A quiet day in Europe but a lot of volatility once Fed Chairman Bernanke started to speak. His formal speech was dovish, as one would expect from him, and the dollar began to weaken, but there was interest in buying dollars and the decline was short-lived. Then during the Q&A session he suggested that the Fed could indeed taper off QE in the next several months if the data allowed, and things went wild. Ten-year Treasury yields soared (up 10 bps on the day), stocks moved lower and of course the dollar went right back up. There was less interest in the minutes from the last FOMC meeting, which occurred before the latest employment data and so were seen as somewhat dated. Policymakers did discuss the question of whether they would taper off QE if the economy significantly improved in Q2, although the discussion was somewhat academic as the economy has not yet shown such signs of improvement.

In sum, the tenor of Bernake’s comments and the FOMC minutes were totally different from what other central banks are discussing. Most everywhere else in the world, the problems central banks face are below-target inflation and too-strong currencies, which put central banks in a neutral to easing mode; the Fed is one of the few that is even considering tightening. This policy difference is likely to support the dollar going forward, in my view.

Overnight the China purchasing managers’ index (PMI) showed a surprise fall in May to 49.6 from 50.4 (50.4 expected). The news hit the AUD and NZD hard, as these economies are closely tied to China’s.

GBP fell after the BoE again voted 6-3 to maintain its current stance. The IMF warned that UK faces low growth and said that monetary policy should remain accommodative. As if to corroborate the IMF’s concerns, April retail sales fell more than expected, adding to the negative sentiment for GBP. Everyone is waiting to see whether Mr. Carney will be like Mr. Kuroda when he comes into office in July. As such I would think the “expectations channel” of monetary policy transmission can still provide further downside for GBP/USD.

EUR/CHF surged after Swiss National Bank president Jordan said the SNB could adjust the floor and/or impose negative interest rates to protect the country from deflation. Of course “could” does not mean “will,” but the uncertainty around the next SNB meeting on 20 June has clearly increased. The pair could go still higher, in my view.

The PMIs will be the focus today. The provisional manufacturing, services and composite Markit PMIs for May are announced for the EU, Germany and France. Later, the US Markit PMI will be announced (not the ISM index). Month-on-month rises are forecast across the board in the Eurozone, although only the German services PMI is expected to get back above 50. The US index, by contrast, is expected to fall but still remain above 50. An improvement in the European indicators could cause a rebound in EUR/USD, especially given the size of the USD movement overnight, but given the strength of dollar demand that we saw yesterday even in the wake of Bernanke’s dovish prepared comments I would not bank on any large decline in USD right now. Also, ECB President Draghi speaks this evening on “The Future of Europe in the Global Economy” and five of his Council colleagues speak throughout the day. We will probably get conflicting guidance on ECB policy from these speeches, adding to the volatility.

