Analysts at Peel Hunt started coverage on shares of Berkeley Resources Limited (LON:BKY) in a research report issued on Tuesday, MarketBeat.com reports. The firm set a "buy" rating and a GBX 93 ($1.14) price target on the stock. Peel Hunt's target price suggests a potential upside of 97.87% from the company's current price.

Other analysts have also issued reports about the company. WH Ireland reaffirmed a "buy" rating and set a GBX 120 ($1.47) target price on shares of Berkeley Resources Limited in a report on Tuesday, September 20th. Liberum Capital reaffirmed a "buy" rating and set a GBX 60 ($0.73) target price on shares of Berkeley Resources Limited in a report on Tuesday, September 20th.

FinnCap reaffirmed a "buy" rating and set a GBX 113 ($1.38) target price on shares of Berkeley Resources Limited in a report on Wednesday, July 27th. Finally, Numis Securities Ltd reissued a "buy" rating and issued a GBX 100 ($1.22) price objective on shares of Berkeley Resources Limited in a report on Friday, July 15th.

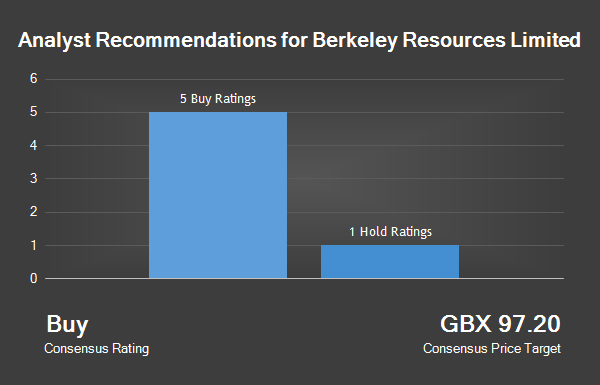

One investment analyst has rated the stock with a hold rating and five have assigned a buy rating to the stock. The company currently has an average rating of "Buy" and an average price target of GBX 97.20 ($1.19).

Shares of Berkeley Resources Limited opened at 47.06 on Tuesday, MarketBeat.com reports. Berkeley Resources Limited has a one year low of GBX 19.50 and a one year high of GBX 57.00. The stock's 50 day moving average price is GBX 48.99 and its 200 day moving average price is GBX 40.67. The stock's market capitalization is GBX 93.33 million.

About Berkeley Resources Limited

Berkeley Energy Limited, formerly Berkeley Resources Limited, is an energy company. The principal activity of the Company is mineral exploration. The Company operates in the segment of uranium exploration and development in Spain. It is focused on bringing its flagship Salamanca Project (Project), which is located in Western Spain into production.