Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

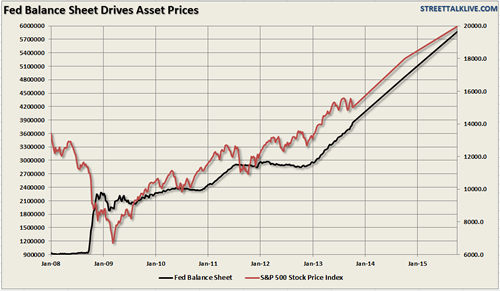

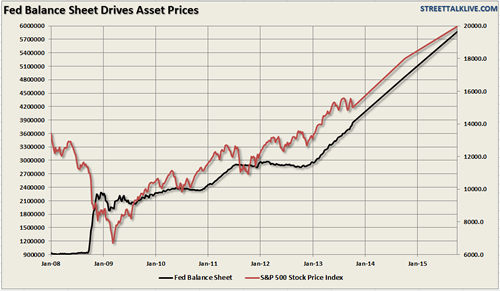

From my standpoint, which may or may not be correct, I believe that global risk markets have become increasingly disconnected from economic reality because of artificial Central Bank support. We are not alone in our desire to stimulate growth by suppressing borrow rates and debasing our Currency. The Japanese have been even more aggressive than US bankers at incenting risk. The Brits are doing it. Mario Draghi (Trichet before him) is playing along at the European Central bank. The Swiss may remain neutral in many global conflicts, but in the race to debase - they're actively involved.

If Central-bank support wanes - so too does risk appetite. I believe it's causation not a feeble correlation. I readily admit I could be wrong. Something about 2% GDP "growth", 7+% persistent unemployment, which is only declining because the Labor Force participation is at multi generational lows (people have given up looking for work and many find a way to get on disability), margin debt at all time highs and the S&Ps/RUT/Wilshire 5000 also at all time highs doesn't sit well with me.

The old adage that "markets can remain irrational longer than you can remain solvent" rings especially true these days. The Federal Reserve's pocketbook isn't bound by the same rules as yours. Same goes for the Bank of Japan, the ECB, the BoE, etc..

There's a Fed meeting that begins tomorrow and ends on Weds with a decision, but there's no press conference so "Street" expectations are for no action. Keep in mind that 6 weeks ago the market expected a nominal pullback from the $85 billion in bond/MBS purchases. That did NOT happen. Then the US Government was shut down. The ensuing deluge of economic data has been middling at best. This is Bernanke's second to last meeting at the head of the table. After this he gets to ride off into the South Carolina sunset, make millions consulting and write a memoir or two. His payday is upon us.

I digress, here's an economic calendar for the week (note: Production, Pending Homes Sales and Dallas Fed were all "misses" this morning). We get CPI and PPI over the next two days. Retail Sales and Consumer Confidence always matter (70% of GDP is consumer driven).....but the Fed Meeting is really what matters most.

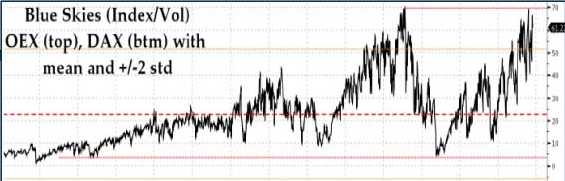

This is interesting

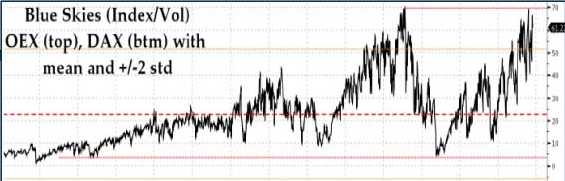

Economic data/confidence plunged around all the "Shutdown" chatter. The divergence is notable even in this terribly grainy picture.

The only other time the Blue Skies Index (which is the OEX divided by Index vol) was this stretched (more than 2 standard deviations over mean) was late 2006/early 2007. Then again, maybe it's different this time.

Moving on the following market tidbits are interesting:

Finally, the Yen has been coiling into a very tight range for months. I expect that it will "resolve" higher or lower before long. The Yen tends to benefit from safe haven trade, meaning it usually goes up if fear comes back into the markets. I would consider upside exposure to the Yen as an alternative to being short US equities.

If Central-bank support wanes - so too does risk appetite. I believe it's causation not a feeble correlation. I readily admit I could be wrong. Something about 2% GDP "growth", 7+% persistent unemployment, which is only declining because the Labor Force participation is at multi generational lows (people have given up looking for work and many find a way to get on disability), margin debt at all time highs and the S&Ps/RUT/Wilshire 5000 also at all time highs doesn't sit well with me.

