Home goods retailer Bed Bath & Beyond Inc. (NASDAQ:BBBY) is slated to report fiscal third-quarter earnings after the market closes tomorrow, Jan. 9. It's been a relatively quiet stretch for BBBY stock, per its 60-day historical volatility of 48.6% -- in the tame 36th annual percentile. However, the options market is expecting a bigger-than-usual post-earnings swing for Thursday's trading.

Specifically, Trade-Alert puts the implied earnings deviation for BBBY at 22.5% -- almost double the 12.2% next-day move the stock has averaged over the last eight quarters. The bulk of this action has occurred to the downside, with the shares closing lower in seven of the past eight quarters, including the past six in a row, though not one of these earnings reactions was large enough to exceed what the options market is pricing in this time around.

It looks as though options traders have been positioning for another negative earnings reaction for BBBY stock. At the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), the equity's 10-day put/call volume ratio of 1.74 ranks in the 96th annual percentile, meaning puts have been bought to open over calls at a quicker-than-usual clip.

This skepticism is seen elsewhere on Wall Street, too. Short interest on Bed Bath & Beyond climbed nearly 10% in the last two reporting periods to 32.91 million shares. This is the most since early 2009, and accounts for more than one-quarter of the retail stock's available float. Plus, all 14 analysts covering BBBY shares maintain a "hold" or worse.

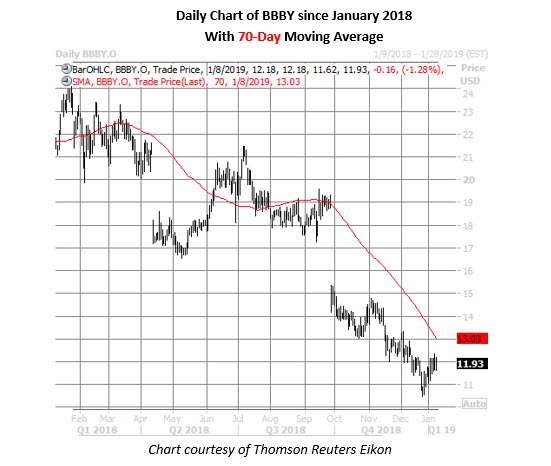

This pessimism is certainly warranted, considering the stock has surrendered 44% in the last 12 months, down 1.3% today at $11.93. And while the equity has recovered some since its 20-year low of $10.46 from Dec. 24, it's now trading near its 70-day moving average, which has ushered the shares lower since July.

In the past six times BBBY has rallied up near this trendline, the security averaged a 10-day loss of 8%, according to data from Schaeffer's Senior Quantitative Analyst Rocky White. The picture gets even bleaker when the time frame is widened to 21 days, with the retail stock averaging a decline of 11.2%.