The Consumer Staples sector ranks first out of the ten sectors as detailed in my sector roadmap. It gets my Attractive rating, which is based on the aggregation of my ratings for 10 ETFs and 9 mutual funds as of April 12, 2012 in the Consumer Staples sector.

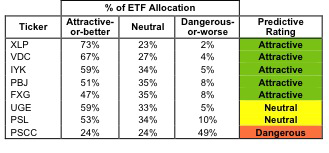

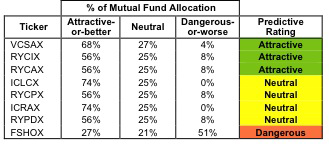

Figures 1 and 2 rank all 8 ETFs and all 8 mutual funds that meet our liquidity standards. The best ETFs and mutual funds allocate more value to Attractive-or-better-rated stocks than the worst ETFs and mutual funds, which allocate too much value to Neutral-or-worse-rated stocks.

To identify the best and avoid the worst ETFs and mutual funds in the Consumer Staples sector investors need a predictive rating based on (1) stocks ratings of the holdings and (2) the all-in expenses of each ETF and mutual fund. Investors need not rely on backward-looking ratings.

Investors seeking exposure to the Consumer Staples sector should buy one of the Attractive-or-better rated ETFs or mutual funds from Figures 1 and 2.

Figure 1: ETFs Ranked from Best to Worst – Consumer Staples

Best ETFs exclude ETFs with TNA’s less than $100 million for inadequate liquidity

Sources: New Constructs, LLC and company filings

Focus Morningstar Consumer Defensive Index ETF (FCD) and Rydex S&P Equal Weight Consumer Staples ETF (RHS) are excluded from Figure 1 because their total net assets (TNA) are below $100 million and do not meet our liquidity standards.

Figure 2: Mutual Funds Ranked from Best to Worst – Consumer Staples

Best mutual funds exclude funds with TNA’s less than $100 million for inadequate liquidity.

Sources: New Constructs, LLC and company filings

ICON Funds: ICON Consumer Staples Fund ICLEX] is excluded from Figure 2 because its TNA is less than $100 million and does not meet our liquidity standards.

Figure 2 shows that ICLCX and ICRAX allocate the most value to Attractive-or-better rated stocks, but they earn a worse, Neutral rating because their total annual costs of 3.0% and 4.4% are higher than the funds that rank above them.

Consumer Staples Select Sector SPDR(XLP) is my top-rated ETF and Vanguard World Funds: Vanguard Consumer Staples Index Fund [VCSAX] is my top-rated mutual fund for this sector. Both earn my Attractive rating.

Procter & Gamble Co.(PG) is one of my favorite stocks held by Consumer Staples ETFs and mutual funds and earns my Attractive rating. PG has a special business. Its brands such as Pampers, Gillette, Downy, and Olay are embedded deep in the consciousness of people around the world and are a part of every day life for most people. These brands translate into superior economic performance for PG. In fact, PG’s economic vs. reported earnings rating places it in the 92nd percentile of all Russell 3000 companies and is one of the reasons I recommend inventors buy PG.

PowerShares S&P Small Cap Consumer Staples Portfolio (PSCC) is my worst-rated Consumer Staples ETF and Fidelity Select Portfolios: Construction Staples Portfolio [FSHOX] is my worst-rated Consumer Staples mutual fund. Both get my Dangerous rating.

Lance, Inc (LNCE) is one of my least favorite stocks held by Consumer Staples ETFs and mutual funds and earns my Very Dangerous rating. LNCE has misleading economic earnings — their reported earnings are positive and rising while their economics are negative decreasing. This is a huge red flag for me and, along with its expensive valuation, is why I recommend investors avoid or short this stock.

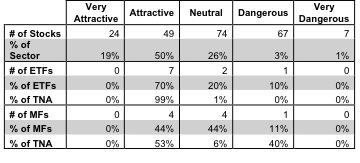

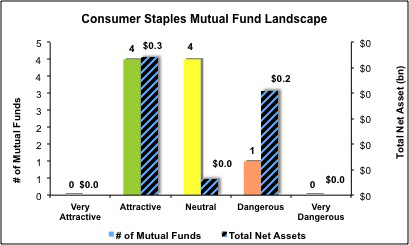

Figure 3 shows that 73 out of the 221 stocks (over 69% of the total net assets) held by Consumer Staples ETFs and mutual funds get an Attractive-or-better rating. This is the main driver behind the Attractive rating for 7 of the 10 Consumer Staples ETFs (99% of total net assets) and 4 of the 9 Consumer Staples mutual funds (44% of total net assets).

The takeaway is: Consumer Staples ETFs and mutual fund managers are effectively allocating capital to high-quality stocks while charging competitive fees.

Figure 3: Consumer Staples Sector Landscape For ETFs, Mutual Funds & Stocks

Sources: New Constructs, LLC and company filings

Consumer Staples ETFs and mutual funds offer excellent investment opportunities. 7 Consumer Staples ETFs and 4 Consumer Staples mutual funds allocate enough value to Attractive-or-better-rated stocks to earn an Attractive rating.

122 stocks of the 3000+ I cover are classified as Consumer Staples stocks, but due to style drift, Consumer Staples ETFs and mutual funds hold 221 stocks.

The fund industry offers many cheap funds but very few funds with high-quality stocks, or with what I call good portfolio management.

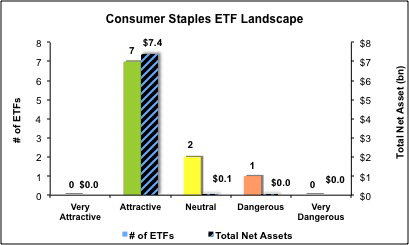

Figures 4 and 5 show the rating landscape of all Consumer Staples ETFs and mutual funds.

Our sector roadmap report ranks all sectors and highlights those that offer the best investments.

Figure 4: Separating the Best ETFs From the Worst ETFs

Sources: New Constructs, LLC and company filings

Figure 5: Separating the Best Mutual Funds From the Worst Mutual Funds

Sources: New Constructs, LLC and company filings

Disclosure: I receive no compensation to write about any specific stock, sector or theme.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Best And Worst ETFs (And Mutual Funds): Consumer Staples Sector

Published 04/18/2012, 03:05 AM

Updated 07/09/2023, 06:31 AM

Best And Worst ETFs (And Mutual Funds): Consumer Staples Sector

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.