2 show the five best and worst-rated ETFs and mutual funds in the sector. The best ETFs and mutual funds allocate more value to Attractive-or-better-rated stocks than the worst ETFs and mutual funds, which allocate too much value to Neutral-or-worse-rated stocks.

To identify the best and avoid the worst ETFs and mutual funds within the Health Care sector, investors need a predictive rating based on (1) stocks ratings of the holdings and (2) the all-in expenses of each ETF and mutual fund. Investors need not rely on backward-looking ratings.

Investors seeking exposure to the Health Care sector should buy one of the Attractive-or-better rated ETFs or mutual funds from Figures 1 and 2. My ratings and free reports on all ETFs and mutual funds in this sector are available on my free ETF and mutual fund screener.

Figure 1: ETFs with the Best & Worst Ratings – Top 5

Best ETFs exclude ETFs with TNA’s less than 100 million for inadequate liquidity.

Sources: New Constructs, LLC and company filings

Focus Morningstar Health Care Index ETF [s: FHC] is excluded from Figure 1 because its total net assets (TNA) are below $100 million so it does not meet our liquidity standards.

Figure 2: Mutual Funds with the Best & Worst Ratings – Top 5

Best mutual funds exclude funds with TNA’s less than 100 million for inadequate liquidity.

Sources: New Constructs, LLC and company filings

Icon Funds: ICON Healthcare Funds [s: ICHCX] and [s: ICHEX] are excluded from Figure 2 because their total net assets (TNA) are below $100 million so they do not meet our liquidity standards.

Health Care Select Sector SPDR [s: XLV] is my top-rated Health Care ETF and Vanguard World Funds: Vanguard Health Care Index Fund [s: VHCIX] is my top-rated Health Care mutual fund. Both earn an Attractive-or-better rating. In fact, XLV is the only ETF I cover to earn my Very Attractive rating.

Amgen Inc [s: AMGN] is one of my favorite stocks held by Health Care ETFs and mutual funds and earns my Very Attractive rating. AMGN offers a strong business model with a ROIC above 14% for the last 7 years, an achievement matched by less than 4% companies in the Russell 3000 over the same time. AMGN’s current valuation at $66.92 implies a permanent 40% decline in profits. Strong profits and low expectations for future profitability offer appealing risk/reward to investors.

First Trust NYSE Arca Biotechnology Index Fund [s: FBT] is my worst-rated Health Care ETF, and Fidelity Advisor Series VII: Fidelity Advisor Biotechnology Fund [s: FBTAX] is my worst-rated Health Care mutual fund. Both earn a Dangerous-or-worse rating.

Amylin Pharmaceuticals, Inc [s: AMLN] is one of my least favorite stocks held by Health Care ETFs and mutual funds. It gets my Dangerous rating. The company is a value destroyer. Not once, over the 14 years I’ve covered the company, has it generated a return on invested capital (ROIC) that meets its weighted average cost of capital (WACC). To justify its current valuation of ~$23.7/share, the company would have to grow its revenues by 20% compounded annually for 20 years while also raising its ROIC from 3% to over 11%. With so much profit growth already baked into the current valuation, I find it difficult to believe the stock has much upside.

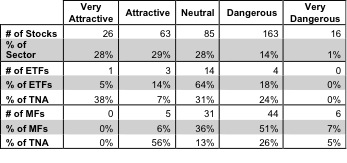

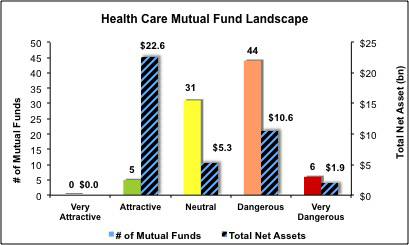

Figure 3 shows that 89 out of the 353 stocks (over 57% of the total net assets) held by Health Care ETFs and mutual funds get an Attractive-or-better rating. However, only 4 out of 22 Health Care ETFs (45% of total net assets) and 5 out of 86 Health Care mutual funds (less than 56% of total net assets) get an Attractive-or-better rating.

The takeaway is: most mutual fund managers allocate too much capital to low-quality stocks but investors do a great job identifying the Health Care ETFs and mutual funds with great portfolio management and low costs. Figure 3 shows that 45% of the value of ETFs and 56% of the value of mutual funds are allocated to Attractive-or-better-rated ETFs and mutual funds.

Figure 3: Health Care Sector Landscape For ETFs, Mutual Funds & Stocks

Sources: New Constructs, LLC and company filings

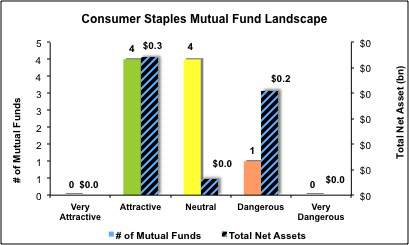

Investors need to tread carefully when considering Health Care ETFs and mutual funds. The sector does offer 9 investments worthy ETFs and mutual funds but is flooded with 99 ETFs and mutual funds that should be avoided. Figures 4 and 5 show the rating landscape of all Health Care ETFs and mutual funds.

As detailed in “Cheap Funds Dupe Investors”, the fund industry offers many cheap funds but very few funds with high-quality stocks, or with what I call good portfolio management.

Figures 4 and 5 show the rating landscape of all Health Care ETFs and mutual funds.

Our sector roadmap report ranks all sectors and highlights those that offer the best investments.

Figure 4: Separating the Best ETFs From the Worst ETFs

Sources: New Constructs, LLC and company filings

Figure 5: Separating the Best Mutual Funds From the Worst Mutual Funds

Sources: New Constructs, LLC and company filings

Disclosure: I receive no compensation to write about any specific stock, sector or theme.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Best And Worst ETFs (And Mutual Funds): Health Care Sector

Published 04/18/2012, 03:12 AM

Updated 07/09/2023, 06:31 AM

Best And Worst ETFs (And Mutual Funds): Health Care Sector

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.