The Market

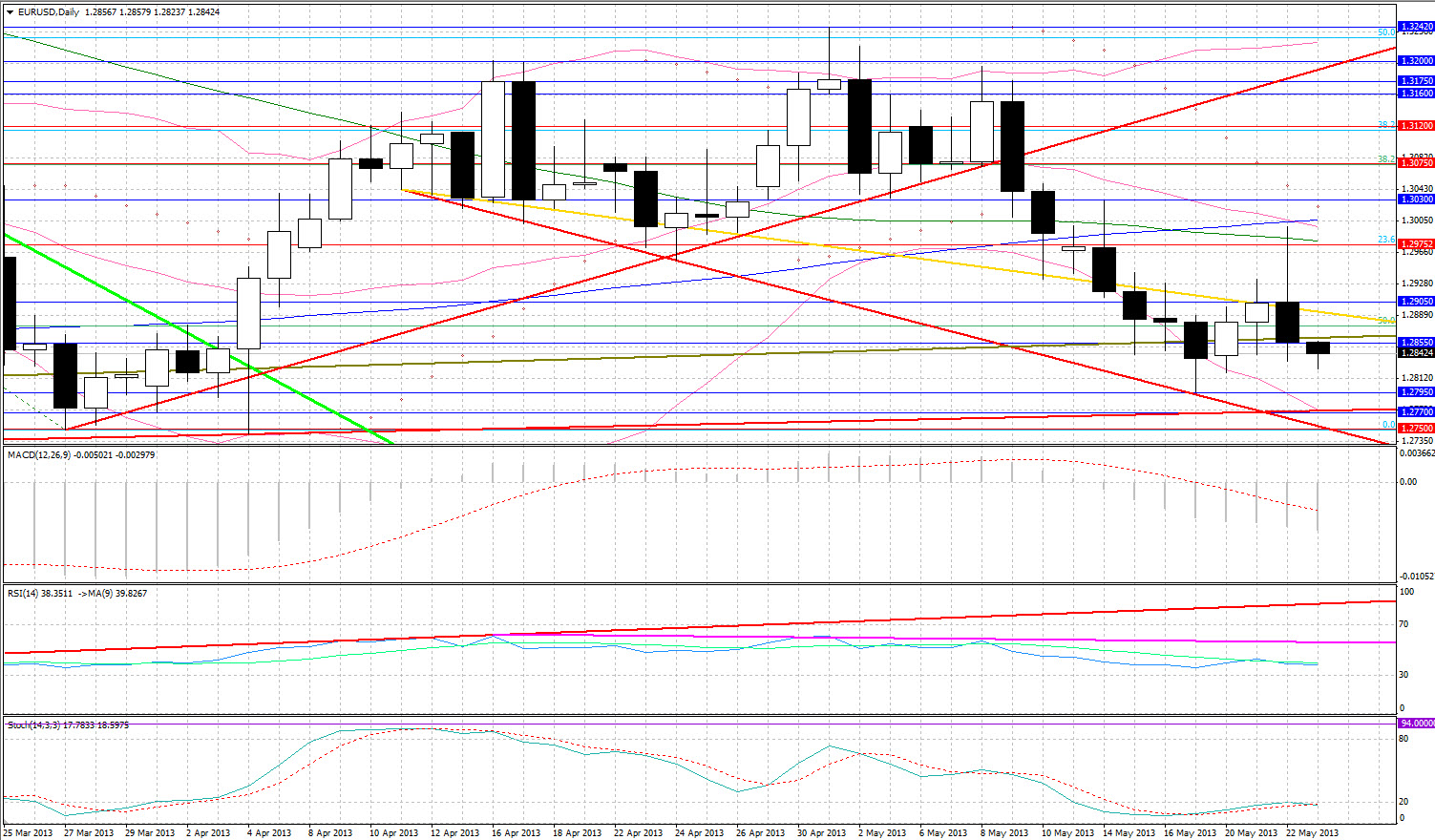

EUR/USD

• EUR/USD suffered losses yesterday after the pair found resistance at the 1.2980-1.3000 . It eventually broke both the 1.2900 psychological and 1.2855 trend line support and the next support now is at 1.2800 . A stronger support can be found close to that at 1.2780 where there is a November rising trendline support and the bottom Bollinger Bands level. Resistance can be found once again at 1.2900 and 1.2980.

