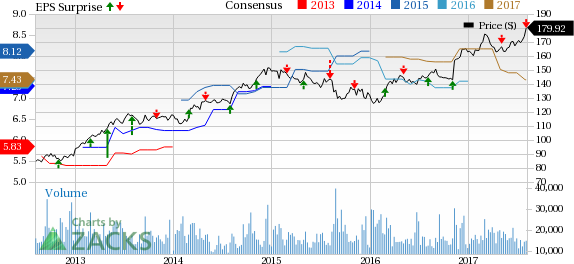

Berkshire Hathaway Inc. (NYSE:BRKa)’s BRK.B second-quarter 2017 operating earnings of $1.67 per share missed the Zacks Consensus Estimate by 9.7%. The bottom line also deteriorated 10.7% year over year.

The earnings decline can be attributed to lower operating earnings from Insurance Operations, plus Finance & Financial products.

Revenues in the reported quarter increased about 6% year over year to $57.5 million.

Pre-tax income of $6.1 billion declined 16.9% year over year.

Segment Results

Berkshire Hathaway’s huge and growing Insurance Operations segment has kept its underwriting profit streak alive for more than 14 years. Revenues from the Insurance group increased 12.1% year over year to $13.7 billion. This segment’s net earnings attributable to Berkshire Hathaway plunged 28.3% year over year to $943 million in the quarter.

Railroad, Utilities and Energy operating revenues climbed 11.2% year over year to $9.8 billion, owing to higher contribution from both BNSF and Berkshire Hathaway Energy. Net earnings of $1.5 billion were up 17.5% year over year, primarily banking on a 24.1% surge in earnings from the railroad business and a 7.1% rise in earnings from the energy business.

Total revenue at Manufacturing, Service and Retailing grew 4% year over year to $31.9 billion. Net earnings improved 11.3% year over year to $1.7 billion in the second quarter of 2017.

Revenues at the company’s Finance & Financial Products – including Clayton Homes (manufactured housing and finance), CORT Business Services (furniture rental), Marmon (rail car and other transportation equipment manufacturing, repair and leasing) and XTRA (over-the-road trailer leasing) – rose 2.2% year over year to $2.0 billion. Net earnings attributable to Berkshire Hathaway declined 16.2% year over year to $332 million in the second quarter of 2017.

Financial Position

As of Jun 30, 2017, consolidated shareholders’ equity was $300.7 billion, up 6.2% from Dec 31, 2016. As of Jun 30, 2017, cash, cash equivalents and the U.S. Treasury bills were approximately $60.2 billion, up 23.1% from the level at 2016-end. For the first six months of 2017, cash from operations soared 74.4% to $26.6 billion compared with $15.3 billion in the same period, last year.

As of Jun 30, 2017, Berkshire Hathaway’s book value increased 6.2% from year-end 2016 to $182.82 per share.

The company exited the quarter with float of about $107 billion.

Zacks Rank

Berkshire Hathaway currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other P&C Insurers

Among other players from the same space that have reported their second-quarter earnings so far, the bottom line at The Progressive Corporation (NYSE:PGR) as well as The Travelers Companies, Inc. (NYSE:TRV) missed the respective Zacks Consensus Estimate, while RLI Corp. (NYSE:RLI) beat the same.

5 Trades Could Profit "Big-League" from Trump Policies

If the stocks above spark your interest, wait until you look into companies primed to make substantial gains from Washington's changing course.

Today Zacks reveals 5 tickers that could benefit from new trends like streamlined drug approvals, tariffs, lower taxes, higher interest rates, and spending surges in defense and infrastructure.

See these buy recommendations now >>

RLI Corp. (RLI): Free Stock Analysis Report

The Travelers Companies, Inc. (TRV): Free Stock Analysis Report

Berkshire Hathaway Inc. (BRK.B): Free Stock Analysis Report

Progressive Corporation (The) (PGR): Free Stock Analysis Report

Original post