I like the markets and football a lot, which makes me very like millions of others.

The Jacksonville Jaguars stink. They are likely to stink all year. Their offense is anemic. I expect them to punt regularly. Their GM (David Caldwell) should consider signing Ben Bernanke because he's clearly a great punter.

The Fed, particularly under Bernanke has made an effort to be more transparent, but in my opinion they became very opaque yesterday. On May 22nd, Bernanke teed up the Taper, but then he decided to punt instead of kicking a field goal (reduce asset purchases by some ceremonial amount).

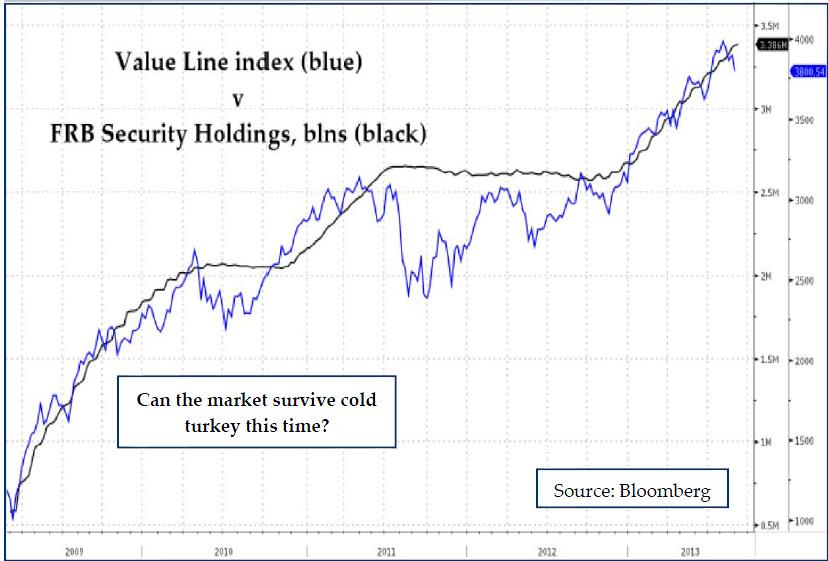

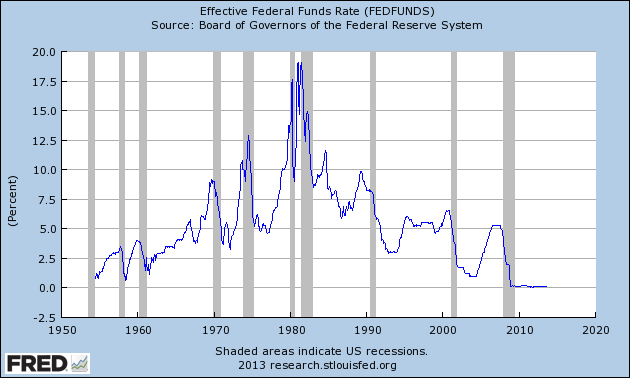

Perhaps the football analogy is a stretch, but the addict behavior continues. Stimulus in the economy, like stimulus in the body/lab rats/whatever produces short term euphoria. Mr. Market's Dopamine receptors have been lit up like the Griswold Residence in December for FIVE YEARS. In the 60 months since the acute phase of the global financial crisis, there has been an ACTIVE FED PROGRAM (QE1, 2, Twist, QE3, Infinity) for 51 of those months. Take a look at what the market did in the 9 months the Fed turned off the spigot (S&P pullbacks averaged about 18%). See for yourself.

At some point, the electricity bill has to be paid.

In my estimation, the Fed's decision to "punt" yesterday was a dangerous one. While Mortgage and Real Estate brokers breathed a collective sigh of relief (housing "recovery" can continue) and systematic traders bid up Equities/Metals and every currency without a US President (or Ben Franklin) on it - the likelihood of unintended consequences continues to grow.

The long term effects of stimulus on the body include:

- Anxiety/irritability

- Tremors/convulsions

- Violent/psychotic behaviors

Bernanke clearly doesn't want to be the Doctor (he does have a PhD in Econ from MIT) to take the market off it's medicine. That's all well and good. Enjoy the euphoria. Bask in the Wealth Effect, but at some point I worry that the "Bernanke Put" turns into a massive "Yellen Margin Call".

Consider this - Correlation or Causation? Can you see the two stretches where the Fed paused?