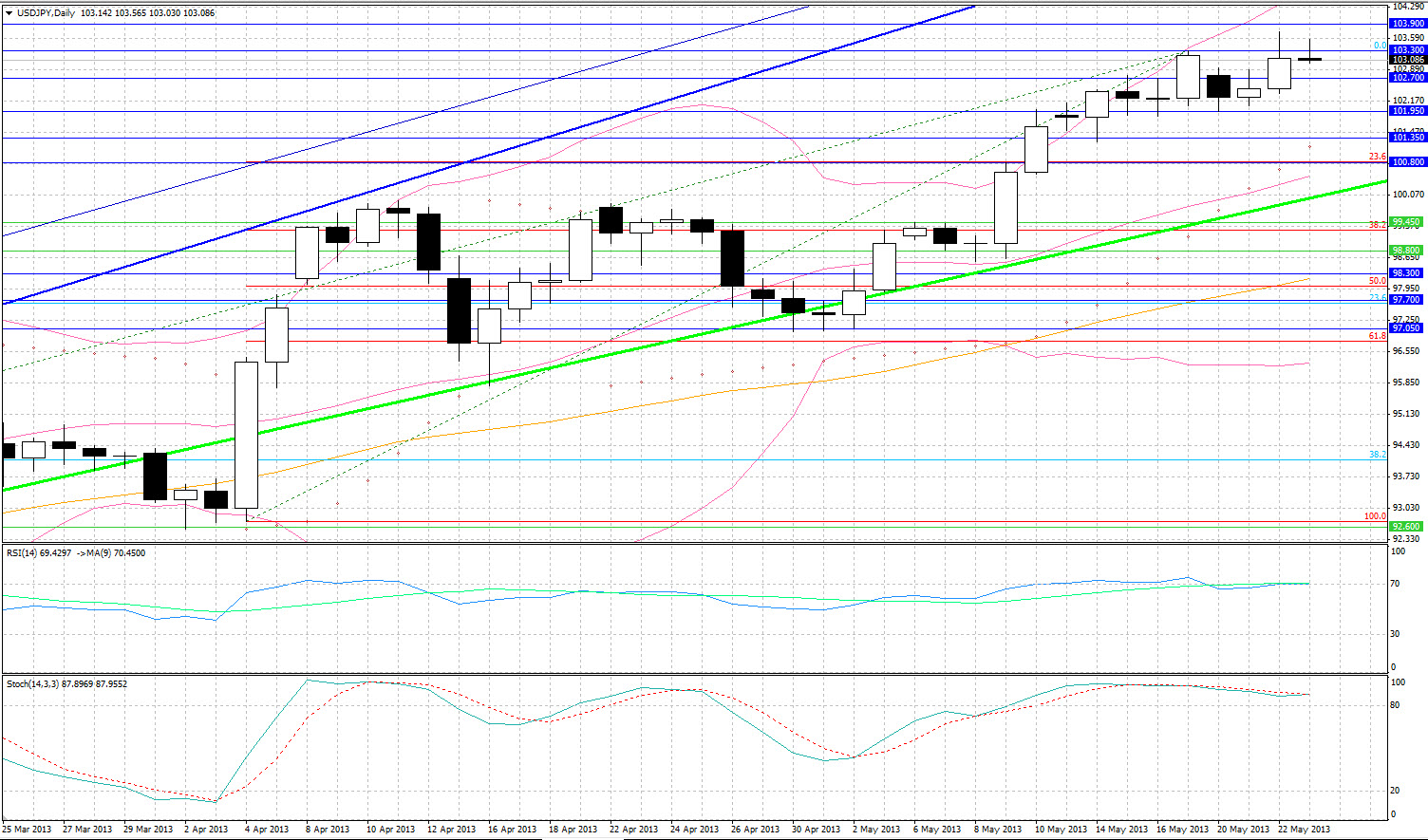

USD/JPY  USD/JPY" title="USD/JPY" width="968" height="576">

USD/JPY" title="USD/JPY" width="968" height="576">

• USD/JPY continued higher and found resistance at 103.90-104.00 area. A break of the 104.00 resistance level could see the pair move another 100 pips towards 105.00 with an intermediate resistance at its top Bollinger Bands level at 104.70. Both the RSI and Stochastic are pointing overbought so some pullback is likely with supports to be found at 102.00 and 101.35.