The old adage that "markets can remain irrational longer than you can remain solvent" rings especially true these days. The Federal Reserve's pocketbook isn't bound by the same rules as yours. Same goes for the Bank of Japan, the ECB, the BoE, etc..

There's a Fed meeting that begins tomorrow and ends on Weds with a decision, but there's no press conference so "Street" expectations are for no action. Keep in mind that 6 weeks ago the market expected a nominal pullback from the $85 billion in bond/MBS purchases. That did NOT happen. Then the US Government was shut down. The ensuing deluge of economic data has been middling at best. This is Bernanke's second to last meeting at the head of the table. After this he gets to ride off into the South Carolina sunset, make millions consulting and write a memoir or two. His payday is upon us.

I digress, here's an economic calendar for the week (note: Production, Pending Homes Sales and Dallas Fed were all "misses" this morning). We get CPI and PPI over the next two days. Retail Sales and Consumer Confidence always matter (70% of GDP is consumer driven).....but the Fed Meeting is really what matters most.

This is interesting

Economic data/confidence plunged around all the "Shutdown" chatter. The divergence is notable even in this terribly grainy picture.

The only other time the Blue Skies Index (which is the OEX divided by Index vol) was this stretched (more than 2 standard deviations over mean) was late 2006/early 2007. Then again, maybe it's different this time.

Moving on the following market tidbits are interesting:

- Platinum is $110 off recent lows (+8%) and testing recent highs around $1485 (PLF14)

- Natural Gas is under pressure on weather forecasts, but could be a compelling speculative long in the next few days.

- The Euro is at multi year highs and the Dollar near multi year lows.

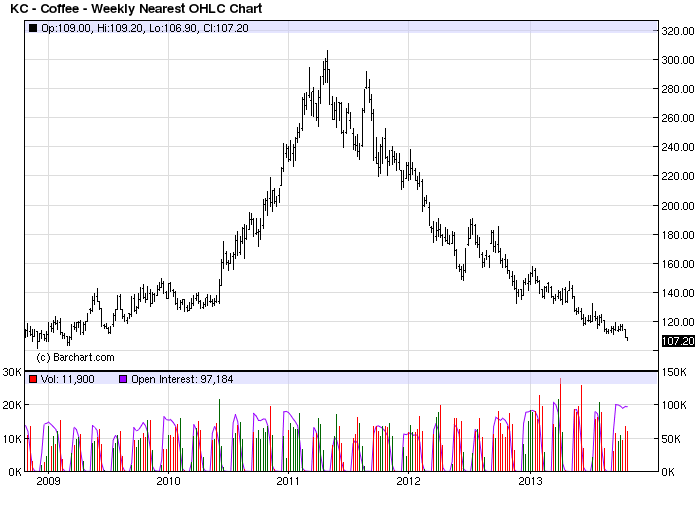

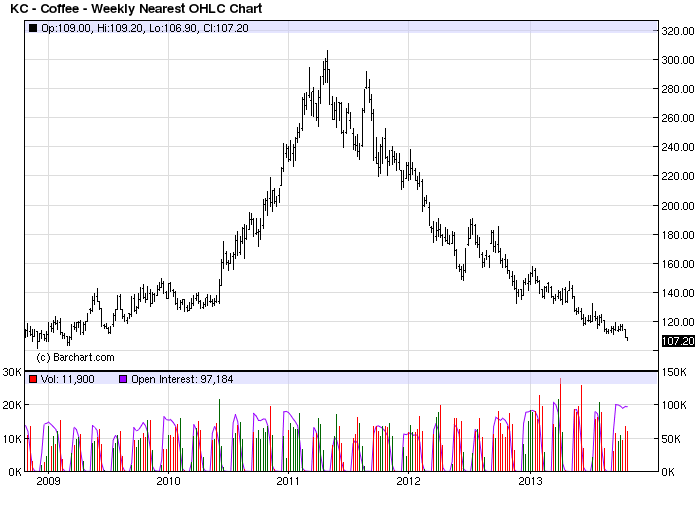

- Coffee traded down to the lowest level since March of 2009

Finally, the Yen has been coiling into a very tight range for months. I expect that it will "resolve" higher or lower before long. The Yen tends to benefit from safe haven trade, meaning it usually goes up if fear comes back into the markets. I would consider upside exposure to the Yen as an alternative to being short US equities.