Next FOMC meetings (opportunities for Bernanke to punt):

October 29-30th (NO press conference)

December 17-18th (Press conference and Bernanke's penultimate meeting)

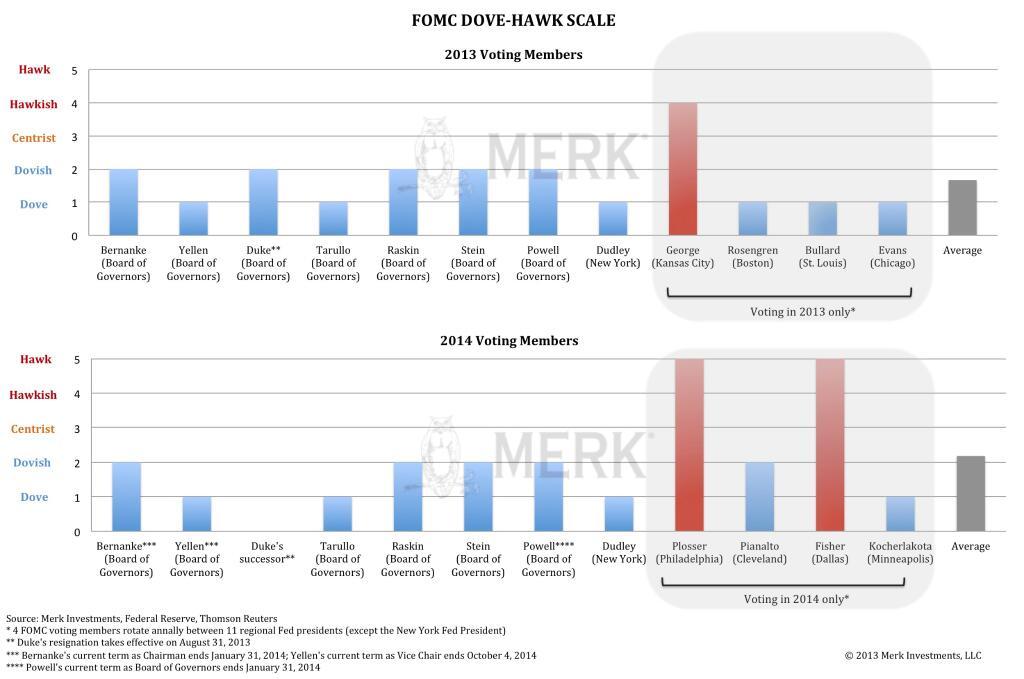

And in 2014 the FOMC composition changes fairly significantly.

Next year the voting members lean as follows.

- Cleveland- Sandra Pianalto- Moderate Dove

- Philadelphia- Charles Plosser- Very Hawkish

- Dallas- Richard Fisher- Very Hawkish

- Minneapolis- Narayana Kocherlakota- Hawkish

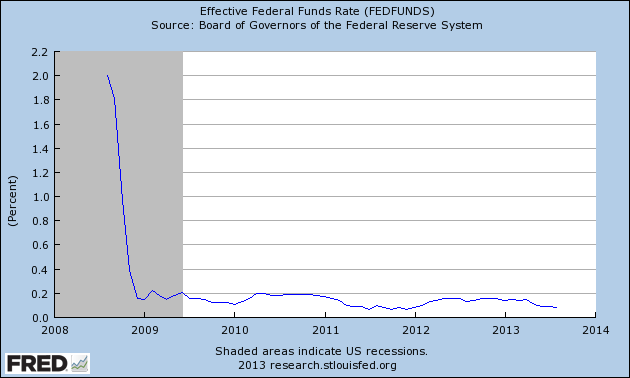

The Equity markets are at all time highs (with the exception of the Nasdaq), yet Fed Funds have been at 0.00%-0.25% for 5 years.

But at some point.......

The Pressure Cooker has been in the ON position for 51 of 60 months.

Steve Quan is a longtime friend of mine and runs Quanholdings LLC. here in Chicago. He's incredibly intelligent and in my experience can consistently find an edge in the Metals options markets (which is INCREDIBLY difficult these days). I value his perspective a great deal.

Risk Disclaimer: This information is not to be construed as an offer to sell or a solicitation or an offer to buy the commodities and/ or financial products herein named. The factual information of this report has been obtained from sources believed to be reliable, but is not necessarily all-inclusive and is not guaranteed to be accurate. You should fully understand the risks associated with trading futures, options and retail off-exchange foreign currency transactions (“Forex”) before making any trades. Trading futures, options, and Forex involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more than your initial investment. Opinions, market data, and recommendations are subject to change without notice. Past performance is not necessarily indicative of future results. This report contains research as defined in applicable CFTC regulations. Both RCM Asset Management and the research analyst may have positions in the financial products discussed.