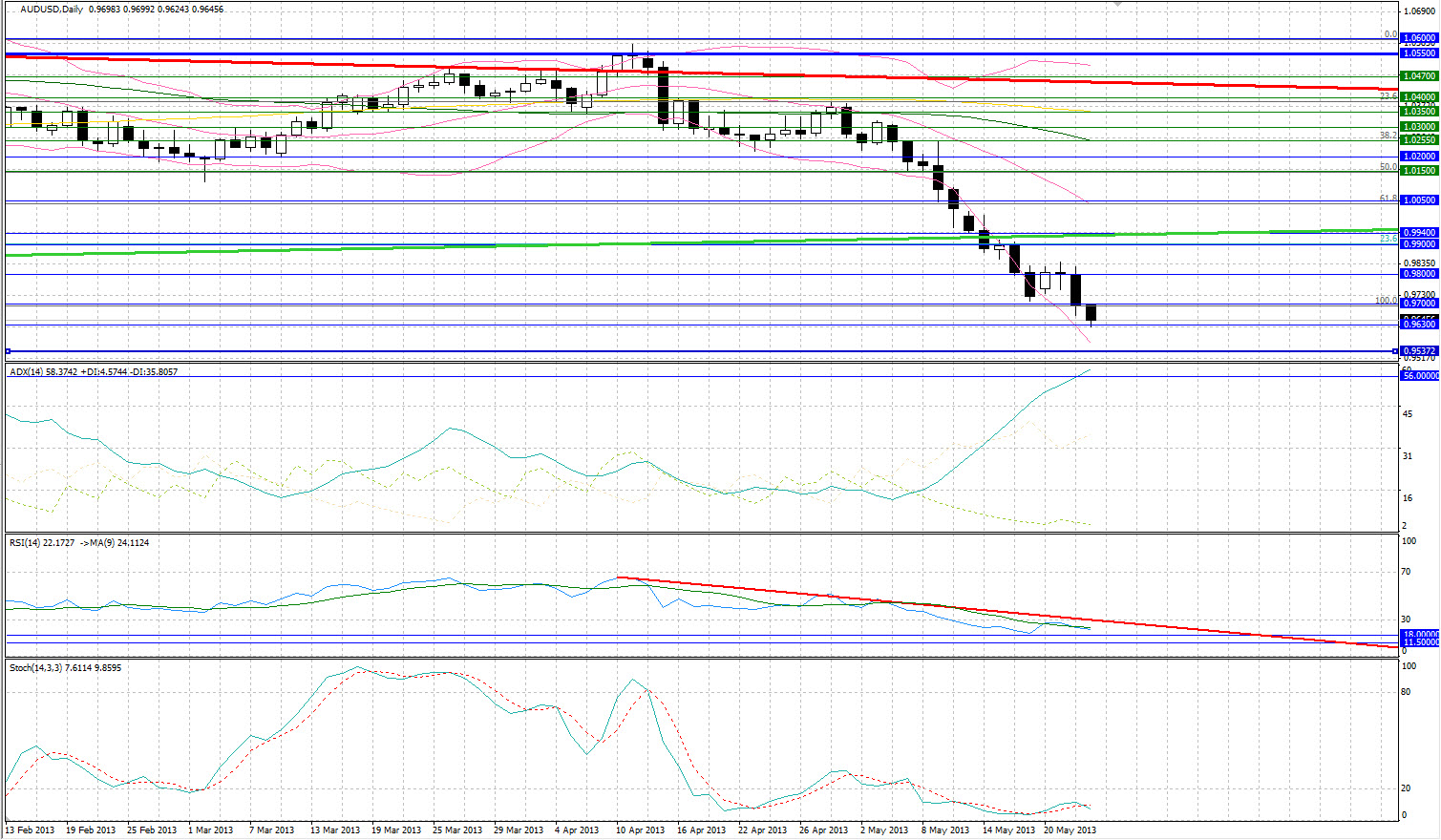

AUD/USD AUD/USD" title="AUD/USD" width="968" height="576">

AUD/USD" title="AUD/USD" width="968" height="576">

• AUD/USD collapsed yesterday and continued to do so overnight after breaking lower through the 0.9700 support level. The next support levels to be found are expected at 0.9600 psychological level and 0.9537 which is a 2 year low. The Average Directional Reading Indicator (ADX) is showing a reading above 50 indicating how strong the trend to the downside of AUD/USD is. If we see a bounce from the drop resistance is to be found at the 0.9700 and 0.9800 levels.

