Becton, Dickinson and Company (NYSE:BDX) , popularly known as BD, reported fourth-quarter fiscal 2017 earnings of $2.40 per share, which beat the Zacks Consensus Estimate of $2.38 and increased 13.2% on a year-over-year basis.

The company registered revenues of $3.166 billion, down from $3.231 billion in the year-ago period. Revenues, however, beat the Zacks Consensus Estimate of $3.136 billion.

Quarterly Details

The BD Medical segment generated revenues of $2.115 billion, which declined 5.3% from the prior-year period. The segment's results reflect an adverse impact from the change in the U.S. dispensing business model.

The BD Life Sciences segment generated revenues of $1.051 billion, up 5.5% from the year-ago quarter. The segment's performance reflects strong numbers across the Biosciences, Diagnostic Systems and Preanalytical Systems units.

U.S. Revenues were roughly $1.644 billion, down 5.9% on a reported basis but up 2.1% on a comparable basis.

International revenues rose 2.6% to $1.522 billion. However, comparable, currency-neutral basis revenues rose 6.9% on the back of solid growth across the company’s businesses.

Guidance

The company expects fiscal 2018 revenues to increase 5% to 6%. The company expects adjusted earnings per share between $10.55 and $10.65 on a stand-alone basis, which represents growth of approximately 12%.

Zacks Rank & Key Picks

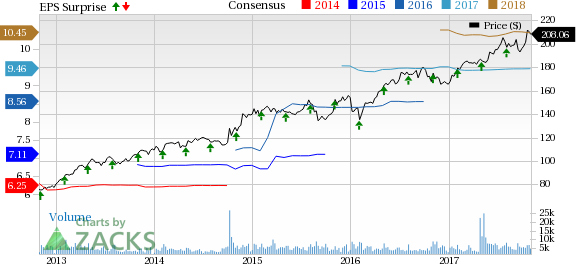

Becton, Dickinson currently carries a Zacks Rank #2 (Buy).

A few other top-ranked stocks in the broader medical sector are PetMed Express, Inc. (NASDAQ:PETS) , Luminex Corporation (NASDAQ:LMNX) and Intuitive Surgical, Inc. (NASDAQ:ISRG) . Notably, PetMed and Luminex sport a Zacks Rank #1 (Strong Buy), while Intuitive Surgical carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

PetMed reported earnings per share of 43 cents for the second quarter of fiscal 2018, up 79.2% from the year-ago quarter’s 24 cents. Also, gross margin expanded 548 bps year over year to 35.2% in the reported quarter.

Luminex reported third-quarter adjusted earnings per share of 19 cents, up 216.7% year over year. The company’s revenues in the quarter increased almost 4.1% year over year to $74.1 million.

Intuitive Surgical posted adjusted earnings of $2.77 per share, up 34.5% year over year, in the third quarter of 2017. Also, revenues increased 18% year over year to $806.1 million.

Zacks’ Best Private Investment Ideas

While we are happy to share many articles like this on the website, our best recommendations and most in-depth research are not available to the public.

Starting today, for the next month, you can follow all Zacks' private buys and sells in real time. Our experts cover all kinds of trades… from value to momentum . . . from stocks under $10 to ETF and option moves . . . from stocks that corporate insiders are buying up to companies that are about to report positive earnings surprises. You can even look inside exclusive portfolios that are normally closed to new investors.

Click here for Zacks' private trades >>

PetMed Express, Inc. (PETS): Free Stock Analysis Report

Intuitive Surgical, Inc. (ISRG): Free Stock Analysis Report

Luminex Corporation (LMNX): Free Stock Analysis Report

Becton, Dickinson and Company (BDX): Free Stock Analysis Report

Original post

Zacks Investment Research