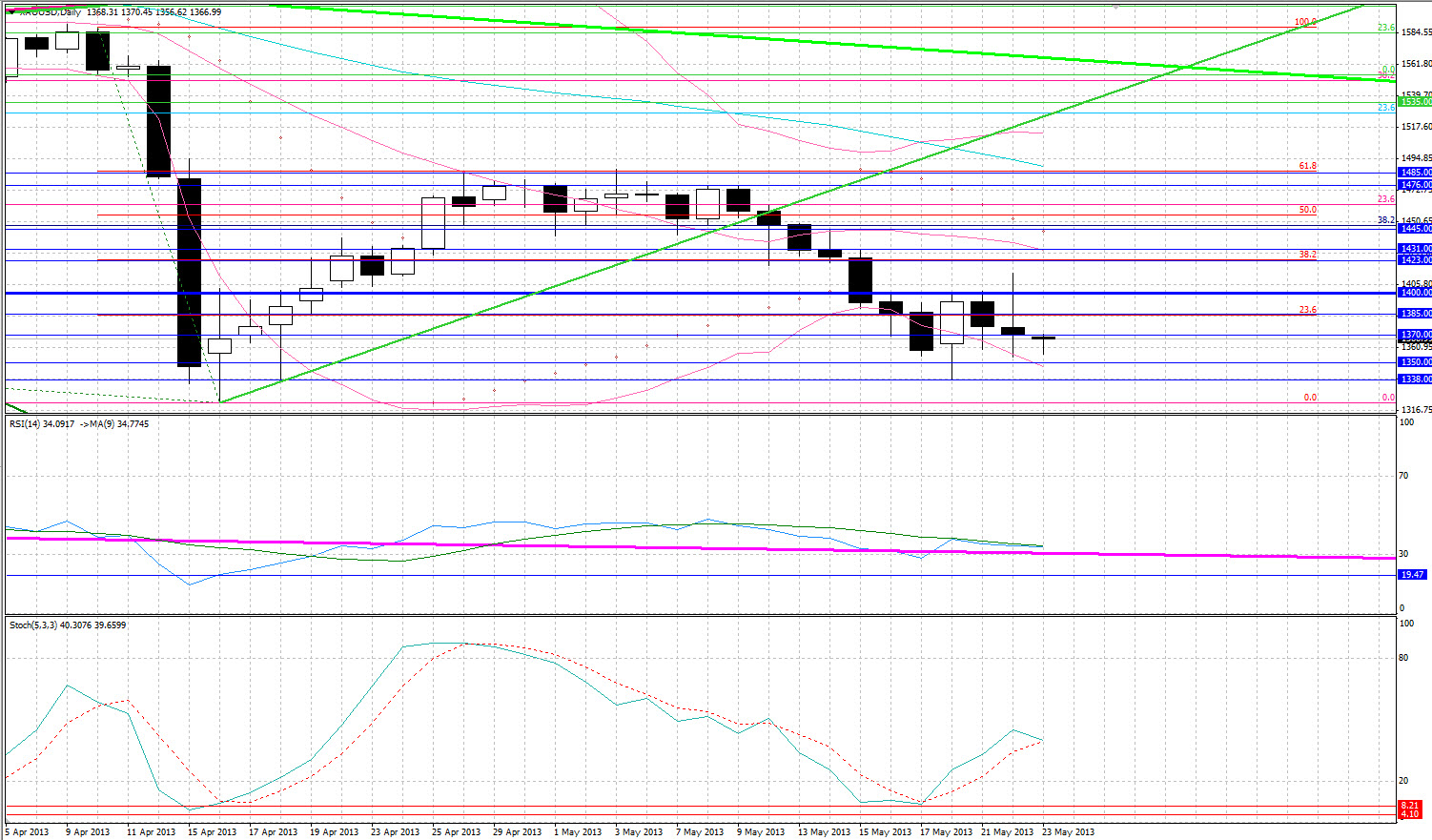

Gold

• Gold ended for a second day with marginal losses forming a spinning top indicating some indecision between buyers and sellers. Gold has been founding support over the last 2 days and continues to do so at its bottom Bollinger level and continues to do so at the $1350 level. A break of this level would find an immediate support at $1340 followed by $1320. Resistance now lies at $1385 followed by $1400.

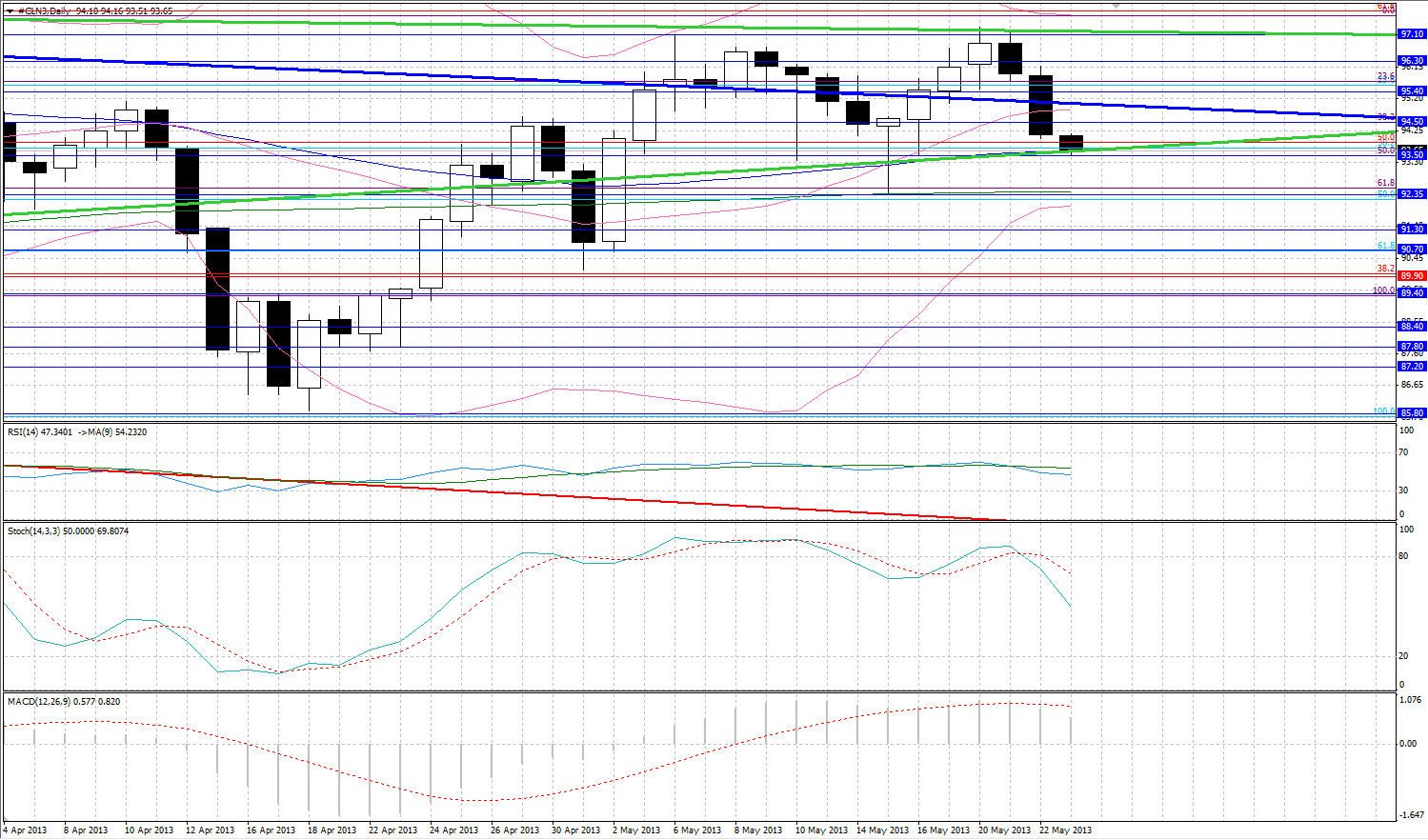

Oil

• WTI got slammed yesterday for a second day and continues to do so after breaking several support levels. An immediate support can be found being tested $93.50, which is a 2½ year rising trendline as well as a previous low. Below this level there is significant resistance at the $92.30-$92.00 area where we have previous lows, the bottom Bollinger level as well as the $92.00 psychological level. With RSI and Stochastic far from being oversold we think it is quite likely to see further declines. Resistance is to be expected at the $94.50 previous high and $95.00.

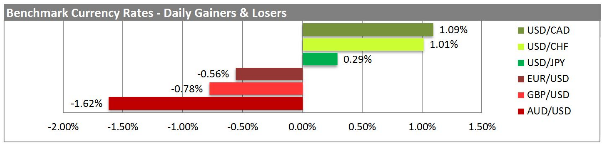

BENCHMARK CURRENCY RATES - DAILY GAINERS AND LOSERS

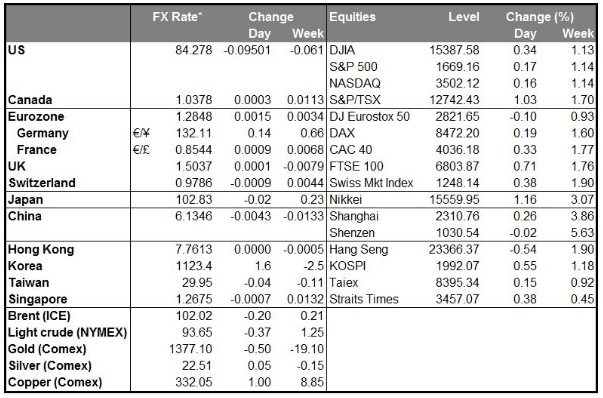

MARKETS SUMMARY

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Bernanke Delivers A Jolt, Sends Dollar Soaring

Published 05/23/2013, 05:49 AM

Updated 07/09/2023, 06:31 AM

Bernanke Delivers A Jolt, Sends Dollar Soaring

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.